Definitions Of Debt And The New Government's Fiscal Rules

9th August 2024

The new government has an ‘ironclad' commitment to reduce government debt. It matters which definition of debt is used for the fiscal rule.

The new government has committed to two main fiscal rules.

The Labour Party manifesto described these ‘non-negotiable' rules as requiring that:

the current budget must move into balance, so that day-to-day costs are met by revenues; and

debt must be falling as a share of the economy by the fifth year of the forecast.

These (self-imposed) fiscal rules are very likely to act as the binding constraint on Rachel Reeves's ability to avoid tax increases or spending cuts in her first fiscal event as Chancellor of the Exchequer later this year. Yet there remains some ambiguity about how these rules will be designed in practice. For instance, over what period must the current budget move into balance? And which definition of debt does the second fiscal rule apply to?

These are technical, even arcane, questions, but could make a considerable difference to the degree of so-called ‘headroom' available this autumn, as measured against those fiscal rules. Given the demands for more spending across the public sector, and her promises not to raise income tax, National Insurance or VAT, Rachel Reeves might be tempted to tweak the rules to give herself a bit more room for manoeuvre. Indeed, recent reports suggest that this is under consideration.

Here, we consider what form these tweaks might take, how much of a difference they might make and whether they would be sensible. We focus largely on the design of the debt target. The upshot is that there is nothing particularly special about the design of the existing debt target - indeed, it leaves a great deal to be desired - and there are justifiable concerns about the interaction with the Bank of England's decisions about the pace of balance sheet reduction (quantitative tightening). Switching to target a different measure of debt might allow for some extra borrowing for investment while continuing to meet the letter of the rule. But a technical change to debt definitions does not change our fiscal reality. If the government wants to run looser fiscal policy - especially to finance additional investment - then it would ideally make that case on its own terms.

Different measures of debt

If the government is committed to having debt falling as a share of the economy by the fifth year of the forecast, it matters how it is defining debt.

There are two main measures of government debt used in the policymaking and forecasting process: public sector net debt (PSND) and public sector net debt excluding the Bank of England (PSND ex BoE). The previous government's debt target - for debt to be falling as a share of national income between the fourth and fifth years of the forecast - was defined in terms of PSND ex BoE (which is sometimes referred to as ‘underlying debt'). One simple change the new government could make would be to instead aim to have headline PSND falling by the fifth year of the forecast.1

There are two key differences between PSND and PSND ex BoE. We discuss each of these in turn.

The Term Funding Scheme with additional incentives for SMEs (TFSME)

The TFSME was a lending scheme launched by the Bank of England in early 2020, offering funding to banks to encourage them to increase lending to small and medium-sized enterprises (SMEs). This followed on from similar previous schemes launched amidst the Eurozone crisis in 2012 and the Brexit referendum in 2016. Drawings from the TFSME peaked at £193 billion in 2021; most of these had a four-year repayment term (though some have since been extended to six- and ten-year terms). The scheme closed for new loans in October 2021.

When the loans were made, the associated liabilities were added to headline PSND (but not to PSND ex BoE). In 2023-24, outstanding TFSME loans were adding around £144 billion to PSND (around 40% more than the £103 billion added by the Asset Purchase Facility, discussed below). Loans under TFSME are ultimately expected to be paid back in full and, as they are repaid, PSND is reduced accordingly.

At no point do loans under the TFSME affect PSND ex BoE. So the TFSME causes PSND to rise more quickly, and then to fall back more quickly, than PSND ex BoE.

Timing of valuation effects on gilts held in the Bank of England's Asset Purchase Facility (APF)

As part of its quantitative easing (QE) programme, the Bank of England bought hundreds of billions of pounds of government bonds (gilts). The Bank is now deliberately shrinking its balance sheet by allowing gilts to mature and by actively selling gilts to the private sector (quantitative tightening, or QT). The crux of the issue (for the question of measuring debt) is that recent increases in interest rates have reduced bond prices, and so the Bank of England is now selling bonds for less than they were worth when they were bought.

Ultimately, what matters from a fiscal point of view is the difference between the price the Bank paid for a gilt (the purchase price) and the price it ends up selling it for (the sale price). These ‘valuation losses' are reflected in PSND and PSND ex BoE at different times.2

Because bonds are traded in markets at a variable price, both the purchase and sale prices are likely to be different from the redemption price (also referred to as the face value: the money the debtor, i.e. the government, promised to pay at the end of the lifetime of the bond). For the headline measure of PSND, the difference between the purchase price and the redemption price of a gilt is recognised at the point when the gilt was purchased (i.e. if a bond with a redemption price of £10 was purchased for £12, PSND increases by £2 at the point of purchase, to reflect the difference between the two). Any further loss is recognised in PSND at the point of sale as the difference between the redemption price and the sale price (so if the same bond was eventually sold for £7, PSND would increase by a further £3 at that point). In contrast, valuation losses appear in PSND ex BoE all at once, at the point when the Bank calls on its indemnity with the Treasury, which often occurs with a lag (in the above example, this would lead to a £5 increase - the difference between the purchase price of £12 and the sale price of £7 - in PSND ex BoE at the point when the indemnity is called).

