Inflation Dropped To 6.4%

16th August 2023

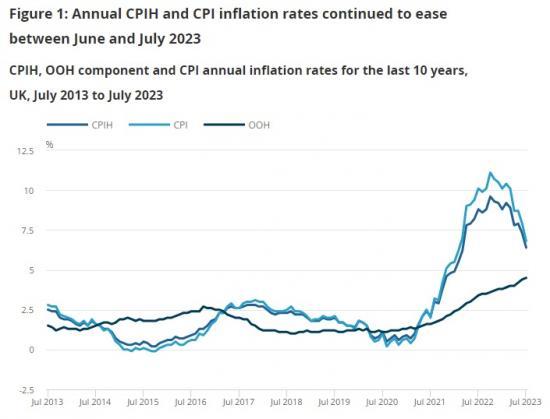

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 6.4% in the 12 months to July 2023, down from 7.3% in June.

On a monthly basis, CPIH fell by 0.3% in July 2023, whereas it rose by 0.6% in July 2022.

The Consumer Prices Index (CPI) rose by 6.8% in the 12 months to July 2023, down from 7.9% in June.

On a monthly basis, CPI fell by 0.4% in July 2023, compared with a rise of 0.6% in July 2022.

Falling gas and electricity prices provided the largest downward contributions to the monthly change in CPIH and CPI annual rates; food prices rose in July 2023 but by less than in July 2022, also leading to an easing in the annual inflation rates.

Hotels and passenger transport by air were the classes that provided the largest offsetting upward contributions to the change in the rate.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 6.4% in the 12 months to July 2023, the same rate as the 12 months to June 2023; the CPIH goods annual rate slowed from 8.5% to 6.1%, while the CPIH services annual rate was 6.5%, up from 6.3% in June.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.9% in the 12 months to July 2023, unchanged from June; the CPI goods annual rate slowed from 8.5% to 6.1%, while the CPI services annual rate rose slightly from 7.2% to 7.4%.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 6.4% in the 12 months to July 2023, down from 7.3% in June, and down from a recent peak of 9.6% in October 2022. Our indicative modelled consumer price inflation estimates suggest that the October 2022 rate was the highest in over 40 years (the CPIH National Statistic series begins in January 2006). The rate in July 2023 was the lowest since March 2022.

The slowdown in the annual rate between June and July 2023 was a result of prices falling by 0.3% on the month compared with a rise of 0.6% a year earlier.

The Consumer Prices Index (CPI) rose by 6.8% in the 12 months to July 2023, down from 7.9% in June, and down from a recent peak of 11.1% in October 2022. Our indicative modelled consumer price inflation estimates suggest that the October 2022 peak was the highest annual inflation rate since 1981 (the CPI National Statistic series begins in January 1997). The rate in July 2023 was the lowest since February 2022.

The easing in the CPI annual rate between June and July 2023 was a result of prices falling by 0.4% on the month compared with a rise of 0.6% a year earlier.

The main drivers of the annual inflation rate for CPIH and CPI are the same where they are common to both measures. However, the owner occupiers' housing costs (OOH) component accounts for 16% of the CPIH and is the main driver for differences between the CPIH and CPI inflation rates. This makes CPIH our most comprehensive measure of inflation. We cover this in more detail in Section 4: Latest movements in CPIH inflation of this bulletin, and provide a commentary on the CPI in Section 5: Latest movements in CPI inflation. We also cover both CPIH and CPI in Section 3: Notable movements in prices, though the figures generally reflect CPIH.

Notable movements in prices

The easing in the annual inflation rates in July 2023 principally reflected price changes in the housing and household services division, particularly for gas and electricity. There were also notable downward effects from food and non-alcoholic beverages, particularly from milk, bread and cereals. Hotels and passenger transport by air provided the largest offsetting upward contributions to the change in the annual rate.

Housing and household services

The Consumer Prices Index including owner occupiers' housing costs (CPIH) annual inflation rate for housing, water, electricity, gas and other fuels was 5.4% in July 2023, down from a peak of 11.8% in January and February 2023 and 7.3% in June 2023. The Consumer Prices Index (CPI) annual inflation rate for housing, water, electricity, gas and other fuels was 6.8% in July 2023, down from a peak of 26.7% in January 2023 and 12.0% in June 2023. This fall is largely because of the lowering of the Office of Gas and Electricity Markets (Ofgem) price cap in July 2023.

