Housing Outlook Q1 2023 - most challenging conditions for living standards on record

29th January 2023

Over the past year, we have seen some of the most challenging conditions for living standards on record. Not only has the price of essentials such as food and fuel soared, but on top of this many households have also faced significant increases in their housing costs - either due to rising rents or increased mortgage payments linked to higher interest rates. In this first Housing Outlook of 2023, we examine how the cost of living crisis is impacting on working-age individuals' ability to cope with their housing costs.

Drawing on our recent YouGov survey of 10,470 adults in the UK, we find that housing stress is being felt much more widely than during the height of Covid-19. Although the effects of the cost of living crisis are broad-based, they are particularly unequal across tenures. Mortgagors are feeling the effects of higher interest rates, but private and social renters are much more likely to report falling behind or struggling with their housing costs than those buying their own home. Moreover, worryingly high numbers of private and social renters report signs of material deprivation and are resorting to sometimes unsustainable strategies to manage their housing costs.

Government support for those struggling with housing costs today is more limited than during the pandemic. Although the levels of forbearance we saw in response to Covid-19 may not be appropriate today, there is still much that policy could do to ease housing stress. For example, private rents have surged in recent years while local housing allowance (LHA) rates have been frozen, suggesting a rebase is urgently required. Likewise, now is the time to make good on the promise of a pre-action protocol for private renters to ensure that tenants and landlords mediate where renters fall into arrears.

Housing cost pressures are currently more severe than during the pandemic

In this first Housing Outlook of 2023, we look at how the painful combination of rising costs and falling real incomes over the past year have affected both homeowners' and tenants' ability to cover their housing costs. For good reasons, much of the focus to date has been on rising energy costs, but over the past year, housing cost increases have hit households too. Private rents have risen at their fastest pace on record (and new listings have risen by nearly 11 per cent on some market measures) as the supply of rental properties is constrained and demand surging. Social rents have also experienced their largest rise in a decade over the past year, with most housing providers uprating rents by the maximum possible 4.1 per cent. And even homeowners have not been immune: after enjoying decades of rock-bottom interest rates, mortgage rates are also on the rise as the Bank of England continues to hike interest rates.

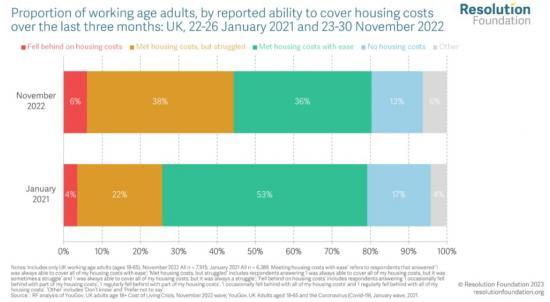

In Figure 1, we use data from our recent YouGov survey of 10,470 adults in the UK to show how all these cost pressures collide.[1] Polling conducted in late November shows clear signs of widespread housing stress: across the working-age population, a larger share of adults had either struggled to meet their housing costs or fallen behind on payments (44 per cent) over the previous three months than those who had been able to meet their housing costs with ease (36 per cent).

To put this into context, the level of housing cost pressure observed in November 2022 was markedly higher than in a wave of our survey conducted at the peak of the second Covid-19 lockdown (January 2021) - despite the fact that a significant portion of the economy was closed at that point. Then, under 4 per cent of working-age adults reported that they had fallen behind on their housing costs over the past three months, a proportion that had increased to 6 per cent in November 2022. But perhaps even more tellingly, a much larger proportion, over one-in-three working-age adults (38 per cent), reported that they had struggled to meet their housing costs over the last three months, a rise of 16 percentage points compared to what we found in January 2021. This is particularly concerning given those reporting that they are currently struggling may be more likely to fall behind with housing payments as the cost of living crisis continues over the coming months.

Renters, single parents and Black and mixed-race adults are most likely to be struggling with housing costs

While the housing cost pressures inflicted by the cost of living crisis are both broad and deep, they are not being felt equally. As shown in Figure 2, renters of both stripes report far higher levels of acute housing stress than their homeowner counterparts. When we look at those facing the most housing cost pressure, one-in-five social renters (19 per cent) and one-in-twelve private renters (8 per cent) reported falling behind on all or part of their housing costs at some point in the last previous three months in November 2022. Meanwhile, homeowners were much less likely to report falling behind with their housing costs, at just one-in-twenty-five mortgagors (4 per cent) and one per cent of outright owners respectively.

Read more HERE