How Does Parliament Scrutinise Tax And Spending?

17th July 2024

Today the king will read his speech outlining what the new Labour government will do in the coming year. The government needs to raise money before it can spend it on all of its proposals. The UK parliament library has published on 16 July 2024 a handy guide to how it does it. A link to the often mentioned Barnet formula explains how that works. A link to the full article is at the bottom of this page.

Parliament scrutinises how the government raises and spends money with the Spending Review; the Budget and associated Finance Bill; and the Estimates process.

Parliament plays an important role in scrutinising how the government raises money (primarily through taxation) and spends it (through public spending). Parliament does this primarily through three scrutiny processes: the Spending Review; the Budget and associated Finance Bill; and the Estimates process.

The public finances at the beginning of the new Parliament

Government spending, borrowing and debt

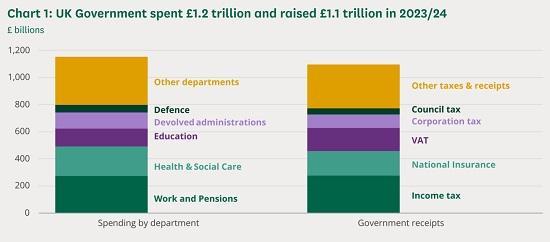

In 2023/24, the UK Government raised £1.1 trillion (mainly from taxes). This is equivalent to £16,200 per person in the UK.

In the same period, government spending on things like public services, state pensions, benefits and debt interest, was £1.2 trillion. This is equivalent to £18,000 per person. A breakdown of receipts and spending is shown in chart 1.

Because the government spent more than it raised in 2023/24, it borrowed £121 billion in 2023/24 to make up the difference. This is equivalent to around £1,800 per person in the UK, or 4.5% of national income, as measured by gross domestic product (GDP).

The government borrows by selling bonds, which are often referred to as gilts. These are essentially interest paying "IOUs", which the government sells to investors.

Broadly speaking, the government's debt is the accumulation of its outstanding past borrowing. Although the government borrows some money in most years, recent crises, including the 2008 financial crisis and covid-19 pandemic, have caused higher spending or lower tax revenues. This has led to increased borrowing and significant increases to government debt.

At the end of 2023/24, government debt was around £2.7 trillion, equivalent to £39,900 per person in the UK. This is equivalent to around 98% of GDP (debt is often expressed as a share of GDP).

Forecasts for government revenues, spending and borrowing

Government revenues, spending, borrowing and debt were all relatively high by UK standards in 2023/24.

In recent years, revenues grew because of policy changes (such as frozen income tax thresholds) and changes in the economy (such as growth in the top earnings and profits for sectors paying more corporation tax). Government spending on debt interest, benefits and staff costs were all higher in 2023/24 than before the covid-19 pandemic. Recent high inflation has played a role in increasing these areas of government spending.

Government debt (as a proportion of GDP) is higher than it has been since the early 1960s, when it was falling following the Second World War.

The new government inherits a target for the debt-to-GDP ratio (debt as a share of GDP) to be falling in five years' time. For this to happen, government borrowing would have to fall from around 4.5% of GDP to closer to 1% of GDP borrowing would have to fall from around 4.5% of GDP to closer to 1% of GDP, according to the latest economic forecasts from the Office for Budget Responsibility.

In March 2024, government revenues were forecast to rise to their highest sustained level since the late 1940s, largely because of changes to income tax and corporation tax. Income tax revenues were forecast to grow to a historic high because of growing earnings and freezes to key thresholds in the income tax system. Onshore corporation tax revenues were also forecast to reach an all-time high following an increase in the main tax rate from 19% to 25% in April 2023 and growing corporate profits.

Based on government plans from before the election, public spending is forecast to fall as a proportion of GDP but to remain higher than the average since the Second World War. The potential implications for departments are explained below.

Parliament's role in financial scrutiny

The public finances cycle consists of:

Spending Reviews, where the government sets spending limits of each of its departments. These occur every few years. Parliament has little formal role in this process.

the Budget, where the government makes and announces tax decisions. This happens once a year.

the Estimates process, where the government presents its plans for public spending. This happens twice a year.

Parliament has an opportunity to scrutinise the public finances in these processes. This scrutiny is supported by independent bodies, such as the National Audit Office and the Office for Budget Responsibility.

The National Audit Office is the UK's independent public spending watchdog. It reports on whether government is delivering value for money and audits the accounts of government departments and other public sector bodies. This helps Parliament scrutinise government spending, largely after it has happened.

The Office for Budget Responsibility is the UK's independent public finances watchdog. It produces the forecasts of the economy and public finances used by the Chancellor in the Budget and other similar fiscal events. It certifies the government's forecasted costs of new policies and looks at the risks facing the public finances. Its reports have information that helps parliamentarians understand how the public finances are performing and evolving.

Public finances cycle: Spending reviews

The government sets spending limits for each of its departments at Spending Reviews. They include both resource (day-to-day) and capital (investment) spending, but do not set limits on demand-driven spending such as benefits.

Spending Reviews typically take place every few years; the most recent Spending Review was in October 2021, which planned out spending up to the end of 2024/25. A new review will be needed early in the 2024 Parliament to give departments certainty about their spending from March 2025.

