Consumer Price Inflation UK - February 2024 - Nudging Down To 3.4%

20th March 2024

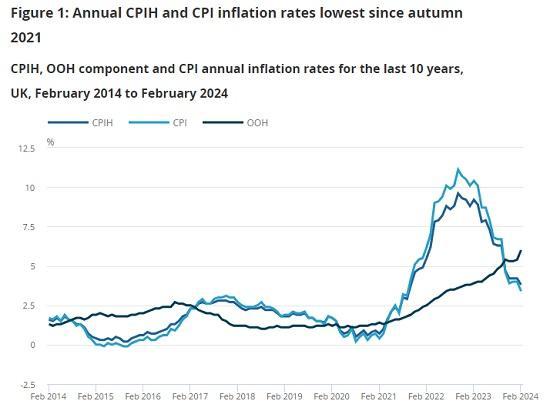

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 3.8% in the 12 months to February 2024, down from 4.2% in January.

On a monthly basis, CPIH rose by 0.6% in February 2024, compared with a rise of 1.0% in February 2023.

The Consumer Prices Index (CPI) rose by 3.4% in the 12 months to February 2024, down from 4.0% in January.

On a monthly basis, CPI rose by 0.6% in February 2024, compared with a rise of 1.1% in February 2023.

The largest downward contributions to the monthly change in both CPIH and CPI annual rates came from food, and restaurants and cafes, while the largest upward contributions came from housing and household services, and motor fuels.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 4.8% in the 12 months to February 2024, down from 5.1% in January; the CPIH goods annual rate slowed from 1.8% to 1.1%, while the CPIH services annual rate eased slightly from 6.1% to 6.0%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.5% in the 12 months to February 2024, down from 5.1% in January; the CPI goods annual rate slowed from 1.8% to 1.1%, while the CPI services annual rate eased from 6.5% to 6.1%.

In line with usual practice at the start of each year, the basket of goods and services, and expenditure weights used in compiling our consumer price inflation statistics have been updated.

This release is the first publication to include improved data from February 2024 on second-hand cars and private rental prices as part of our programme to transform consumer price statistics.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 3.8% in the 12 months to February 2024, down from 4.2% in January and down from a recent peak of 9.6% in October 2022.

Our indicative modelled consumer price inflation estimates suggest that the October 2022 inflation rate was the highest in over 40 years (the CPIH Accredited Official Statistic series begins in January 2006). The annual rate in February 2024 was the lowest since October 2021 when it was also 3.8%.

The easing in the annual rate between January and February 2024 was a result of prices rising by 0.6% on the month compared with a rise of 1.0% a year earlier.

The owner occupiers' housing costs (OOH) component of CPIH rose by 6.0% in the 12 months to February 2024, up from 5.4% in January. This is the highest annual rate since July 1992 in the constructed historical series. OOH costs rose by 0.9% on the month compared with a 0.3% increase between January and February 2023.

The Consumer Prices Index (CPI) rose by 3.4% in the 12 months to February 2024, down from 4.0% in January and well below its recent peak of 11.1% in October 2022. Our indicative modelled consumer price inflation estimates suggest that the October 2022 peak was the highest rate in over 40 years (the CPI Accredited Official Statistic series begins in January 1997). The annual rate in February 2024 was the lowest since September 2021, when it was 3.1%.

The easing in the annual rate between January and February 2024 was a result of prices rising by 0.6% on the month compared with a rise of 1.1% a year earlier.

The main drivers of the annual inflation rate for CPIH and CPI are the same where they are common to both measures. However, the OOH component accounts for approximately 16% of the CPIH and is the main driver for differences between the CPIH and CPI inflation rates.

Notable movements in prices

The easing in the annual inflation rates reflected downward contributions from nine divisions, partially offset by upward contributions from two. Large downward effects from food and non-alcoholic beverages, and restaurants and hotels were partially offset by a large upward effect from housing and household services.

Food and non-alcoholic beverages

Prices for food and non-alcoholic beverages rose by 5.0% in the year to February 2024, down from 7.0% in January. The February figure is the lowest annual rate since January 2022. The rate has eased for the eleventh consecutive month from a recent high of 19.2% in March 2023, the highest annual rate seen for over 45 years.

