Scotland's Budget Report Preview - Non-domestic Rates

13th December 2023

Fraser of Allender report.

Non-domestic rates (also known as business rates) are a form of property tax for non-domestic properties, for example commercial and industrial premises. This is a devolved tax, so the non-domestic rates (NDR) differ between Scotland and the rest of the UK - in fact, there are different regimes for each of the four nations.

The amount of tax that a non-domestic property is liable for is determined by three elements:

The rateable value of the property - this is an estimate of the market rental value of a property;

The poundage - this is a tax rate set nationally by the Scottish Government that is applied to the rateable value of the property;

Any reliefs the property is eligible for - these are tax reliefs for properties of certain characteristics that are deducted from the tax bill.

NDR revenues

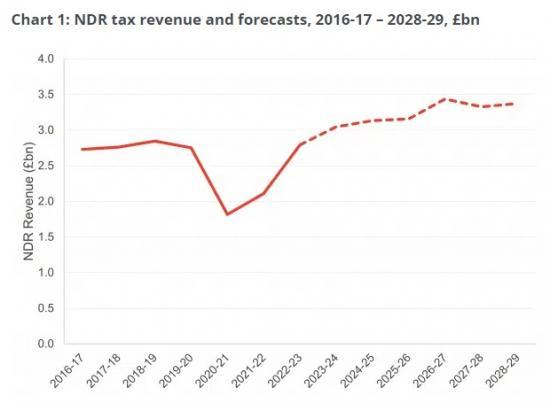

In 2022-23 revenue from NDR totalled £2.8bn. Chart 1 shows that NDR revenue in cash terms has returned to pre-pandemic levels. Revenue dropped during the pandemic in part due to an increase in reliefs, most notably the reliefs for retail, hospitality, leisure and airport properties - which were heavily affected by public health restrictions - and the introduction of the Intermediate Property Rate in 2020-21.

Chart 1 also shows the forecasts for future tax revenues produced by the Scottish Fiscal Commission in May 2023, based on the poundage and reliefs announcements in last year's Budget and the updated valuation roll from the revaluation of rateable values in April 2023. NDR revenue is forecast to grow over the next 5 years to £3.4bn in 2028-29.

While NDR revenue in cash terms has returned to pre-pandemic levels, revenue as a proportion of GDP has not returned to its previous levels (Chart 2). In 2022-23 NDR revenue accounted for 1.46% of GDP, down from 1.73% in 2018-19 and its high of 1.78% in 2016-17. The SFC expects some recovery over the forecast period, but the introduction of the intermediate rate in particular means that revenues as a share of GDP are forecast to remain below the levels in the mid-2010s.

Read the full report HERE