UK House Price Index For September 2024

20th November 2024

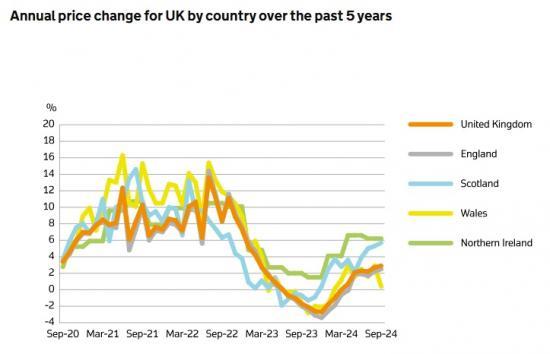

The UK HPI shows house price changes for England, Scotland, Wales and Northern Ireland.

UK house prices rose by 2.9% in the year to September 2024, up from the revised estimate of 2.7% in the 12 months to August 2024. On a non-seasonally adjusted basis, average house prices in the UK increased by 1.5% between August 2024 and September 2024, up 0.5% from the same period 12 months ago (August and September 2023).

Average UK house price annual inflation was 2.9% (provisional estimate) in the 12 months to September 2024, up from the revised estimate of 2.7% in the 12 months to August 2024.

The average UK house price was £292,000 in September 2024 (provisional estimate), which is £8,000 higher than 12 months ago. Average house prices in the 12 months to September 2024 increased in England to £309,000 (2.5%), increased in Wales to £217,000 (0.4%) and increased in Scotland to £198,000 (5.7%). The average house price increased in the year to Q3 (Jul to Sep) 2024 to £191,000 in Northern Ireland (6.2%).

Headline statistics for September 2024

The average price of a property in the UK was

£292,000

The annual price change for a property in the UK was

2.9%

The UK Property Transactions Statistics showed that in August 2024, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 90,000. This is 5.4% higher than a year ago (August 2023). Between July 2024 and August 2024, UK transactions decreased by 0.4% on a seasonally adjusted basis.

House price monthly increase was highest in Yorkshire and the Humber where prices increased by 2.7% in the year to August 2024. The highest annual growth was in the The North West, where prices increased by 4.6% in the year to August 2024.

The UK HPI is based on completed housing transactions. Typically, a house purchase can take 6 to 8 weeks to reach completion. As with other indicators in the housing market, which typically fluctuate from month to month, it is important not to put too much weight on one month's set of house price data.

Economic statement

Average UK house price annual inflation was 2.9% (provisional estimate) in the 12 months to September 2024, up from the revised estimate of 2.7% in the 12 months to August 2024.

The average UK house price was £292,000 in September 2024 (provisional estimate), which is £8,000 higher than 12 months ago. Average house prices in the 12 months to September 2024 increased in England to £309,000 (2.5%), increased in Wales to £217,000 (0.4%) and increased in Scotland to £198,000 (5.7%). The average house price increased in the year to Q3 (Jul to Sep) 2024 to £191,000 in Northern Ireland (6.2%).

On a non-seasonally adjusted basis, average UK house prices decreased by 0.3% between August 2024 and September 2024 compared with a decrease of 0.5% in the same period 12 months ago. On a seasonally adjusted basis, average house prices in the UK decreased by 0.1% between August 2024 and September 2024.

Of English regions, annual house price inflation was highest in the North East, where prices increased by 6.5% in the 12 months to September 2024. London was the English region with the lowest annual inflation, where prices decreased by 0.5% in the 12 months to September 2024.

The Royal Institution of Chartered Surveyors' (RICS') September 2024 UK Residential Market Survey reported a sustained improvement in market activity, with measures of demand, sales and new listings all continuing to return to positive readings. Looking ahead, RICS also reported that the forward-looking sentiment is consistent with further modest growth in headline sales volumes over the coming months.

The Bank of England’s Agents’ summary of business conditions - 2024 Q3 reported that the recent cut in Bank rate has led to improved sentiment in the secondary housing market. However, this has yet to be reflected in agreed sales or prices.

HMRC’s UK Property Transactions Statistics showed that in September 2024, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 92,000. This is 8.9% higher than 12 months ago (September 2023). Between August 2024 and September 2024, UK transactions increased by 0.9% on a seasonally adjusted basis.

The Bank of England’s Money and Credit September 2024 release reported that mortgage approvals for house purchases, an indicator of future borrowing, increased to 65,600 in September 2024, the highest level since August 2022 (72,000).