Higher Inflation In UK Pushes Debt Interest Spending Up Sharply

28th June 2022

Commentary on the Public Sector Finances: May 2022 from the Office for budget Responsibility.

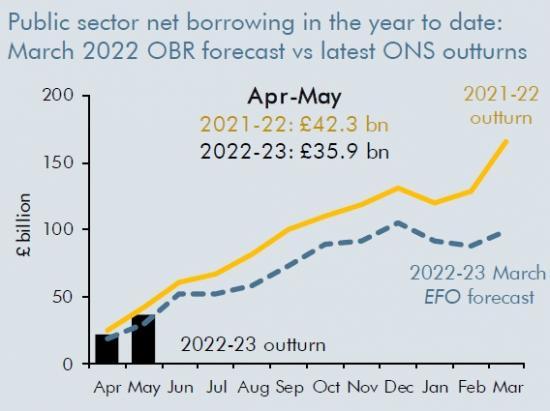

The budget deficit continued to fall in May, with year-to-date borrowing of £35.9 billion down £6.4 billion on last year. But it was £6.4 billion above our most recent forecast profile. This overshoot reflects both lower receipts and higher spending - with debt interest spending in the year to date a fifth higher than forecast thanks to the jump in RPI inflation. With the Bank of England now expecting CPI inflation to reach 11 per cent later this year, debt interest can be

expected to continue to overshoot our forecast.

Headlines

• Public sector net borrowing (PSNB) was £14.0 billion in May and £35.9 billion in the first two months of 2022-23. The latter is down £6.4 billion (15.2 per cent) on last year but £6.4 billion (21.7 per

cent) above our March 2022 forecast profile.

• Central government accrued receipts (excluding PSNB-neutral transfers related to quantitative easing) were £66.6 billion in May, up £5.7 billion (9.4 per cent) on last year but £1.6 billion (2.4 per cent)

below our March forecast. The year-to-date receipts shortfall is £4.0 billion (2.9 per cent).

• Central government spending (excluding PSNB-neutral local authority grants) in May was £69.0 billion, £0.1 billion (0.2 per cent) higher than last year and £3.1 billion (4.7 per cent) above forecast.

Year-to-date spending is £5.9 billion (4.2 per cent) above forecast, reflecting upside surprises in inflation-linked debt interest payments and in spending on goods and services.

• Net debt in May stood at 95.8 per cent of GDP. This is up 0.5 per cent of GDP on a year earlier, but is 0.1 per cent of GDP below our March forecast.

• Revisions: Borrowing in April 2022 was revised up by £3.3 billion thanks to both downward revisions to receipts and upward revisions to debt interest costs and spending on subsidies, partially offset by

lower investment spending.

Detail

1. The Office for National Statistics (ONS) and HM Treasury published their Statistical Bulletin on the May 2022 Public Sector Finances this morning. Each month the OBR provides a brief analysis of the data and a comparison with our most recent forecast - in this instance our March 2022 Economic and fiscal outlook (EFO). We compare the latest outturns with monthly profiles consistent with this forecast that were published on 12 May.

2. Borrowing in April-to-May 2022 of £35.9 billion was down £6.4 billion (15.2 per cent) on the first two months of last year, but is £6.4 billion (21.7 per cent) higher than forecast. This overshoot is explained by both central government receipts, which came in £4.0 billion (2.9 per cent) below profile, and central government spending, which came in £5.9 billion (4.2 per cent) above profile. These surprises were partially offset by borrowing by both local authorities (£2.0 billion below profile) and public corporations (£1.5 billion below profile).

3. The small downside surprise in central government accrued receipts (excluding PSNB-neutral transfers related to quantitative easing) so far in 2022-23 is made up of several modest shortfalls receipts across a range of smaller taxes, although interest and dividend receipts and VAT were, respectively, £1.5 billion and £0.8 billion below profile (the former is a revenue line for which data is more provisional than the taxes collected by HMRC).

