Autumn Budget 2024 - Background Briefing

27th October 2024

On 30 October 2024, the Chancellor, Rachel Reeves, will deliver the new Labour government's first Budget. She is the first female Chancellor and will be the first woman to deliver a Budget.

Departments' spending plans for the rest of 2024/25 and 2025/26 will be set in the first part of the ‘Spending Review' process. Plans for 2026/27 and 207/28 will be set next spring.

The Office for Budget Responsibility (OBR) will publish revised forecasts for the economy and public finances on the same day as the Budget statement. The OBR is the independent public finances watchdog, which produces the official forecasts for the economy and public finances used by the Chancellor.

Economic situation

After contracting in the second half of 2023, the economy rebounded in the first half of 2024, with GDP growth driven by business-facing services. Growth is expected to continue over the rest of 2024, albeit at a more modest pace, and economists forecast the economy to expand by just over 1% in 2025.

Inflation has subsided, with consumer prices up by 1.7% in September 2024 compared with a year before, much lower than the period of high inflation seen in recent years. This has boosted household incomes, as average wages are rising faster than prices. The Bank of England is expected to cut interest rates later this year and in 2025, potentially boosting household budgets and consumer spending.

The new government has prioritised economic growth as its primary "mission". The government has spoken of its desire to be more active in economic policy, working with the private sector to facilitate growth. The government's recently released industrial strategy green paper provides a blueprint for what it says will be a 10-year plan. Meanwhile, the Chancellor has said that investment will be an important feature of the upcoming Budget.

Achieving the government's ambitions

In the Budget, the Chancellor will set out the government's plans for its term in office, laying out how it will spend to meet its ambitions and how it will fund this spending. The Chancellor faces several challenges.

The government inherits spending plans which are widely thought to be tight: some departments potentially face real-terms (inflation-adjusted) spending cuts, and the government's investment spending would also fall under the plans. The Chancellor may want to address these issues. She sees investment as essential for improving economic growth and says "invest, invest, invest is the theme of this Budget".

To increase spending the government would need to raise more from taxes or borrow more. However, Labour's manifesto commitments to not increase the UK's largest taxes or increase taxes on working people limit the Chancellor’s options for raising taxes. Proposed ‘fiscal rules’ on balancing the day-to-day budget and getting debt falling, as a percentage of GDP, also constrain her ability to borrow.

The Chancellor will publish her self-imposed targets for the public finances - the ‘fiscal rules’ - at the Budget. The new rules will replace the existing ones inherited from the previous government. Using a different measure of government debt from that used by the previous government could increase the amount the Chancellor can borrow for investment spending.

The effort required to meet these challenges will, in part, be determined by the OBR’s outlook for the economy. If it believes the economy is looking in better shape than it did in its March 2024 forecast, it will likely forecast faster growth and higher tax revenues. If the OBR is more pessimistic, however, it will likely forecast lower growth and tax revenues.

The public finances

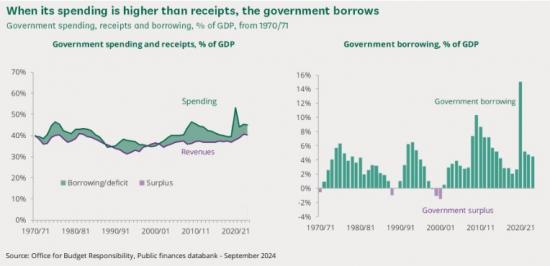

Both government spending and revenue from taxes and other receipts are relatively high by UK standards. With government spending being the higher of the two, the government is borrowing to fund around 10% of its spending.

UK governments borrow in most years. Government borrowing was equivalent to around 4.4% of GDP in 2023/24. Borrowing is forecast to fall in the coming years, largely because of rising income tax revenues and the tight spending plans discussed above.

Government debt, which is largely the stock of the government’s past borrowing, is equivalent to around 99% of GDP. It has grown from around 35% of GDP in 2006/07 with big increases during the 2007-2009 financial crisis and covid-19 pandemic. The debt-to-GDP ratio is forecast to fall gradually over the next five years.

Note

This article was first published at the House of Commons library. To read it with links and more graphs go HERE