The upshot is that both PSND and PSND ex BoE will eventually reflect the same valuation losses associated with a given gilt purchase and sale but will do so at different times. Valuation losses associated with QT are scored later, and more abruptly, in PSND ex BoE than in PSND. This can interact unhelpfully with a promise to reduce PSND ex BoE between the fourth and fifth years of the forecast.

Implications and alternatives

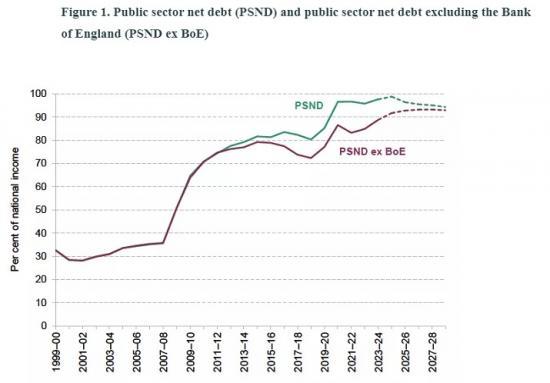

It is worth stressing that these differences have a much larger impact on the profile of debt than on its level, as illustrated by the convergence between the two measures in Figure 1. In other words, they can have important effects on the path debt takes over the next few years (including the change between the fourth and fifth years of the forecast), but these timing effects have limited relevance for the medium-term sustainability of the public finances. All else equal, the two measures should converge over time.3 Any meaningful assessment of debt sustainability, and any sensible set of fiscal rules, ought therefore to look through such short-term fluctuations.

It is also worth highlighting that these are not the only existing measures of debt, and there is nothing to stop the government from producing a new definition of debt to be used in the fiscal rules. The government could, for example, develop a new, custom-built measure that attempts to entirely strip out valuation losses on the Bank of England's APF. Or the government could decide to target a broader measure of the government balance sheet, such as public sector net worth, which captures a more comprehensive range of assets and liabilities. The key point is that there is no single perfect measure of the government's fiscal position and focusing too much on one to the exclusion of others can produce perverse incentives for the ‘gaming’ of targets.

The design of the current budget balance rule

The previous Conservative government, in addition to its debt target, had a ‘supplementary’ target. This target required overall government borrowing (public sector net borrowing, or PSNB) - the difference between total spending and total revenues – to be below 3% of national income in the fifth year of the rolling forecast period. The new Labour government proposes to replace this with a rolling target for current budget balance – that is, a target for all day-to-day spending to be covered from revenues, allowing borrowing only for investment.

There is much to commend a rolling target for current budget balance. There are good reasons to treat borrowing for productive investment differently from borrowing for consumption, and a rolling target avoids the need for sharp policy adjustments to economic shocks (see Emmerson and Stockton (2021) for a more detailed discussion).

One outstanding question, however, is the horizon over which the government will seek to achieve current budget balance. Perhaps the most likely outcome is that the government will target current budget balance in the fifth year of the forecast, to align with the debt target (and because a shorter horizon could require tax rises and spending cuts over and above those already planned – see the next section). The risk of having a rule that binds five years ahead is that it is too easy for governments to ‘game’ the rule by promising future tax rises and spending cuts that they have no intention of implementing – or that it may be someone else’s job to implement or to jettison. This risk arises with any rule that targets the future, but it grows larger when the target year is further away. A shorter time horizon would make the rule more difficult to game but would leave less time for adverse shocks to work through the system and less time to adjust to any permanent downgrades in the UK’s growth prospects. To strike this balance, researchers at the Institute for Government recommend that the government opt for a three-year horizon, with some sort of ‘escape clause’ to provide the flexibility to respond to larger shocks.

What impact might different choices have?

Table 1 outlines the margin by which the government would have been meeting (or missing) different fiscal rules at the March 2024 Budget.

Row (1) shows that the then government was meeting its debt (PSND ex BoE) target by a margin of £8.9 billion and its borrowing (PSNB) target by a margin of £56.8 billion. Row (3) shows that if the government had instead been targeting PSND, it would have been meeting its debt target by a margin of £24.9 billion. In other words, switching to a target couched in terms of headline PSND in March 2024 would have added some £16 billion to the government’s so-called ‘headroom’.

Now that we have entered a new fiscal year, the forecast period rolls forward by a year (the fifth year of the forecast becomes 2029–30 rather than 2028–29).4 Were the government to switch to PSND this autumn, there is no reason to think that this would have the exact same impact as it would have done in the spring. Indeed, given the convergence between the two measures as temporary Bank of England interventions expire (see Figure 1), we might expect a smaller impact from switching between the two. Nonetheless, this serves as a useful illustration of the sorts of sums involved.

