Introductory Interest-free Credit Card Offers Dwindle

6th November 2023

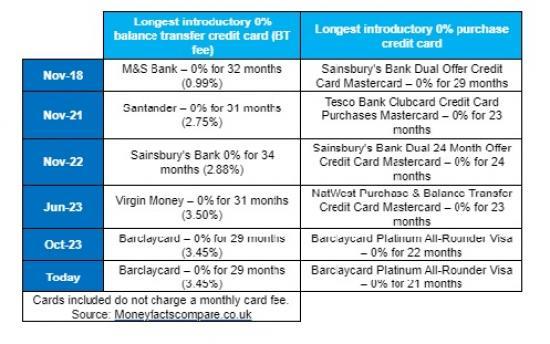

Over the past month, several introductory interest-free offers have been slashed. The latest analysis by Moneyfactscompare.co.uk highlights the movement in the market and the current top offers for consumers looking for a new deal.

Since the start of October 2023, Barclaycard, Virgin Money, MBNA and Halifax have reduced either their 0% introductory purchase or balance transfer offers*.

Over the past 12 months, the length of the top interest-free terms has shortened. The top 0% purchase offer in November 2022 offered 24 months interest-free compared to 21 months today. The top 0% balance transfer offer in November 2022 offered 34 months interest-free compared to 29 months today.

The average purchase APR on a credit card stands at its highest point on Moneyfacts' electronic records of 34.5% APR (since records began in June 2006), so borrowers should be wary when using their existing card to cover the festive spend.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said , "Shoppers considering an interest-free credit card to spread the cost of their purchases would be wise to review the latest offers in the run-up to Black Friday and Cyber Monday this month, as some of the lengthiest 0% offers have been slashed. The top 0% introductory purchase credit card currently offers shoppers almost two years to pay back their debt, which could be a lifeline for those worried about covering the cost of Christmas this year.

"There are only a couple of weeks to go until Black Friday and Cyber Monday, but many retailers have already started tantalising consumers with offers. According to American Express, 41% of shoppers indicated deals and offers would influence their decision to spend more on gifts for family and friends. Covering a rise in any spending may be difficult for some households, especially as they continue to face a cost of living crisis. A credit card should never be used in excess to cover the cost of Christmas, but they can be useful as a short-term method if borrowers stick to a repayment plan to not leave any debts hanging overhead for long.

"Some of the longest interest-free balance transfer offers carry higher transfer fees, but there are still some fee-free offers for borrowers to consider instead. Those borrowers who do not have an interest-free offer on their current deal must be concerned that interest rates within the credit card market have risen, indeed the average purchase rate stands at a record high of 34.5% APR. If someone borrowed £1,000 on a credit card that charges 34.5%, but made £100 in fixed repayments, it would cost them around £165 in interest and take a year to repay. However, if they stuck to repaying £50 per month, it would take twice as long to repay and cost around £400 in interest**."

*Since the start of October 2023: Barclaycard reduced its 21-month introductory interest-free purchase transfer offer to 20 months and its 27-month balance transfer offer to 20 months, with another card reducing its 19-month balance transfer offer to 18 months. Halifax reduced its introductory interest-free 25-month balance transfer offer to 23 months. MBNA Limited reduced its introductory interest-free 19-month balance transfer offer to 18 months. Virgin Money reduced its introductory interest-free 25-month balance transfer offer to 24 months.

**Based on a £1,000 borrowing on a credit card charging 34.5% APR, with a minimum repayment of 2.5% or £5 whichever the greater. Difference in interest based on fixed repayments of £100 or £50.