Scottish Government Launches ‘people, Not Profit' Campaign

14th November 2018

Scottish Government Launches ‘people, Not Profit' Campaign To Support The Scottish Credit Unions Sector.

The ‘People, Not Profit' credit unions campaign has been launched by Aileen Campbell, Cabinet Secretary for Communities and Local Government today (Wednesday 14 November 2018), as results of a new survey reveal that one in five (20%) people in Scotland have not heard of a credit union.

The launch was held at the Capital credit union in Edinburgh during Talk Money Scotland Week (12-18 November 2018).

www.improvementservice.org.uk/talk-money-scotland-week-2018.html

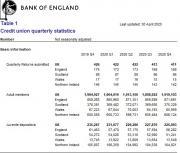

Currently, around 400,000 people across Scotland are part of a credit union; approximately 7% of the population. The campaign seeks to support the growth of the sector by raising awareness of credit unions and the services they offer to a wider and more diverse audience.

A recent survey revealed that one in five (20%) people in Scotland had not heard of credit unions, and only two fifths (39%) questioned thought they would be eligible to be a member of a credit union. The survey also found that one in four people (28%) wrongly believe that credit unions make profits for shareholders, just like banks.

The campaign will highlight that credit unions are not-for-profit organisations providing loans and savings, and that most people living in Scotland would be eligible to join at least one credit union based on where they work or where they live. A new website www.CreditUnions.scot has been launched to help people find out which credit union they could be a member of.

http://www.creditunions.scot/

Aileen Campbell, Cabinet Secretary for Communities and Local Government commented: "In helping build a fairer Scotland, we want to protect people from getting into unmanageable debt and falling into the hands of predatory, high cost lenders. A key part of this is making sure that people are aware of the financial services and fair alternatives available, including credit union membership.

"Our new campaign will highlight the benefits of joining a credit union and I would encourage everyone to visit the new website to find out more."

Michael Sheen, actor and social activist, has also worked with the Scottish Government to produce a short video explaining what a credit union is. He added: "I'm very pleased to be backing the People, Not Profit campaign, and I share the Scottish Government's ambition to grow and raise awareness of this sector. I'm a member of a credit union myself, and so I know first-hand the benefits they offer. What's important to me is that they are owned by the people who actually use their services, and any profits that they make are invested back into the credit union."

The ‘People, Not Profit' advertising campaign features outdoor, social media, digital and radio advertising.

The campaign has been developed in partnership with the credit unions sector in Scotland. The development of the campaign was also shaped via research and testing with representatives from the target audience.

For more information visit www.CreditUnions.scot.

About Credit Unions

Credit unions are not-for-profit organisations. They are owned by the people who use their services, and not by external shareholders or investors. Any profits are invested straight back into the Credit Union to keep interest rates on loans and savings competitive.

All credit unions offer savings accounts and loans. Many offer additional products such as junior savings accounts, Christmas savings accounts, prepaid debit cards, insurance products, cash ISAs and mortgages.

Membership of a credit union is based on a common bond e.g. working for a particular employer or in a certain industry, or simply living or working in a specific area, and so the majority of people living and working in Scotland are eligible to be a member of a credit union.

Visit www.CreditUnions.scot to find out more.

Hi-Scot Credit Union covers Highlands and Islands - www.hi-scot.com

There may also be a credit union for you attached to your employment such as the police etc.

Some employer have arrangements with credit unions for regular monthly savings to be deducted from salaries so check with your employer. Employers can easily have this set up by contacting a credit union.

Credit Unions pay an annual dividend on savings instead of interest.

Credit unions do not charge their members transaction fees. Since the interest is charged only on the outstanding balance of the loan, you will pay even less if you repay in a shorter time than planned.

Credit unions do not charge their members transaction fees. Since the interest is charged only on the outstanding balance of the loan, you will pay even less if you repay in a shorter time than planned.

It pays to be a member and to have at least £250 of savings to get access to the lowest interest rates on loans.

Free life insurance on all loans is one of the many benefits of borrowing from a credit union. So no problems for your family if you die.

Related Businesses