A Deep Dive Into The Latest Labour Market Statistics

14th February 2024

Today (13 February 2024) marks an important milestone for labour market wonks. After being deprived of a full labour market release since early autumn due to data issues around one of the ONS' core surveys, this morning we got (almost) the full set of labour market data up to the end of 2023. The release sheds light on a whole host of important policy issues, from how tight the labour market is to the scale of the rise in worklessness due to ill health. So, what have we found out?

The labour market has continued to cool

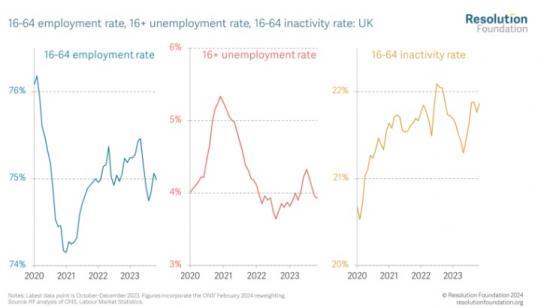

First, the data shows a familiar story on the headline trends: as with the past few months, the labour market has broadly continued to gradually cool, but without a sharp turning point.

We can see this most clearly in vacancies. The number of job openings has fallen for the 19th month in a row, having been going down since the summer of 2022, following a post-lockdown hiring boom. But it's worth bearing in mind that the level of vacancies remains above pre-Covid-19 levels - and the fall in vacancies in the latest period was the smallest since May-July 2022.

The unemployment rate remains low, at just 3.8 per cent. But there is less good news on employment, which has flatlined at around 75 per cent, down from 76.2 per cent on the eve of the pandemic (when the employment rate was also trending upwards). So, unemployment is low, but employment is also low - and that reflects the fact that economic inactivity has continued to rise (more on that later in this blog).

Pay growth is also cooling, but thanks to falling inflation, workers are still getting real pay rises

All else equal, we'd expect a cooling labour market to push down on wage growth, as employers facing less competition for workers come under less pressure to offer big pay rises to recruit and retain staff. And we seem to be seeing some of that. Year-on-year growth in regular pay (excluding bonuses) fell from a peak of 7.9 per cent over the summer to 6.2 per cent at the end of 2023.

Pay growth of 6.2 per cent is still far higher than we're used to - and far higher than the Bank of England is comfortable with. They're worried that in the absence of productivity growth, firms will have to pay for wage rises by putting up prices, fuelling further inflation. But looking at shorter-term changes could provide some solace. Focusing here on private sector pay (which is what matters for inflationary pressures), pay growth over the three months to December 2023 grew by the equivalent of just 2.5 per cent a year. This is far closer to levels the Bank thinks are consistent with inflation staying close to its 2 per cent target.

And there's good news for workers as well as the Bank: workers are seeing real-terms growth in their pay packets thanks to fast-falling inflation. Over the year to Q4 2023, average wages grew by 1.8 per cent in real terms - the strongest growth since October 2019 (ignoring artificially-high growth during the pandemic). Though there are questions about how long this can last in the absence of productivity growth, after a 15-year wage stagnation a return to real wage growth is long overdue.

728,000 more working-age adults are out of the labour force than on the eve of the pandemic

But today's data also highlights the state of a longer-term challenge at the top of policy makers' agendas: the growing number of people who are economically inactive. Since the eve of the pandemic, inactivity among 16-64-year-olds has gone up from 8.6 million to 9.3 million, a rise of 728,000. And with the return of the full labour market stats release, we can now say a bit more about what’s going on, and which groups are most affected.

First, the age profile of the post-pandemic rise in inactivity has tended to be skewed towards older workers (50-64-year-olds, as well as the 65+ age group not shown on this chart), particularly those retiring early. But the youngest age group (16-24) have recently overtaken them: in October-December 2023, 16-24-year-olds accounted for more than half (377,000) the 728,000 rise in economic inactivity since the eve of the pandemic. Some of this might reflect the rise in inactivity due to studying - up 200,000 since the start of the year. But it could also reflect the ongoing rise in health conditions, particularly mental health, among the young.

Second, the majority of the rise in inactivity has been among men, with women accounting for less than a third of the rise. Economic inactivity has always been higher among working-age women than men, and just before the Covid-19 pandemic the rates stood at 24.7 per cent and 16.3 per cent respectively. But since December-February 2020, the rise in inactivity among men has been three times that among women (2.1 versus 0.7 percentage points). This could partly reflect that the one area of inactivity that has bucked the trend and fallen since the onset of the pandemic has been those inactive for caring reasons - a group that is disproportionately female.

Finally, the extent to which we should be worried about rising inactivity depends, in part, on the reasons for that inactivity. (We may not be too concerned, for example, about a rise in people not working due to studying, especially if that reflects people gaining the skills and qualifications to get a better job later on.) But the rise in people too unwell to work is unequivocally a big concern from both a public health and an economic standpoint. In the last quarter of 2023, the number of people not working due to long-term sickness stood at 2.8 million, a record broken only by the previous month’s data which was marginally higher (by 13,000). And although there is a break in the ONS’ data series in mid-2022, there’s a clear upwards trend that shows little sign of slowing.

Note

To read this Resolution Foundation article with graphs go HERE