The main driver behind the change was gas, with monthly prices falling by 25.2% between June and July this year, compared with a rise of 0.1% between the same two months a year ago. This is the highest recorded fall in the price of gas since the series began in 1988 and meant that gas provided a downward contribution of 0.44 percentage points to the monthly change in the CPIH annual rate. Electricity also provided a substantial downward contribution, with prices falling by 8.6% between June and July this year, compared with a rise of 0.4% between the same two months a year ago. This meant that electricity provided a downward contribution of 0.20 percentage points to the monthly change in the CPIH annual rate.

Other categories provided an offsetting positive contribution to the monthly change in the CPIH annual rate. Actual rentals for housing rose by 1.7% between June and July this year compared with a 0.8% rise between the same two months a year ago. This provided an upward contribution of 0.06 percentage points to the monthly change in the CPIH annual rate and was mostly from registered social landlord rents. Imputed rents rose by 0.4% between June and July this year compared with 0.3% between June and July last year, meaning it provided an upward contribution of 0.02 percentage points to the monthly change in the CPIH annual rate.

Food and non-alcoholic beverages

Food and non-alcoholic beverage prices rose by 0.1% between June and July 2023, compared with a rise of 2.3% between the same two months a year ago. This resulted in an easing in the annual rate to 14.9% in July 2023, the slowest annual rate of growth since September 2022. This is down from 17.4% in June 2023 and from a recent high of 19.2% in March 2023, which was the highest annual rate seen for over 45 years.

The easing in the annual rate was widespread, with 10 of the 11 detailed classes seeing a fall in inflation. Three of the ten classes also saw a fall in monthly price between June and July 2023. One of these categories was milk, cheese and eggs, which provided a negative contribution of 0.04 percentage points to the monthly change in the CPIH annual rate. The annual rate of this class eased to 18.7% from 22.8% in June, while its monthly rate saw a fall of 0.4%. Milk products drove the negative contribution, with the price of whole milk falling 5.8% on the month and the price of low-fat milk falling 3.2% on the month. This resulted in both items together providing a negative contribution of 0.03 percentage points to the monthly change in the CPIH annual rate.

The second-largest downward contribution came from the bread and cereals category, where the annual rate eased to 14.4% from 16.7% in June. Within this category, bread, crumpets, pizzas and breakfast cereals made the largest negative contributions to the monthly change in the CPIH annual rate.

The only category that did not provide a negative contribution to the monthly change in the CPIH annual rate was fish, where the contribution remained the same from one month to the next. Most items in this category made no difference to the monthly change in the CPIH annual rate. Canned tuna provided a small upward contribution, but this was cancelled out by the small downward contribution made by frozen fish fingers.

Transport

Transport was the only division that saw a negative annual rate, with prices falling by 2.1% in the year to July, following a fall of 1.7% in June 2023. Prices rose by 1.3% between June and July this year, compared with a rise of 1.8% between the same two months a year ago.

The negative contribution of 0.04 percentage points to the monthly change in the CPIH annual rate provided by transport was fairly small compared with other divisions. However, some categories provided strong positive or negative contributions that cancelled each other out when the whole division was taken into account.

The largest downward contribution came from motor fuels, where prices fell by 24.9% in the year to July 2023, compared with a fall of 22.7% in June. Average petrol and diesel prices stood at 143.2 and 145.2 pence per litre respectively in July 2023, compared with 189.5 and 197.9 pence per litre in July 2022. Petrol prices rose by 0.2 pence per litre between June and July 2023, compared with a rise of 5.5 pence per litre between the same two months a year ago. Diesel prices fell by 0.5 pence per litre this year, compared with a rise of 5.5 pence per litre a year ago.

The second largest downward contribution came from the purchase of vehicles. Motorcycles and bicycles, and new cars had no effect on the monthly change in the CPIH annual rate. However, used cars made a negative contribution of 0.05 percentage points. The annual rate of the price of second-hand cars eased to 2.3% from 4.6% in June, with prices falling 1.4% on the month.

The largest positive contribution came from passenger transport by air, where the annual rate rose to 29.8%, up from 26.7% in June and the largest rise since May 2023. The monthly rise in price between June and July 2023 was 25.3%, up from 22.3% between the same months in 2022. This led to passenger transport by air providing an upward contribution of 0.06 percentage points to the monthly change in the CPIH annual rate.

Restaurants and hotels

The division with the largest positive contribution to the monthly change in the CPIH annual rate was restaurants and hotels, where the annual rate rose to 9.6% in July, up from 9.5% in June. Much of this was driven by accommodation services, which saw a 12.2% rise in the year to July, up from 11.3% in June. This led to accommodation services providing an upward contribution of 0.04 percentage points to the monthly change in the CPIH annual rate.

Read the full report HERE