Council steps up opposition to pay day lending

28th November 2013

The Highland Council is to write to the UK Government, the Scottish Government and the Convention of Scottish Local Authorities to highlight its total opposition to the high-cost short-term credit offered by pay day lending companies and the misery that spiralling debt brings to the poorest in society.

A priority, they say, is to cap the level of interest on the repayment of loans, which can be as high as 4,000 per cent, at no more than 60 per cent.

At the same time, a council delegation is to seek an early meeting with officials of the Hi- Scot Credit Union, which is based in Stornoway, to discuss what additional support the Council can provide to increase awareness and membership of the union. The Council sees the Credit Union as a viable alternative form of affordable credit to consumers across the Highlands.

The issue was considered by members of the Finance Housing and Resources Committee, who also wished more to be done to highlight that unsolicited door-to-door selling of loans is an offence.

Councillor Dave Fallows, Chair, Finance Housing and Resources Committee, said: �I have very grave misgivings about the ease with which people can borrow money and the very high rate of interest they pay for the privilege. In many cases, it places the poorest people in our society in even greater debt.

�I will be urging the powers that be to introduce legislation that curbs the level of interest payday lenders can charge for their loans. The Council will also be seeking to hold discussions with Hi Scot Credit Union to identify what steps can be taken to increase their Highland membership of 350 and promote the benefits of saving, borrowing and planning via a credit union.�

Hi-Scot Credit Union details can be found on their web site at -

http://www.hi-scot.co.uk/

Wick Highland Councillor Bill Fernie is a volunter unpaid director of the Hi-Scot credit union said, "We offer a safe haven for savings and those savings are protected in the same way as any bank deposits. We also offer our members access to low cost loans that are very competitive - probably one of the best places to borrow any place after your family.

"We have been growing slowly trying to make sure we could meet and balance the demands from savers and borrowers. We have a very good balance sheet now."

"Savers do not get interest but get paid dividend at the end of each financial year. However our dividned has been very competitive and is likely to be about one and half percent compared to half a percent in interest in many other savings accounts."

"Savers not only help their own financial position but allow the credit union to offer low cost loans to others in our community."

" We have been very efficient and kept our running costs to a minimum and we use post offices to access accounts making it easy for anyone to use the credit union once they have membership."

"We have not spent huge amounts o n advertising and marketing but we are now increasing our leafleting and visits by our tiny team of staff."

"We now have a mobile office comliments of Barclays Bank and that will be touring around giving advice on joining the credit union"

"If peeople begin to make savings with the credit union they will soon see that a credit union is a form of cooperative that really works for all its members, savers and borrowers. I hope many more people wil consider joiing to boost the funds and get a great deal and help the community and perhaps some individuals heading to the high cost lenders."

"Check it all out on the web site where you can see the cost of loans and then think how much cheaper it is to borrow from the credit union."

More About Hi-Scot Credit Union

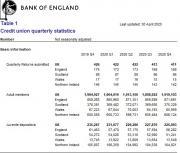

The credit Union has now been operating for 7 years. The first years accounts show generated income of �10,000, this year�s accounts show generated income of �180,000. The Credit Union is entirely self-funded � i.e. does not receive any grant support � and this year the Credit Union has covered it�s operating expenses with its own generated income. The target for the next 12 months is to generate a larger surplus to allow us to start strengthening the balance sheet.

The Credit Union has issued �4 million in loans since it opened. It is anticipated that the Credit Union will lend in excess of �1m this financial year.

Much of this lending has been for those who have difficulty accessing affordable credit elsewhere. �1 million has formally flagged as lending to the �financially excluded�. Highland Council, through the Fairer Scotland fund, has underwritten �600,000 of this. The Fairer Scotland money will underwrite many millions of pounds worth of loans in the years to come.

Retained loan balances are currently �1.3 million. Retained deposits are currently �2.1 million.

The Credit Union has 2,250 members. 358 of these live or work in the Highland region. It is anticipated the Credit Union will attract between 400 and 500 new members in this financial year.

Related Businesses