Prices rose by 0.2% between January and February 2024, compared with a monthly rise of 2.1% a year ago. Prices have been relatively high but stable since early summer 2023, rising by less than 2% over the nine months between May 2023 and February 2024. This compares with a sharp rise of around 22% seen over the previous 14 months between March 2022 and May 2023.

The annual rates for most types of food product eased between January and February 2024, with the largest effect coming from bread and cereals. Overall, prices for bread and cereals rose by 0.3% on the month, compared with a rise of 2.3% between January and February 2023. Prices of packs of cakes and some bread products (for example, white sliced loaves) fell between January and February this year but rose a year ago. The resulting annual rate for bread and cereals in February 2024 was 6.0%, the lowest observed since March 2022.

Other smaller downward effects came from classes such as meat, vegetables, and milk, cheese and eggs. Overall, the annual rate eased in 10 of the 11 food and non-alcoholic beverages classes with oils and fats the exception; its annual rate rising from 8.0% in January to 8.3% in February 2024.

Restaurants and hotels

The annual inflation rate for restaurants and hotels was 6.0% in February 2024, down from 7.1% in January, and the lowest rate since February 2022. On a monthly basis, prices rose by 1.0% between January and February 2024, compared with a rise of 2.0% between the same two months a year ago.

The easing in the rate reflected a downward effect from restaurants and cafes, where prices rose by 0.7% on the month, less than the 2.1% rise between January and February 2023. The downward contribution was largely driven by the prices of alcohol, such as gin, whisky and various beers.

The easing in the annual rate for restaurants and cafes was slightly offset by accommodation services, where prices rose by 5.3% in the year to February, up from 4.5% in January. Within this category, the effect was from overnight hotel accommodation, where prices are collected just before the date of the nominal overnight stay. The price can vary depending on the number of available rooms, resulting in month-to-month volatility.

Housing and household services

The overall easing in the inflation rate was partially offset by an upward effect from housing and household services, whose annual rate was 2.9% in February 2024, up from 2.5% in January. This compares with a recent peak of 11.8% observed in January and February 2023.

The 0.4 percentage point increase in the rate between January and February 2024 reflected upward effects from owner occupiers' housing (OOH) costs and, to a lesser extent, actual rentals for housing, along with electricity, gas and other fuels. OOH costs rose by 6.0% in the year to February 2024, compared with a rise of 5.4% in January.

The annual rate for actual rentals for housing was 6.9% in the year to February 2024, up from 6.5% in January, with the rise between months caused by price increases from privately rented properties. For the first time, we have used our new Price Index of Private Rents (PIPR) as the source of rental prices. This replaces the Index of Private Housing Rental Prices and forms part of our transformation of consumer price statistics - see Section 8: Measuring the data.

Overall prices for electricity, gas and other fuels fell by 18.2% on the year, compared with a fall of 18.4% in January. The rate was slightly smaller as a result of a rise in the price of liquid fuels between January and February this year compared with a fall a year ago.

Transport

Overall prices in the transport division fell by 0.4% in the year to February 2024, compared with a fall of 0.5% in January. The annual rate has been negative for the latest four months.

The small overall change in the annual rate masks larger, partially offsetting movements in some of the more detailed transport categories, with a large upward effect from motor fuels partially offset by smaller downward effects, for example, from second-hand cars, and maintenance and repairs.

The average price of petrol rose by 2.3 pence per litre between January and February 2024 to stand at 142.2 pence per litre, down from 148.0 pence per litre in February 2023. Diesel prices rose by 3.0 pence per litre in February to stand at 151.3 pence per litre, down from 169.5 pence per litre in February 2023. These movements resulted in overall motor fuel prices falling by 6.5% in the year to February 2024, compared with a fall of 9.2% in the year to January.

Second-hand car prices fell by 0.5% between January and February 2024, compared with a rise of 1.1% between the same two months a year ago. On an annual basis, prices fell by 7.3% in the year to February 2024, compared with a fall of 5.9% in January. The annual rate has been negative for seven consecutive months. This month marks the first use of Auto Trader data to improve our coverage of the second-hand car market.

The small downward effect from maintenance and repairs resulted from prices falling by 0.3% on the month this year compared with a rise of 1.4% in 2023. The effect came from prices of roadside recovery services falling this year but rising a year ago.

Read the full ONS report for more information and graphs