A Fiscal Drag On Almost Everyone - Left Hand Right Hand Of Taxes

6th March 2024

No matter what is in the UK budget presented by chancellor Jeremy hunt today Fiscal Drag is already in play taking ever more tax from most people.

In the Spring Statement, Rishi Sunak said raising the NICs thresholds would deliver an average saving of £330 in the year from July 2022. OBR analysis in the March 2022 Economic and Fiscal Outlook said the amount saved by taxpayers would diminish until 2025/26 due to NICs thresholds being frozen.

What is fiscal drag?

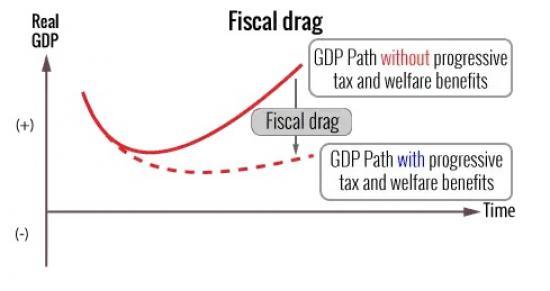

Freezing tax thresholds increases people's taxable income without nominal tax rates actually increasing. This results in additional revenue to the Government. This phenomenon is called ‘fiscal drag', as more taxpayers are ‘dragged' into paying tax, or into paying tax at a higher rate.

Although fiscal drag is not uncommon, its size depends on three elements: the setting of thresholds and allowances (also known as just ‘thresholds'), growth in prices (inflation), and growth in earnings. How thresholds are set is an important determinant of the magnitude of fiscal drag, especially if inflation is high.

Left Hand Right Hand

The freezing of personal allowances is already dragging more people into paying tax and more into paying Higher rates. This effect will continue until 2028 dragging more and more tax from workers and pensioners.

The much rumoured second reduction in national insurance will not compensate for the fiscal drag pulling more moany from people as their wages or other income rises.

How does the Government set tax thresholds?

The process of increasing thresholds proportionally in line with the growth of an index (such as inflation) is called ‘indexation'.

The Government has a policy of increasing certain thresholds each year in line with inflation. This process is known as ‘uprating’. Uprating policies are not always observed. When thresholds and allowances are ‘frozen’, there is an overall increase in tax paid to the Treasury without an actual increase in tax rates.

In the UK, a number of tax thresholds (particularly income tax ones) have been frozen since April 2022, and are currently expected to remain so until April 2028.

Stealth Taxes

Since freezing thresholds raises overall tax revenue without taxes actually increasing, the policy has also been branded as a "stealth tax", as reported by the Observer in its analysis of the 2022 Autumn Statement. Think tanks such as the Resolution Foundation (PDF) and the Institute for Fiscal Studies (PDF) have warned against relying on freezing thresholds for a long time as a way to raise revenue. However, other commentators have argued there is a case for this type of tax measure. An editorial in the Financial Times in March 2022 said that they did not oppose ‘stealth taxes’ in principle, arguing that the thresholds freeze in a high-inflation environment would help raise revenue to cover the cost of Covid-19 schemes. However, they also added that, in a high-inflation environment, the reduction in the real value of people’s incomes would be felt. The Government said that the value of the Personal Allowance is the highest in the G20, and that the Government had almost doubled it since 2010.