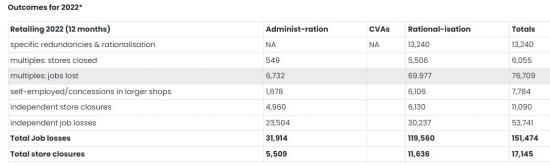

17145 Store Closures And 151,474 Job Losses in 2022

2nd January 2023

Business Rates, Online Competitors, Coronavirus and other misfortunes:

Permanent Crisis. Retailing in most of the Western World has been in crisis for more than ten years. This followed rapid debt-fuelled expansion of shops in the 2000s that pushed up rents in city centres to astronomical levels. This came to an end in the financial crisis of 2008, which led to the collapse of many retailers and store closures. The most famous business failure was Woolworths.

The New Consumer. What followed were changes in consumer behaviours. The challenges to living standards led to more 'shopping around' by consumers and the resurrection of value as part of the purpose of consumption. Even well-off people started boasting about 'Aldi prices' and how good Primark was. In order to regain profitability, many retailers cut staffing and other costs and closed their branches in smaller towns and less prosperous suburbs.

Spending on Leisure Undercutting Retail Sales. Added to the problems caused by over-expansion, high operating costs and competition from online sellers, retailers were also suffering because they were losing their share of consumer spending. Money that would otherwise be spent in shops was going on meals out, short breaks, gym membership, subscriptions to Streaming Channels, foreign holidays and spa, health and wellbeing treatments. Although foreign tourists were visiting Britain in the 2010s, their numbers and spending levels were far below what UK residents spent when holidaying abroad.

We published a report in 2014, Retail Futures 2018, arguing that the growth in online retailing and changing consumer demand would lead to one in five UK stores closing in the next five years. In fact it took 5 years, 6 months for this to happen.

Irresistible Growth of Online Retailing. The growth in online retailing was faster in the UK than any other country. By 2006 the online share of retailing was 6.6%. In 2013 it was 12.7% and 19.2% in 2019. This growth in online market share mainly came at the expense of physical shops. They lost 12.6% of their market in the years 2006-2019. The covid pandemic gave a further boost to online shopping, when many shops were closed or unwelcoming to customers. By the end of 2021, online had captured 26.5% of the UK retail market, although it has fallen back a little since then. By the late 2010s most physical stores had also got into online trading, enabling customers to buy online or phone up and collect instore or have the goods delivered. Ten years ago the online operations of John Lewis Partnership (JLP), now John Lewis & Partners, were equivalent to one of its large department store. By 2021, more than one-half of JLP's business was done online. Even this employee-owned business has had to dispose of part of its portfolio of stores.

The Pandemic. The Coronavirus pandemic has accelerated the pre-existing trends in shopping behaviour. In most countries, including the UK, households were advised to 'work from home', non-essential shops were closed for long periods, and shopping in the remaining stores and malls was made unpleasant. Hygiene and social-distancing rules and the frequent closure or restrictions of hospitality (pubs, coffee bars, restaurants etc) made a day out shopping impossible for part of the year and an obstacle course even when shops were open. Working from home also meant, of course, that employees could no longer 'pop in' to nearby shops or buy goods on their way to or from work. Total sales in London's Oxford Street fell from the usual £10bn pa to £2bn in 2020.

As though this was not bad enough already, each nation became preoccupied with offical death, hospitalisation and infection figures, the necessity of adherence to ever-changing covid regulations and the regular demands for even greater Lockdowns made many people greatly fearful of even passing another person on the pavement. Visiting a shop for some people was tantamount to suicide.

Not only have Coronavirus and government attempts to curb it been a hammer blow against the retail sector during the pandemic, but major parts of the sector will probably remain significantly disadvantaged because consumers have not reverted fully to their pre-pandemic behaviour. This means that footfall in the high street in 2022 was 10%-15% below the level of 2019 (the last full year before covid). Shopper footfall may never get back to the levels of the latter 2010s.

Read more at www.retailresearch.org/retail-crisis.html

See also - www.pwc.co.uk/industries/retail-consumer/insights/store-openings-and-closures.html