Bank Of England Report Shows Household Borrowing Down And Savings Up

1st March 2021

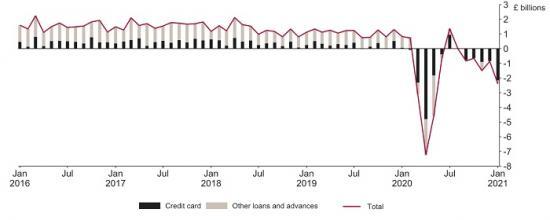

The Bank of England Report published today shows that consumers made big repayments to reduce borrowing and in total reduced borrowing

Lending to individuals

Households' consumer credit weakened in January with net repayments of £2.4 billion. This compares to an average net repayment of £1.0 billion between September and December 2020 and was the largest net repayment since May 2020. The decline reflects less new borrowing. As a result, the annual growth rate fell further to -8.9%, a new series low since it began in 1994.

Within consumer credit, the weakness on the month primarily reflected net repayments on credit cards (£2.2 billion) with some repayments of other forms of consumer credit (£0.2 billion). The annual growth rates of both components fell further, to -19.4% and -3.9%, respectively. For credit cards, this represents a new series low; for other forms of consumer credit, this is the lowest since October 2010.

The ‘effective' rate - the actual interest rates paid - on interest-charging overdrafts bounced back by 31 basis points to 20.82% in January, close to series high in September 2020 (20.86%). Rates on new personal loans to individuals rose slightly to 5.41% but remains low compared to an interest rate of 7.03% in January 2020. The cost of credit card borrowing rose by 27 basis points to 18.03% in January.