The Chancellor Should Reform Alcohol Taxes In The Budget

24th October 2021

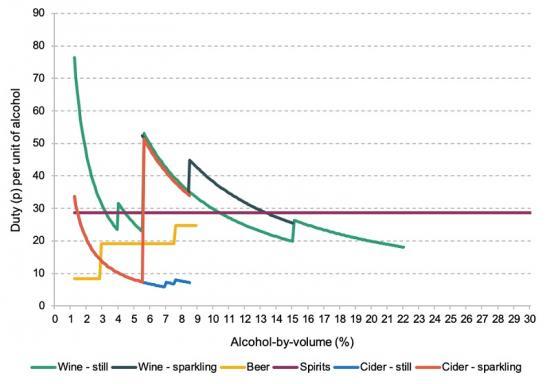

Press reports suggest that the Chancellor is planning an overhaul of the UK's system of alcohol duties. The current system, which raises about £12 billion a year, is certainly ripe for reform. Figure 1 shows that the duty per unit of alcohol varies massively depending on alcohol type, whether it is still or sparkling, and how strong it is. Depending on the strength of the alcohol the most tax efficient way to drink can be beer, or cider or still wine (but not spirits or sparkling wine). There is no good reason for such incoherence.

The rationale for levying duty on alcohol is that drinking creates costs to society not wholly borne by the drinker. These include the public health costs of treating alcohol-related disease, drink driving and anti-social behaviour. If every drink consumed created the same amount of "social costs", then a well-designed system would tax each unit of alcohol at the same rate - this would correspond to a flat line on Figure 1, with no variation across type or alcoholic strength. This is precisely the system we have for taxing spirits. Currently, the average tax rate on alcohol is just under 20p per unit. If we taxed all drinks at this rate, then cider would become more expensive, while wine and spirits would be cheaper.

Notes on Fig 1: Each line shows the duty per unit of alcohol (10ml of ethanol) for different types of alcohol depending on its alcohol-by-volume content, shown on the horizontal axis.

However, there is evidence that a large fraction of the social costs of drinking are generated by "heavy" or "problem" drinkers. When this is the case, the tax system can better target these social costs by levying higher rates on drinks preferred by heavy drinkers. In a recent paper, IFS researchers showed that a reform that increases the tax on high-strength spirits and brings the tax on cider in line with that on beer would more effectively target heavy drinking than the current system.

An important part of such a reform involves taxing drinks in proportion to the amount of alcohol that they contain. Although we currently do this for beer and spirits, cider and wine are taxed per litre of product sold. This means that the tax per unit of alcohol is lower for higher strength products - this is why the lines for wine and cider are downward sloping in Figure 1. To date, the UK government's ability to reform this aspect of alcohol taxation has been limited by EU requirements on how alcohol is taxed. Now that we have left the EU, there is an opportunity to improve the system.

It is worth emphasizing that main reason to do so is to more effectively target problematic drinking, while limiting the impact of price rises on consumers. It should also be remembered that because these taxes are levied on all drinks consumed in the UK they do not affect producers' ability to export their products. In addition, alcohol duties should not be used to "help" domestic producers - if people prefer drinking champagne to Kent sparkling wine, then tax should not be used to distort these choices. And while some features of the current tax system - such as preferential rates on cider - are designed to help British apple growers, they also act to discourage beer drinking, making British brewers worse off than would otherwise be the case.

The government should stop trying to favour certain parts of the industry, instead focusing on removing distortions and creating a simpler system of alcohol taxes targeted at socially costly drinking. If the Chancellor announces such a system of alcohol taxation in his Budget on October 27, then that's something we should raise our glasses to.

This article was first published at the Institute for Fiscal Studies

See the original at https://ifs.org.uk/publications/15761