Public Sector Finances UK March 2024

23rd April 2024

Borrowing - the difference between public sector spending and income - was £11.9 billion in March 2024, £4.7 billion less than in March last year.

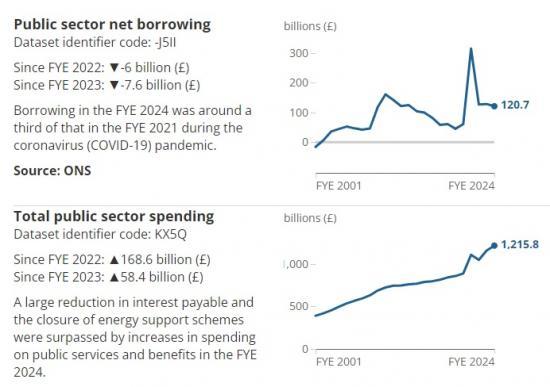

Borrowing in the financial year ending (FYE) March 2024 was provisionally estimated at £120.7 billion, £7.6 billion less than in the same twelve-month period a year ago but £6.6 billion more than forecast by the Office for Budget Responsibility (OBR).

Compared with the annual value of the UK's economy, borrowing in the FYE March 2024 was provisionally estimated at 4.4% of the UK's gross domestic product (GDP), 0.6 percentage points less than in the same twelve-month period a year ago.

The current budget deficit in the FYE March 2024 was provisionally estimated at 1.9% of GDP, 1.3 percentage points less than in the FYE March 2023.

Public sector net debt excluding public sector banks (debt) at the end of March 2024 was provisionally estimated at 98.3% of GDP; this was 2.6 percentage points more than at the end of March 2023, and remains at levels last seen in the early 1960s.

Excluding the Bank of England, debt was 89.4% of GDP, 8.9 percentage points lower than the wider debt measure.

Public sector net worth excluding public sector banks was in deficit by £709.3 billion at the end of March 2024, a £95.8 billion larger deficit than at the end of March 2023.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was £28.3 billion in March 2024, £3.2 billion more than in March 2023, and brings the total for the FYE March 2024 to £158.8 billion.

Central government borrowing

Central government forms the largest part of the public sector and includes HM Revenue and Customs, the Department of Health and Social Care, the Department for Education, and the Ministry of Defence.

The relationship between central government's receipts and expenditure is an important determinant of public sector borrowing. In March 2024, central government borrowed £11.9 billion, £7.0 billion less than in March 2023.

Central government receipts

Central government's receipts were £90.6 billion in March 2024, £6.6 billion more than in March 2023. Of this £6.6 billion increase in revenue:

central government tax receipts increased by £6.0 billion to £68.1 billion, with increases in Income Tax, Corporation Tax and Value Added Tax (VAT) receipts of £3.1 billion, £1.5 billion and £0.8 billion respectively

compulsory social contributions (largely National Insurance contributions) increased by £0.1 billion to £17.4 billion

A detailed breakdown of central government income is presented in our Public sector current receipts: Appendix D dataset.

Central government expenditure

Central government’s total expenditure was £102.5 billion in March 2024, £0.4 billion less than in March 2023. Of this £0.4 billion decrease in spending:

net social benefits paid by central government increased by £3.5 billion to £23.7 billion, largely because of inflation-linked benefits uprating.

central government departmental spending on goods and services increased by £2.2 billion to £36.2 billion, as inflation increased running costs

interest payable on central government debt increased by £0.4 billion to £2.5 billion, largely because the interest payable on index-linked gilts rises and falls with the Retail Prices Index

subsidies paid by central government reduced by £5.5 billion to £2.4 billion, largely because of the cost of the Energy Price Guarantee (for households), as explained on GOV.UK, and the Energy Bill Relief Scheme (for businesses), as explained in GOV.UK guidance, affecting this month the previous year

payments recorded under central government "other current grants" reduced by £2.4 billion to £1.6 billion, largely because of the cost of the previous year’s Energy Bills Support Scheme, as explained on GOV.UK, when six relief payments were made directly to households monthly between October 2022 and March 2023, affecting this month the previous year

Interest payable on central government debt

In March 2024, the interest payable on central government debt was £2.5 billion.

Borrowing in March 2024

The public sector spent more than it received in taxes and other income in March 2024, requiring it to borrow £11.9 billion. This was £4.7 billion less than in March 2023.

The large month-on-month increases in the Retail Prices Index (RPI) since early 2021 led to substantial increases in debt interest payable, with the largest three months on record occurring in 2022 and 2023. The additional interest caused by RPI inflation is described as "‘capital uplift" and affects the value of the gilt principal.

Capital uplift was negative in March 2024, with a reduction of £1.6 billion reflecting the 0.3% decrease in the RPI between December 2023 and January 2024. This decreased the capital uplift on the three-month lagged index-linked gilts (as shown on the UK Debt Management Office website), which make up around three-quarters of the index-linked gilt stock.

Red the full ONS report HERE