FCA reveals findings from first cryptoassets consumer research

13th March 2019

The Financial Conduct Authority (FCA) has published two pieces of research looking at UK consumer attitudes to cryptoassets, such as Bitcoin or Ether. The research includes qualitative interviews with UK consumers and a national survey.

The qualitative research indicated some potential harm, including that many consumers may not fully understand what they are purchasing. For example, several of those interviewed talked of wanting to buy a ‘whole' coin, suggesting they did not realise they could buy part of a cryptoasset. Despite this lack of understanding, the cryptoasset owners interviewed were often looking for ways to ‘get rich quick', citing friends, acquaintances and social media influencers as key motivations for buying cryptoassets.

Both the survey and qualitative research found that some cryptoasset owners made their purchases without completing any research beforehand.

However, despite the general poor understanding of cryptoassets amongst UK consumers, findings from the survey suggest that currently the overall scale of harm may not be as high as previously thought.

73% of UK consumers surveyed don't know what a 'cryptocurrency' is or are unable to define it - those most aware of them are likely to be men aged between 20 and 44. We estimate only 3% of consumers we surveyed had ever bought cryptoassets. Of the small sub-sample of consumers who had bought cryptoassets, around half spent under £200 - a large majority of these said they had financed the purchases through their disposable income.

Bitcoin appears to be the favourite cryptoasset for consumers with more than 50% of the cryptoasset owner survey sub-sample reporting to have spent their money on this product, while one in three [34%] chose Ether.

Christopher Woolard, the FCA's Executive Director of Strategy and Competition commented:'This research gives us evidence we haven't had before about how consumers interact with cryptoassets. This will help us ensure we are acting on evidence as we seek to protect consumers and market integrity. The results suggest that although cryptoassets may not be well understood by many consumers, the vast majority don't buy or use them currently. Whilst the research suggests some harm to individual cryptoasset users, it does not suggest a large impact on wider society. Nevertheless, cryptoassets are complex, volatile products - consumers investing in them should be prepared to lose all of their money.'

The FCA has previously warned that cryptoassets, including Bitcoin for instance, are highly volatile and risky. Many tokens (including Bitcoin and ‘cryptocurrency’ equivalents) are not currently regulated in the UK. This means that the transfer, purchase and sale of such tokens currently fall outside our regulatory remit. This means it is unlikely that consumers will be entitled to make complaints to the Financial Ombudsman Service or protected by the Financial Services Compensation Scheme if things go wrong.

The FCA is working with the Government and Bank of England, as part of a UK Cryptoassets Taskforce, to understand and address the harms from cryptoassets and encourage innovation in the interests of consumers. The FCA is currently consulting on guidance to clarify the types of cryptoassets that fall within the existing regulatory perimeter. Later this year the FCA will consult on banning the sale of certain cryptoasset derivatives to retail investors. HM Treasury is also exploring legislative change to potentially broaden the FCA’s regulatory remit to bring in further types of cryptoassets.

Research

How and why consumers buy crypto assets -

https://www.fca.org.uk/publication/research/how-and-why-consumers-buy-cryptoassets.pdf

Cryptoassets: Ownership and attitudes in the UK

https://www.fca.org.uk/publication/research/cryptoassets-ownership-attitudes-uk-consumer-survey-research-report.pdf

What we found

Many consumers see cryptoassets as a fast-track to easy wealth

Consumers purchasing cryptoassets are often looking for ways to ‘get rich quick’. Many of those interviewed by the Revealing Reality researchers perceived cryptoassets as a shortcut to easy money and wealth. They often cited influence from others, including social media, as motivation for investing.

Many consumers may not fully understand what they are purchasing

Revealing Reality found many consumers overestimated their knowledge of cryptoassets. Several of those interviewed talked of wanting to buy a ‘whole’ coin, not realising that they could buy just part of one.

Many consumers seemed to have a sense that they were investing in tangible assets, due to the language and imagery associated with cryptoassets, such as ‘mining’ and ‘coin’.

There are signs that cryptoassets are accompanied by risky behaviours

Consumers’ initial engagement with cryptoassets is often prompted by the advice of a few, influential recommendations. However, many told the qualitative researchers that they were distrustful of mainstream media or official sources of information.

Often consumers don’t complete due diligence prior to purchasing. Several consumers interviewed told Revealing Reality that they hadn’t completed much, or any, research on cryptoassets. Similarly, the Kantar TNS survey found (amongst a much smaller sub- sample) that 1 in 6 consumers don’t complete any research prior to purchasing cryptoassets.

Some consumers are aware of risks, including price volatility. But some even say that risk is part of the attraction. Many don’t appear to have any strategy to sell their assets or a sense of what would motivate them to do so.

Anecdotal evidence may overstate harm

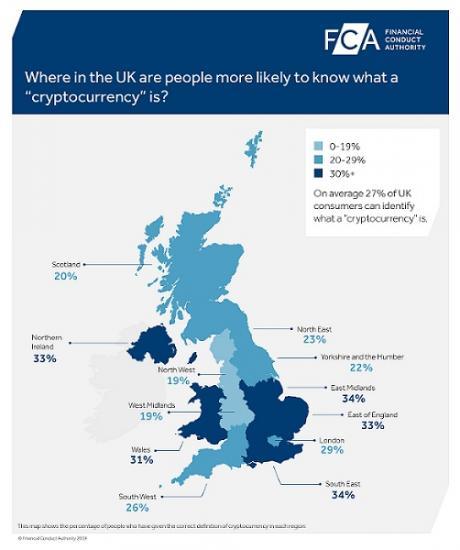

Only a small minority of UK consumers have bought cryptoassets and many do not understand what they are. We estimate that only 3% of those surveyed had ever bought cryptoassets, and 73% of UK consumers don’t know what a 'cryptocurrency' is or are unable to define it. The term is most recognised by men aged 20- 44 years old and in the AB social grade (i.e. middle class and upper middle class).

Consumers generally don’t spend much on cryptoassets and they tend to use their own money. Our survey indicated that, amongst a small sub-sample, around half of those who buy cryptoassets spend under £200. Most use their own disposable income - none of those we surveyed within the sub-sample, said that they borrowed money.

Most consumers who haven’t bought cryptoassets to-date aren’t likely to do so. Of those who had never bought cryptoassets, only one in 100 people told us that they would definitely buy in the future.

About the research

The research provided a wealth of information about consumers’ attitudes and motivations in relation to cryptoassets, but is exploratory in nature rather than conclusive. Whilst Kantar TNS surveyed 2,132 UK consumers, only a minority of those were able to correctly identify what a 'cryptocurrency' is. The number of consumers who reported buying cryptocurrencies was much lower (51) - we should, therefore, be careful with the inferences we draw from these sub-samples.

We used the term 'cryptocurrency' for the purposes of the survey as the term is more widely used. Otherwise, we generally prefer to use the term 'cryptoasset'.