If a new review has not been concluded by December 2024, this will affect the provisional local government finance settlement. This settlement allocates funding to local authorities for the following financial year and is usually published each December.

There is no legislation governing Spending Reviews and they do not involve any formal role for Parliament, although select committees often scrutinise aspects of each review.

Commentary over future spending plans

Before the election, the government made several commitments regarding the budgets for the NHS, defence, schools, overseas aid, childcare funding commitments, and the resulting increases to Barnett consequentials (see the box for more). These commitments would leave much less money available for the remaining, "unprotected" areas of spending. The Office for Budget Responsibility has estimated that if resource spending follows the path set out in the March 2024 Budget, the unprotected areas of spending would be cut in real terms by 2.3% per year.

In May 2024, the International Monetary Fund said that the existing spending plans do not "sufficiently account for known pressures" in public services. It estimates that resource spending will actually grow at double the rate set by the government, that is, 2% per year.

Devolved administrations' budgets

The Spending Review process relates only to the spending of UK Government departments. Different processes apply to the budgets of devolved administrations, as explained in the following box.

The Barnett formula: Grants for the devolved administrations

The devolved administrations’ budgets (in Scotland, Wales and Northern Ireland) will be determined at the Spending Review largely by the Barnett formula. The funding settlements the devolved administrations receive from the UK Government are widely known as ‘block grants’. The Barnett formula determines the annual change in the block grants.

It works so that each administrations’ block grant is equal to the previous year’s block grant plus a share of changes in UK Government spending on areas that are devolved to Scotland, Wales and Northern Ireland, proportional to population sizes. Broadly speaking, for devolved services, the Barnett formula aims to give each country the same pounds-per-person change in funding.

Public finances cycle: The Budget and the Finance Bill

The Budget and other fiscal statements

By convention, the Chancellor presents the government’s Budget once a year. This is a statement on economic and fiscal policy, setting out major tax and spending decisions. It is accompanied by a Budget report, written by the Treasury.

Following the Budget, the government introduces a Finance Bill to implement the tax measures set out in the statement. For many years the Chancellor has given a second statement on economic and fiscal policy during the course of the financial year. Occasionally the second statement is also followed by a Finance Bill.

Despite its name, the Budget typically makes only small changes to the budgets of government departments. The Spending Review and the Estimates process deal with these aspects of the public finances.

The Office for Budget Responsibility publishes its forecast for the economy and public finances, to accompany both of these fiscal events. This report includes a detailed costing of the government’s individual tax and welfare spending measures.

Additionally, the Commons Treasury Committee’s work usually includes scrutiny over the Budget and other major fiscal statements.

The Library publishes a list of Budget debates and finance bills since 1968, as well as a detailed briefing for each Budget and Finance Bill.

The Finance Bill

Parliament scrutinises the Finance Bill in much the same way as other government bills, although unlike for other bills, the House of Lords has no power to amend it. Before the government introduces the Finance Bill, the House of Commons is asked to approve a series of ‘ways and means’ resolutions. These allow tax measures to come into effect before the bill receives Royal Assent, if this is necessary.

Usually, parties select a limited number of clauses in the bill for debate in a committee of the whole House. The remaining clauses of the bill get debated in a public bill committee, where a number of MPs (usually 17), reflecting the party balance in the House, participate and vote.

Changes to the Budget timetable

In 2017 the Treasury published a new timetable for the Budget and the tax policy making process. This timetable had the Chancellor presenting the Budget in the autumn, then presenting a second statement on economic and fiscal policy in the spring.

In recent years the timing of annual Budgets has not always followed this pattern, and there have been several additional fiscal events.

Public finances cycle: The Estimates process

Parliament authorises the government’s spending plans in the Estimates process, which usually takes place twice a year.

The initial plans are presented in the Main Estimates, which are normally laid before Parliament in May and voted on in July. Towards the end of the financial year (in February and March), the government then presents Supplementary Estimates which update the earlier plans.

When Parliament approves these Estimates, it also approves the Vote on Account, which provisionally approves spending for departments in the first part of the new financial year to tide them over until the next Main Estimates.

Parliament voted on an amendment to the Supplementary Estimates in March 2024, which was the first time this had happened in over 20 years. No such amendment has been approved since 1921.

Parliamentary scrutiny of the Estimates

The Estimates process involves very few opportunities for Parliament to scrutinise and amend the Estimates, and Parliament rarely takes advantage of the opportunities it does have. In evidence submitted to the Procedure Committee in 2018, the Organisation for Economic Co-operation and Development said the UK has a tradition of weak financial scrutiny, at least before spending takes place.

The Commons’ Procedure Committee has looked into options for improving parliamentary scrutiny in recent years, and in 2019 it said that a Budget Committee could be set up to assess whether departmental programmes could be delivered under the spending plans proposed in the Estimates. There has been no attempt since then to set up such a committee.

There is more opportunity for parliamentary scrutiny of the Scottish Government’s, Welsh Government’s and the Northern Ireland Executive’s budgets. For instance, Scottish Committees submit spending proposals which the Scottish Government considers when forming the draft budget. Draft budgets are produced in Wales and Scotland which are scrutinised by the Senedd and Scottish Parliament, respectively, before they are approved.

Read the full article with many links to more information HERE