4. HMRC cash receipts - the most timely indicator of tax performance, albeit one that can be particularly influenced by one-offs and timing effects - showed a different picture in May to that from April, when factors including stronger-than-expected March bonus payments drove a 9.8 per cent upside surprise. In contrast, cash receipts in May were £1.8 billion (3.2 per cent) below our March forecast profile. This was largely driven by:

• PAYE income tax and NICs cash receipts in May were £0.2 billion (0.7 per cent) below profile. May's cash receipts reflect April 2022 liabilities, which is the first month that the 1¼ percentage point rise in employee and employer NICs rates took effect (as well as the freezing of the personal allowance and higher-rate thresholds). It is therefore possible that some of the unexpected strength in receipts on March pay and some of the unexpected weakness in receipts on April pay reflects forestalling - bringing forward some income - in order for it not to be subject to the higher NICs rates.

• Cash VAT receipts in May were £1.9 billion (15.2 per cent) below profile. These payments relate to VAT liabilities on spending one-to-three months earlier, meaning the latest outturns cover the period from February to April. Cash VAT receipts have surprised on the upside in recent months, so the shortfall may just reflect monthly volatility. The shortfall against profile is mainly due to higher VAT repayments in May rather than lower payments. While higher-than-expected petrol prices directly boost VAT payments (since petrol is subject to the standard rate of VAT), they may also have contributed to record VAT repayments in May (since they raise fuel-related input costs for companies that can claim back VAT). It is still too early to see how the April rise in the domestic energy price cap has affected VAT receipts given the lag between VAT liabilities being incurred and cash payments being made. Our forecast assumes that by switching spending from standard- to reduced-rate goods, the net effect of higher domestic energy prices on VAT receipts will be negative.

• Onshore corporation tax cash receipts were £0.8 billion (46.3 per cent) above profile in May, and £1.5 billion (31.4 per cent) above profile for the year to date. Our forecast assumes that profits growth will slow this year as margins are squeezed by higher energy prices and wages, while use of the super-deduction increases. The surprise could therefore reflect a combination of last year's strong profits and weak business investment continuing to a greater extent than assumed. Many business taxes are paid quarterly and May is not a peak month - June cash receipts, which include payments from very large companies, will provide clearer information on any persistence in higher corporation tax cash receipts.

5. The upside surprise in central government spending (excluding local authority grants) so far in 2022-23 is driven by:

• Higher-than-expected spending on goods and services (£2.9 billion, or 5.0 per cent, above profile). Data on departmental spending remain very provisional at this stage of the financial year and will often reflect plans rather than outturns.

• Higher spending on debt interest costs (£2.5 billion, or 21.6 per cent, above profile), reflecting higher-than-forecast RPI inflation increasing payments on index-linked gilts.

RPI inflation was 11.1 per cent in April and 11.7 per cent in May, respectively 0.6 and 1.4 percentage points above our March forecast. With the Bank of England expecting the CPI measure of inflation to top 11 per cent in October - over 2 percentage points higher than the peak in our March forecast - further significant upside surprises in debt interest spending can be expected through the year.

• These were partly offset by a £4.0 billion (26.3 per cent) shortfall in net investment spending in the year to date. Spending data are still provisional at this point in the year and investment spending tends to be heavily end-loaded within the fiscal year, so it is possible that this could simply be a timing effect that will unwind through the year.

6. Borrowing in April was revised up by £3.3 billion from last month's estimate, thanks to both lower receipts and higher spending. The £0.8 billion downward revision to receipts reflected weaker May cash receipts being accrued to previous months - PAYE and NICs in particular, which accrues to April. The £1.8 billion upward revision to central government spending (excluding local authority grants) reflected higher spending on debt interest and subsidies, partially offset by lower investment.

7. Borrowing in 2021-22 has been revised down by £0.9 billion to £143.7 billion, largely reflecting a downward revision to borrowing by local authorities. This means the like-for-like upside surprise relative to our March forecast has fallen to £8.6 billion. Possible reasons for this difference have been discussed in previous months' commentaries. We will consider it more fully in our next Forecast evaluation report later this year.

8. Borrowing in 2020-21 has been revised down by £7.7 billion to £309.6 billion, thanks to a downward revision to current expenditure to reflect the inclusion of final audited resource accounts for central government departments, including the department for health and social care. The vast majority of this revision (£7.1 billion) relates to expenditure on goods and services.

9. Public sector net debt (PSND) in May 2022 was 95.8 per cent of GDP, up 0.5 per cent of GDP on a year earlier, but 0.1 per cent of GDP below the monthly profile consistent with our March forecast.

Source - https://obr.uk//docs/dlm_uploads/Monthly-PSF-commentary-June-1.pdf