Retail Sales Great Britain - September 2024

19th October 2024

Retail sales volumes (quantity bought) are estimated to have risen by 0.3% in September 2024, following a rise of 1.0% in August 2024 (unrevised from our last publication).

Computers and telecommunications retailers grew strongly but were partly offset by decreases in supermarkets.

Looking at the quarter, sales volumes rose by 1.9% in Quarter 3 (Jul to Sept) 2024, when compared with Quarter 2 (Apr to June) 2024.

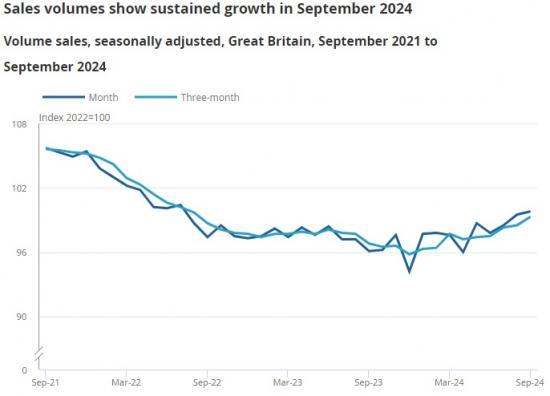

The chart shows the quantity bought in retail sales over time, for both the rolling three-month-on-three-month and the month-on-month movement.

Sales volumes rose by 0.3% during September 2024 following a 1.0% rise in August 2024. In September, sales volumes were at their highest index levels since July 2022. During the year to September 2024, sales volumes rose by 3.9%, the largest annual rise since February 2022.

When compared with their pre-coronavirus (COVID-19) pandemic level in February 2020, volumes were down by 0.2%.

More broadly, there was a 1.9% rise during the period from July to September 2024 (Quarter 3) when compared with the three months to June 2024 (Quarter 2), the joint largest, shared with March 2024, since July 2021. This quarterly rise was across all main sectors. When comparing with the same period last year, there was a 2.6% rise, the largest since March 2022.

Non-food stores sales volumes - the total of department, clothing, household and other non-food stores - rose by 2.5% in September 2024, following a rise of 0.6% in August.

The strongest sub-sector growth was from other non-food stores, which rose by 5.5% over the month to September 2024. Within "other non-food", computer and telecommunications retailers had the strongest contribution to growth.

Partly offsetting this, supermarkets sales volumes fell by 2.4% during the month to September 2024, leading to the largest month-on-month fall for food stores this year. Comments from retailers pointed to unseasonably poor weather and consumers continuing to cut back on luxury food items.

Readthe full ONS report HERE