DISPOSABLE INCOME FOR SCOTTISH FAMILIES HITS £200 PER WEEK MILESTONE FOR THE FIRST TIME

27th July 2016

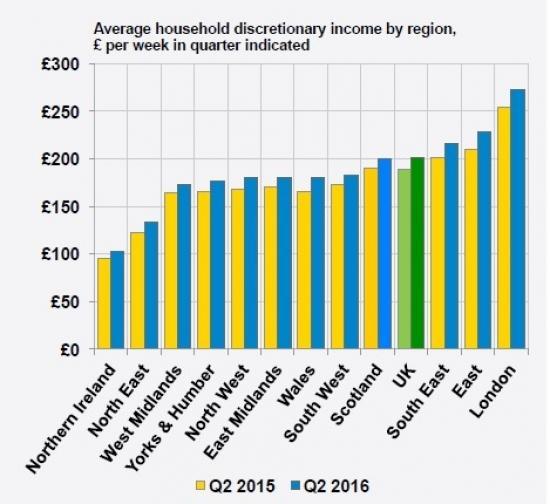

· The average Scottish household had a weekly disposable income of £200 a week last quarter, an average of £10 more than in Q2 2015.

· Scotland's spending power grew 5.1% on the same period last year, with discretionary income reaching £200 per week

· In comparison to the rest of the UK, Scotland still remains at the bottom of the regions in terms of the rate of spending power growth.

· The rate of unemployment across the country has improved in recent months but still remains above the level seen across the UK as a whole.

Families across Scotland welcomed another rise in spending power in Q2, with average discretionary income reaching £200 a week for the first time, according to Asda's monthly Income Tracker.

The latest figures revealed that families enjoyed an extra £10 a week on average in Q2, compared to the same period last year.

Contributing to the boost to Scottish's bank accounts was the continued momentum of the labour market. Unemployment across the country has improved in recent months but still remains above the level seen across the UK as a whole. In addition, wage growth across the country remains more muted than in other parts of the UK.

After slowing for three consecutive quarters, growth in average discretionary incomes in Scotland rose in Q2 2016, reaching 5.1% year-on-year.

Transport costs provided upward pressure on overall levels of inflation, following an increase in the cost of airfares for flights within Europe, as well as a rise in the price of petrol (2.3p per litre) and diesel (2.6p per litre) between May and June.

While essential item inflation remained in negative territory at -0.1%, the falling cost of food and drink helped to ease pressure on purse strings, with prices declining by 0.4% between May and June. In addition to this, larger household expenses such as mortgage interest payments - which fell by 0.2% over the same period - also provided some respite for UK families.

Taking a look across the nation, Welsh households saw the fastest growth in gross income (2.8%) in the second quarter of the year. In further good news, those in the North East welcomed a sharp decline in unemployment in the latest quarter which subsequently saw household income levels boosted by 2.2%. These factors helped raise spending power in these areas significantly, equating to an additional £15 per week in Wales and an extra £11 per week in the North East.

In contrast, there was a sharp fall in spending power growth in the West Midlands, falling from 7.5% to 5.4% between the first and second quarter of the year, attributed largely to a cooling across the region’s labour market in recent months.

Further insights from Asda’s Income Tracker highlighting movements in income levels across the nation revealed that:

· Households in London saw slower rates of spending power growth compared with the national average, however average discretionary income across the capital (£272) remained well above other UK regions

· Strong growth in the East of England continues to narrow the gap with London, with the region seeing positive growth (£18 per week) for the third consecutive quarter

· Households across Northern Ireland experienced the smallest uplift in income in the latest quarter, with discretionary income reaching £103 a week

Sam Alderson, Economist, Cebr, said: "Whilst the latest data shows a slight slowing in spending power growth, we continue to see a picture of broad increases in discretionary incomes across the country."

"In the uncertain economic environment the UK now faces, the gains in spending power seen in recent years cannot be understated. Whilst consumers have understandably lost some confidence in recent weeks, improved finances should provide some support in navigating the uncertain outlook."

An Asda spokesperson said: "While a rise in consumer price inflation and transport costs influenced the overall growth in consumer spending power, families across Scotland continued to enjoy some buoyancy in their bank balances last month thanks to a continued fall in essential items and steady levels of wage growth.

“Building on this, record levels of employment across Scotland have also boosted confidence, and it’s pleasing to see that this particular trend has led to an upward swing in income growth across the country.

“With June’s Income Tracker continuing on the positive incline we have been used to over the last year and a half, it remains to be seen how recent events will affect disposable income in the coming months."

The full report is available here: https://protect-eu.mimecast.com/s/Z1bUBkdZwoix