Richard Murphy Makes Alternative Tax Suggestions Ahead Of The Budget

5th March 2024

Richard Murphy has been working on Wealth report for sometime and amongst many ideas a list of taxes that could yield huge amounts to help in the budget.

The talk in the media is often about income tax and corporation taxes but there many other potential revenue raising places to look seriously at.

The Taxing Wealth Report 2024: a pre-Budget summary

Posted on March 4 2024

From Richard Murphy's blog on 4 March 2024

The Taxing Wealth Report 2024 and the Budget

In anticipation of the UK budget this week, I thought it important to provide a summary of the work that I have been doing on the Taxing Wealth Report 2024.

That report will be published in full shortly. All the recommendations noted below are listed on a single page of the Taxing Wealth Report 2024, from which links to detailed workings are supplied.

Introduction

The Taxing Wealth Report 2024 was written for one primary reason. Its aim was to demonstrate that the claim made by politicians from both the UK's leading political parties that there is no money left to support the supply of better public services in the UK is not true.

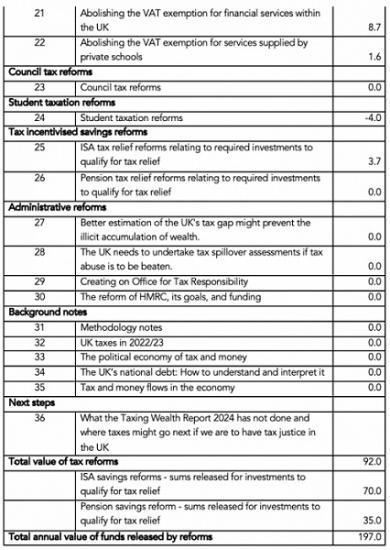

The Taxing Wealth Report 2024 shows that there is the potential to raise around £90 billion of additional tax revenue each year from fairly straightforward reforms to the UK's existing tax system.

All of these reforms would result in additional tax being paid only by those who are better off. Unless a person's income comes mainly from investments or rents, very little of what the Taxing Wealth Report 2024 suggests would have very much impact on them unless their income exceeded £75,000 per year. This would, however, be fair. As the Taxing Wealth Report 2024 shows, those with wealth in the UK are massively undertaxed compared to those who work for a living. Correcting this imbalance is entirely appropriate, simply in the interest of social justice.

Importantly, whilst the detailed workings underpinning the Taxing Wealth Report 2024 have required a lot of research, the ideas implicit in the recommendations made are quite straightforward. So, for example, it is suggested that pension tax relief should only be provided at the basic rate of income tax whatever the highest tax rate of the person making the contribution. If that change was made an additional £14.5 billion of tax would be paid in the UK each year.

It is also proposed that national insurance should be paid by anyone on their earnings from work at the same rate, and that the reduction in that rate that now applies for those earning more than about £50,000 a year should be abolished. This might raise more than £12 billion in tax a year, assuming national insurance rates used in 2023.

If an income tax charge equivalent to national insurance was also made on all those with income from investments and rents or capital gains exceeding in combination £5,000 a year, then that simple change might raise £18 billion in revenue each year whilst removing an obvious injustice within the tax system that has also been widely exploited by those seeking to avoid tax.

Aligning income tax and capital gains tax rates when there is no obvious reason why they should differ might raise a further £12 billion of tax year.

If only HM Revenue & Customs could be persuaded (or funded) to collect tax from all small companies that owe it when at least 30% of that revenue is lost each year at present due to under-investment in its collection, then maybe £6 billion a year of extra corporation tax might be collected, plus as much again in additional VAT and PAYE which is also likely to be lost from those companies not paying the corporation tax that they owe.

Charging VAT on the supply of financial services, almost all of which are consumed by those with wealth, might raise £8.7 billion a year, having allowed for existing insurance premium tax payments.

Numerous other, smaller, tax changes could also be made, whilst some inappropriate charges, like those for student loans that only raises £4 billion a year for what is, in effect a tax, could be abolished.

On top of all this, what the Taxing Wealth Report 2024 also shows is that if the conditions attached to tax-incentivised savings in ISA and pension fund accounts were changed, then up to £100 billion of savings per annum could be transferred from their current speculative use to become the capital that is necessary to underpin the transformation of the UK economy. That money could either be invested in our crumbling state infrastructure, or in the transition that is necessary to beat the impact of climate change. Incentives for such tax-incentivised savings accounts now cost £70 billion a year, which is more than the UK defence budget. Almost no social benefit currently arises from this massive subsidy to wealth. In a country where there are £8,100 billion of financial assets, this transformation will not rock financial markets, but it will transform the future prospects of the UK.

That transformation might come in three ways.

Firstly, and vitally, inequality in the UK might be addressed. The tax owing by those on low pay has to be reduced and the benefits that they enjoy have to be increased if everyone is to have a chance of fully participating in the UK economy without the stress that millions now suffer.

Secondly, if the UK government undertook measures to tackle inequality and simultaneously spent more on recruiting suitably qualified people to supply UK government services of the standard that is now needed to meet our current health, social care, housing, justice and environmental crises, then the boost to household incomes that would inevitably follow would provide the basis for the growth that every government claims to be necessary. Growth cannot come before that spending takes place. It would, as a matter of fact, follow it.

Thirdly, the UK has under invested in its own future for decades, having placed all its savings into the care of the City of London, who have used them for speculative activity rather than for the creation of real economic activity. Correcting that by redirecting tax incentivised savings into investment in the essential underpinning of the economy that we need might, yet again, generate new income for the UK's private sector and households, whilst ensuring that we are equipped for the very different future that we must face.

Having money available will not guarantee that the UK will have a better future. However, without there being money available, that future is not possible. The Taxing Wealth Report 2024 demonstrates that more than enough money is available to transform our society, to increase the incomes of those in need in the UK, to create growth, to stimulate employment, to increase the well-being of our companies, and to underpin the investment that we require. No politician can now say otherwise. The fact is that the choices that they can make are explained in this report. If they do not wish to use the options that it demonstrates are available, it is for them to explain why. However, what none of them can ever claim again is that there is no money left, because it is there for them to ask for whenever they wish to use it, and that is precisely why the Taxing Wealth Report 2024 matters.

Summary of proposals

The Taxing Wealth Report 2024 is made up of a series of proposals for the reform of taxes and the administration of tax in the UK, with some selected supporting explanatory notes also being added.

https://www.taxresearch.org.uk/Blog/2024/03/04/the-taxing-wealth-report-2024-a-pre-budget-summary/

The Taxing Wealth Report 2024 recommendations to date and their suggested value

Yo can sign up for his regular newsletter from his blog at https://www.taxresearch.org.uk/

Read about the Wealth Report HERE

This report will let you see there are many more ideas than our political parties want to deal with.