On the face of it, this suggests that the new Chancellor could give herself as much as £16 billion of extra fiscal wiggle room through a change in debt definitions that few people understand or care about. There is an important caveat, however. Row (4) shows that in March 2024, a target for current budget balance in year 5 would have been met by a margin of £13.9 billion, less than the £24.9 billion of ‘headroom’ against a target for PSND to be falling in the fifth year. It then becomes relevant what any additional ‘headroom’ from the switch to headline PSND is used for. If used to increase public investment, adherence to a current budget balance rule – which ignores any borrowing for investment – would be unaffected. But if it were used to cut taxes or increase day-to-day spending, this would reduce the margin with which the current budget balance target is being met. In March 2024, if an additional £16 billion (the amount of additional ‘headroom’ a switch to headline PSND would have provided at that point) had been spent this way, it would have meant breaching a target for current budget balance.

This is a long way of saying that if Labour switched from targeting PSND ex BoE to targeting headline PSND, it would allow for more public investment while staying within the letter of this new rule – some £16 billion had this change been implemented in March 2024, though perhaps a bit less this autumn. The scope for tax cuts or increases in day-to-day spending (e.g. to fund higher public sector pay awards) would still be limited by the commitment to current budget balance, which would likely become the binding constraint on non-investment spending.

Should the government change the definition of debt in the fiscal rule?

From the above, we can conclude that the new government might, by changing the definition of debt, be able to increase its scope for borrowing to invest without breaching the letter of its fiscal rule. The question is, should it?

Consider first the case for switching from targeting PSND ex BoE to targeting headline PSND, and using any additional ‘headroom’ to cut taxes or increase spending. However the government chooses to measure debt in its fiscal rules, a fiscal loosening is a fiscal loosening, and additional borrowing is additional borrowing. To think that switching from a PSND ex BoE target to a PSND target justifies such a loosening, one would have to think that either:

one-off repayments of loans taken out by firms under the Bank of England TFSME mean that the government can ‘afford’ to tax less or spend more on a permanent basis; or

recognising valuation losses from Bank of England QT earlier in time means that the government can ‘afford’ to tax less or spend more on a permanent basis, even if lifetime losses are unchanged.

Neither of these arguments is convincing. It is difficult to see a principled case for targeting headline PSND rather than PSND ex BoE, and if the government wants to have a fiscal rule for debt, there are good reasons to think that the latter is a better measure. Indeed, this is presumably why previous governments have focused on PSND ex BoE.

This is absolutely not to defend the design of the existing debt rule, the undesirable features of which have been extensively discussed elsewhere. In particular, it is clearly undesirable for a government’s choices over tax and spending to be affected by Bank of England decisions about the appropriate pace of QT. Andrew Bailey, the Governor of the Bank of England, appeared to signal in a speech in May that the pace of QT is likely to slow, given that the Bank could reach its ‘Preferred Minimum Range of Reserves’ as soon as 2025 and that active sales beyond that point could take the stock of reserves below that range. That would likely make the new Chancellor’s life easier, by reducing valuation losses over the forecast period, but would leave the government’s long-run fiscal position more or less unchanged.5 More recent reports have instead suggested that the Bank will in fact accelerate the pace of QT, which could make it more difficult for the Chancellor to have debt falling in the fifth year of the forecast. Either way, the point is that in no sensible world should this lead to permanent tax cuts or spending increases via a change in measured ‘headroom’. This speaks to the poor design of the existing rule, as well as to the very fine margin by which the government is meeting that rule, which means such changes take on outsized importance.

It might be possible to define some new measure of government debt that strips out valuation losses on gilts held in the Bank of England’s APF. If one takes the view that fiscal policy ought to be made with no regard to valuation gains or losses on APF gilt holdings (a perfectly reasonable position), then this may well be seen as an improvement. But a better outcome might be to recognise that precisely targeting the change in any measure of debt between the fourth and fifth years of the forecast does not lend itself to sensible fiscal policymaking. A target specified in terms of borrowing or debt servicing costs might give a better indication of what kind of fiscal policy stance is ‘affordable’, or compatible with longer-term fiscal sustainability.

Conclusion

Moving the fiscal goalposts by using a different definition of debt in the government’s fiscal rule is one way that the new Chancellor might seek to create additional fiscal space this autumn. The impact of such a change would be fairly modest in scale, and such a technical change seems unlikely to spark an adverse political or market reaction – particularly if any additional margin against a redefined fiscal rule is used for public investment. All fiscal rules are in some sense arbitrary, the current rule is poorly designed, and we should not overstate the significance of such a change.

Nonetheless, it is very difficult to see a principled case for targeting headline PSND rather than the existing measure of ‘underlying’ debt (PSND ex BoE). Any such change would almost certainly be motivated by the impact on so-called ‘fiscal headroom’ and the fact that additional borrowing would be possible without breaching the letter of the rule, at least in the short term. If the government wants to borrow more and spend more, it would ideally make the case for doing so on its own terms, rather than hide behind fiscal jiggery-pokery.

If the government does tweak its debt target, the commitment to achieving current budget balance could take on greater significance and become the primary binding constraint on tax and spending decisions. Additional borrowing for investment may be possible while staying within a modified debt rule. But any substantial and permanent increase in spending on public services or social security this autumn would likely need to be accompanied by higher taxes to meet the letter and, more importantly, the spirit of the rule.

Authors

Isabel Stockton and Ben Zaranko

For more IFS articles go HERE