Is Now The Right Time To Look For A Mortgage Deal?

3rd August 2024

While the decision will be met with relief from many borrowers, the mortgage market has already made optimistic strides over recent weeks.

"Fixed mortgage rates have been falling at a steady pace, with lenders feeling more encouraged to re-price their deals due to positive swap rates," explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

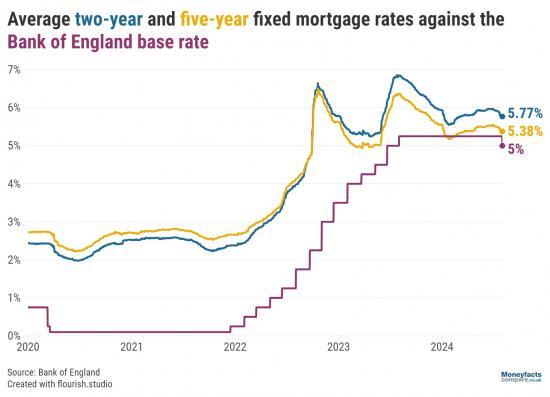

As a result, average two- and five-year fixed mortgage rates decreased considerably month-on-month for the first time since February 2024, and now sit at 5.77% and 5.38%, respectively, Moneyfacts' data today revealed. Furthermore, last month also saw the brief return of sub-4% mortgages for the first time since April 2024.

Nevertheless, those looking to refinance will likely find rates higher than the last time they fixed; the average two-year mortgage charged 3.95% in August 2022, while the average five-year fixed rate was 2.84% in August 2019.

"Borrowers coming off a deal this year must acknowledge that they will need to set aside more of their income to cover higher repayments," urged Springall.

However, with the average Standard Variable Rate (SVR) remaining persistently high at above 8.00%, securing a new fixed deal could still prove more cost-effective than awaiting further reductions while sitting on a lender's ‘revert to' rate.

Indeed, Oliver Dack, Spokesperson for Mortgage Advice Bureau, noted the company had already seen a rise in clients "taking matters into their own hands and proactively considering their options" in the weeks and months prior to today's announcement.

"A cut to the base rate is undoubtedly welcome news for the mortgage market and we hope it incentivises more people to look for a new deal," he said.

"Recently, there's been an increased appetite for shorter-term fixed deals among our clients; it seems people are open to reviewing rates more frequently - especially if they believe there'll be further cuts to the base rate in the not-too-distant future.

"To this extent, we’ve also had more borrowers express interest in tracker mortgages, but it’s important to keep in mind these products can come with a greater number of restrictions and therefore don’t always offer much flexibility. We’d encourage anyone interested in a tracker mortgage to seek advice in order to ensure it’s suited to their circumstances."

Read the full article at moneyfactscompare.co.uk with links to deals and more