UK Budget 2021 And Implications For Scotland

4th March 2021

From the Fraser of Allender Institute of Strathclyde University.

Rishi Sunak's 2021 budget was delivered in three parts.

First were measures taken to continue to protect the livelihoods of individuals and businesses whilst health restrictions remain in place. Many of these measures had been pre-announced, including a six month extension to furlough and to the uplift to Universal Credit. Others, including announcements of further business support grants and extensions of business rates and stamp duty reliefs will have implications for the Scottish budget - discussed below.

The second part was entitled ‘fixing the public finances'. This was where the Chancellor highlighted the need for fiscal restraint in future years, given the likelihood that the economy will be permanently smaller as a result of Covid.

The main measures here were on income tax (where allowances and thresholds will be frozen in 2022/23 and beyond), and on corporation tax, where the headline rate will increase from 19% currently to 25% in 2023. As noted by the OBR, these measures will take tax as a percentage of national income to its highest level since the late 1960s.

But across the budget and November Spending Review in combination, the government has also cut more than £15 billion a year from departmental resource spending plans from 2022-23 onwards, compared to its pre-pandemic plans.

In combination, the tax and spending measures in the Budget will raise £32bn per year by 2025. By this point the OBR forecasts that annual borrowing will have fallen to only £74bn, or 2.8% of GDP, with debt at around 100% of GDP.

Of course, there are huge uncertainties in all of this - on the pace of the economic recovery, the feasibility of the proposed spending plans, and the costs of servicing government debt. The spending plans in particular look ambitious, particularly when we consider that the government has made no allowance for covid-related spending beyond 2021/22 (despite an acceptance that vaccination programmes may be required for some years to come). Whether the plans will be delivered remains to be seen, but for now the Chancellor seems keen to demonstrate he can oversee fiscal consolidation.

The third part of Sunak's speech was about ‘building the future economy'. There were measures to support infrastructure investment, particularly in the ‘green economy’ through a new UK-wide investment bank (replacing the European Investment Bank) and various other measures. The final showpiece announcement came in the form of 8 new freeports in England.

But Sunak’s vision for a ‘future economy’ made no mention of welfare or social security. The uplift to Universal Credit is still seen very much as a temporary policy for exceptional times, the need for which will erode once the economy is back to normal. This was a return to an old normal, rather than the ‘new normal’ that many hoped the pandemic might usher in.

So what were the implications for Scotland?

More consequentials

First, the budget brings with it further Barnett consequentials, boosting the Scottish budget in 2021/22.

The chancellor announced another £1.2bn of Barnett consequentials for the Scottish budget in 2021/22. This is well above the £500m that the Scottish Government had assumed that they would get when the draft Scottish budget was published.

It also comes in addition to the £1.2bn of consequentials announced for Scotland by the UK Government in February. Whilst these consequentials technically related to the 2020/21 financial year, the Scottish Government will be able to transfer this funding into 2021/22.

Since the draft Scottish budget was published therefore, it has been boosted by some £2.4bn. Half of this relates to ‘late’ consequentials for 20/21 that the Scottish Government has chosen to carry into 21/22, and half of which relates to new announcements in today’s budget.

Cabinet Secretary for Finance Kate Forbes has already outlined how the £1.2bn of late consequentials will be allocated in 2021/22 (see Annex B of the Scottish Parliament Finance Committee’s budget report). And of the £1.2bn consequentials confirmed today, £500m had already been accounted for in the draft budget. So that leaves around £700m of new spending allocation. It remains unclear how this remaining allocation is split between resource and capital.

Tax policy implications

The implications on the tax side are less significant, but important nonetheless.

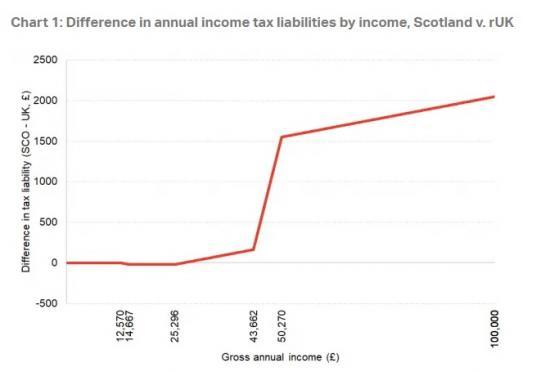

UK income tax personal allowance and thresholds were unchanged from those trailed in November. As such, the difference in tax liability between Scotland and rUK in 2021/22 remains unchanged (see chart).

Fraser of Allender web site - https://fraserofallander.org/