2017/2018 Council Tax

20th February 2017

From 1 April 2017 the Scottish Government is changing the basis on which properties are assessed for Council Tax and this will increase the charge for Council Tax properties that are banded E to H.

The Highland Council has no discretion in this matter and must apply these increases to the Council Tax charges from 1 April 2017. Households living in properties in Bands A-D are not affected by these increases.

Further information on the Council Tax increases by the Scottish Government can be found on their website at:

• www.gov.scot/Topics/Government/local-government/17999/counciltax

To check what band your property falls under visit the Assessor's web site at:

• www.saa.gov.uk/

Queries relating to Council Tax Bands must be made to the Assessor by emailing assessor@highland.gov.uk or by phoning 01463 703311.

In addition to the increase in Council Tax set by the Scottish Government on properties falling within Bands E to H, The Highland Council has been given the flexibility to increase Council Tax on all properties, Bands A to H, by up to 3% from 1 April 2017. Council Tax legislation, set by the Scottish Government, determines any increase must be applied to all Bands in A to H.

At the meeting of the Highland Council on 16 February 2017 it was agreed to increase Council Tax on all properties by 3% from 1 April 2017.

Council Tax for 2017/2018 can be found at: www.highland.gov.uk/downloads/download/525/council_tax_rates.

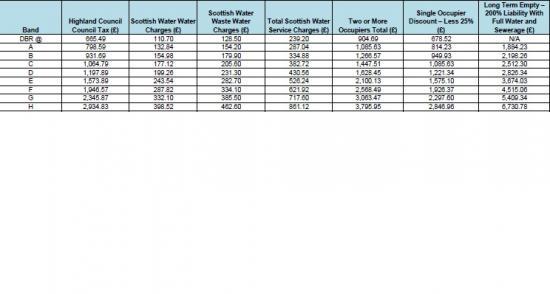

Scottish Water and Waste Water Service charges are also shown and these charges are set by Scottish Water.

A comparison of Council Tax Charges between 2016/2017 and 2017/2018 can also be found at www.highland.gov.uk/downloads/download/525/council_tax_rates

If households would like support with their personal budgeting they should contact the Council's Welfare Support Team at welfare.support@highland.gov.uk or by phoning 0800 0901004. This support includes checking and claiming your entitlement to all benefits.

Alternatively households may wish to contact their local Citizens Advice Bureau which provides a service on behalf of the Council to help individuals and households manage debts.

Financial assistance is available for those on low incomes to reduce their Council Tax bills. This is called Council Tax Reduction. A leaflet providing details of this relief can be found at www.highland.gov.uk/counciltax

Households already in receipt of Council Tax Reduction will have their entitlement automatically recalculated.

Households can check whether they are eligible for assistance by completing the Highland Council’s innovative ‘Apply Once’ online application form at www.highland.gov.uk/applyonce

This form will also automatically identify any other entitlements that are administered by the Council based on the individual’s circumstances. Households supply their details only once and the Council will put into payment all entitlements that are legitimately available to them.

The 82,000 households who are currently paying their Council Tax by Direct Debit do not need to cancel or change their existing payment amount as this will be updated automatically from 1 April 2017. Households who wish to set up a Direct Debit for payment of their Council Tax can do so at www.highland.gov.uk/counciltax.

Related Businesses