Consumer Price Inflation Dips Slightly To 10.5% Overall But Food Prices Rise Again - UK December 2022

18th January 2023

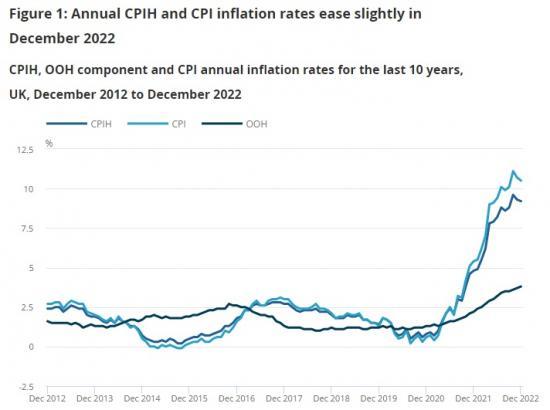

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 9.2% in the 12 months to December 2022, down from 9.3% in November.

The largest upward contributions to the annual CPIH inflation rate in December 2022 came from housing and household services (principally from electricity, gas, and other fuels), and food and non-alcoholic beverages.

On a monthly basis, CPIH rose by 0.4% in December 2022, compared with a rise of 0.5% in December 2021.

The Consumer Prices Index (CPI) rose by 10.5% in the 12 months to December 2022, down from 10.7% in November.

On a monthly basis, CPI rose by 0.4% in December 2022, compared with a rise of 0.5% in December 2021.

The largest downward contribution to the change in both the CPIH and CPI annual inflation rates between November and December 2022 came from transport (particularly motor fuels), clothing and footwear, and recreation and culture, with rising prices in restaurants and hotels, and food and non-alcoholic beverages making the largest partially offsetting upward contributions.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 9.2% in the 12 months to December 2022, down from 9.3% in November and 9.6% in October. Indicative modelled consumer price inflation estimates suggest that the October rate was the highest rate in over 40 years (the CPIH National Statistic series begins in January 2006). In the most recent month however, the CPIH annual rate was equal to the rate recorded just over 30 years earlier, between September and December 1990. The 0.1 percentage point fall in the annual rate between November and December 2022 came as a result of prices rising by less on the month than they did a year earlier: 0.4% in the month to December 2022, compared with 0.5% a year earlier.

The Consumer Prices Index (CPI) rose by 10.5% in the 12 months to December 2022, down from 10.7% in November and 11.1% in October. Indicative modelled consumer price inflation estimates suggest that the CPI rate would have last been higher than the October 2022 figure in 1981 (the CPI National Statistic series begins in January 1989). The slowing in the CPI rate between November and December came as a result of CPI prices rising 0.4% in the month to December 2022, compared with a larger rise of 0.5% a year earlier.

The main drivers of the annual inflation rate for CPIH and CPI are the same where they are common to both measures. However, the owner occupiers' housing costs (OOH) component accounts for around 17% of the CPIH and is the main driver for differences between the CPIH and CPI inflation rates. This makes CPIH our most comprehensive measure of inflation.

Notable movements in prices

The easing in the annual inflation rate in December 2022 principally reflected price changes in the transport division, particularly for motor fuels. There were also downward effects from clothing and footwear, and recreation and culture. The largest, partially offsetting, upward effects came from restaurants and hotels, and food and non-alcoholic beverages.

Transport

The annual inflation rate for transport was 6.9% in December 2022, down for a sixth consecutive month from a peak of 15.2% in June 2022, and the lowest rate since May 2021. The main driver behind the easing in the rate between November and December 2022 came from motor fuels, which was partially offset by rising transport services prices.

Overall, fuel prices rose by 11.5% in the year to December 2022, down from 17.2% in the year to November. Average petrol prices were unchanged between November and December last year, but fell by 8.3 pence per litre between the same two months of 2022. Diesel prices also contributed to the change in the rate, falling by 8.8 pence per litre this year, compared with a smaller fall of 0.1 pence per litre a year ago. Average petrol and diesel prices stood at 155.3 and 179.1 pence per litre in December 2022, and were last lower in February 2022 when petrol stood at 147.6 pence per litre, and in April 2022 when diesel stood at 176.1 pence per litre.

