Budget measures bring number of families entitled to Universal Credit to 7 million

10th November 2021

The Institute for fiscal Studies article outlines the changes to universal credit form the recent budget.

Universal Credit (UC) has been steadily rolled out since 2013, with 4 million families1 now claiming it, but several million still on the older ‘legacy' benefits that it is replacing. The Budget saw the Chancellor make some tweaks to the system which will (when UC is fully rolled out) increase annual spending by about £3 billion.

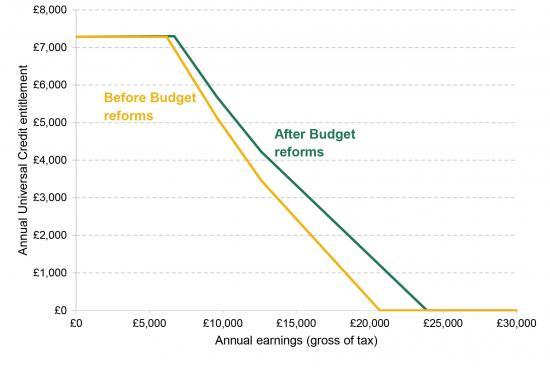

The fundamental structure of the benefit is relatively simple: a basic entitlement is calculated, based on a number of factors such as whether the claimant is a single or couple, how many children they have, how much rent they are liable for (if any), and whether they have any disabilities. That basic entitlement is the amount that they get if the claimant's family has no other source of income2. Some claimants (those with children or disabilities) are entitled to a ‘work allowance' - an amount they can earn without losing any UC. As they increase their (total family) earnings above the work allowance they see their UC steadily tapered away. This can be seen in Figure 1, which shows annual UC entitlements for an example family (a lone parent, with one child, who owns her own home) both before and after the Budget changes. Prior to the Budget, an extra £1 of (after-tax) earnings reduced UC entitlements by 63p. The Budget reduced that to 55p, and raised work allowances (for those already with one) by £500 per year.

There are two things to note from the figure. First, the Budget reforms increase incomes by significant amounts for those in work; if this example lone parent homeowner worked full-time at the National Living Wage, her UC entitlement would go up by £940 per year. Among all working families entitled to UC, the average increase in income from the reform is £1,100. Second, the reforms also mean that UC stretches further up the income distribution. Before the Budget, a lone parent in this situation could earn up to £20,700 per year before losing all entitlement to UC. After the Budget reforms that figure will rise to £23,900.

Read the full article HERE