Within the transport category, the easing in motor fuels in December 2022 was partially offset by transport services with annual price rises of 11.3% for passenger transport by road (largely because of coach fares) and 44.1% for passenger transport by air. The annual rate of 44.1% is the largest recorded rate for this class since at least January 1989, when our constructed series begins. Earlier in the year, price inflation for passenger transport by air reached an annual rate of 40.3% in August 2022 and had subsequently been falling. However, the annual rate for December 2022 is an increase of 19.8 percentage points from the previous month.

Clothing and footwear

Prices of clothing and footwear rose, overall, by 6.4% in the year to December 2022, down from 7.5% in November. On a monthly basis, prices fell by 0.3% between November and December 2022. However, in the previous year, the increase in the proportion of our clothing sample that was on sale was smaller than is usually observed, and overall prices rose by 0.7% in the month to December 2021. This is therefore primarily a base effect, as prices usually fall into December each year. Prior to the coronavirus (COVID-19) pandemic, clothing and footwear prices on average fell by 1.3% in the month to December (between 2017 and 2019). The downward effect in 2022 was principally from garments.

Recreation and culture

The annual rate for recreation and culture was 4.8% in December 2022, down from 5.3% in November. The easing in the rate came largely from games, toys and hobbies, where prices were down by 4.8% in the year to December, compared with a fall of 0.5% in the year to November. The movements in this category mostly reflect price changes for computer games, which can sometimes be large, in part depending on the composition of bestseller charts. Short-term movements in the annual rate should therefore be interpreted with a degree of caution. There was a partially offsetting effect from audio-visual equipment (for receiving and reproducing sound and picture), where prices were largely unchanged in the year to December 2022, compared with a fall of 5.3% in the year to November. Typically, prices in this spending category fall on the month to December; 1.8% on average between 2017 and 2019. In 2022, however, prices rose 3.1% on the month.

Restaurants and hotels

Partially offsetting some of the easing inflation rates previously noted, the annual rate for restaurants and hotels was 11.4% in December 2022, up from 10.2% in November. The December annual rate was the highest since the constructed historical estimate of 11.4% in September 1991, and was last higher in August 1991, when it was 11.8%.

The increase in the annual rate reflects price rises of 0.9% between November and December this year, compared with price falls of 0.1% between the same two months in 2021.

The effect came primarily from accommodation services, where prices rose on the month, compared with a fall in the same month a year earlier, particularly for overnight hotel accommodation. Fairly broad-based rises in restaurant and cafe prices averaging 0.7% also contributed to this effect, compared with a smaller rise of 0.5% in the previous year.

Food and non-alcoholic beverages

Food and non-alcoholic beverage prices rose by 16.9% in the 12 months to December 2022, up from 16.5% in November. The annual rate of inflation for this category has risen for 17 consecutive months, from minus 0.6% in July 2021. Indicative modelled estimates suggest that the rate would have last been higher in September 1977, when it was estimated to be 17.6%.

The increase in the annual rate for food and non-alcoholic beverages between November and December 2022 was driven by price movements from 4 of the 11 detailed classes. The largest upward effect came from milk, cheese and eggs, where prices overall rose 4.1% between November and December 2022 compared with a smaller rise of 1.5% between the same two months in 2021. There were further upward effects from sugar, jam, honey, syrups, chocolate and confectionery, and mineral waters, soft drinks and juices that were offset by a small downward effect from bread and cereals. Prices rose in the month to December 2022 for all three categories; however, in the case of bread and cereals, they rose more slowly than in the same month of the previous year.

Latest movements in CPIH inflation

Annual goods inflation rate eases but services and core inflation rise in December 2022.

the annual inflation rates for the Consumer Prices Index including owner occupiers' housing costs (CPIH) all goods and all services series, together with CPIH excluding energy, food, alcohol and tobacco (often referred to as core CPIH). The CPIH inflation rate is added for comparison.

The CPIH all goods index rose by 13.4% in the 12 months to December 2022, down from 14.1% in November. The easing in the rate has been led by a downward contribution to the change from motor fuels, with other downward contributions from clothing and footwear, and games, toys and hobbies.

The CPIH all services index rose by 5.8% in the 12 months to December 2022, up from 5.4% in November. It was last equal in September 1992, and is the highest rate since 6.0% was observed in August 1992. The largest upward contribution to the change in the rate between November and December 2022 was from price rises for transport services, and restaurants and hotels.

The core CPIH annual rate increased from 5.7% to 5.8% between November and December 2022. The rate was also at 5.8% in September and October 2022, but was last higher in March 1992, when it was 6.0%.

Note

The above are extracts from the ONS report.

To read the report full ONS go HERE