Motorists Can Seize Savings as Car Insurance Costs Decline

5th July 2014

- Drivers actively shopping around for best deal benefit as average car insurance premiums now £406 a year

- June saw first monthly fall in premiums since February 2014

British motorists continue to benefit from declining car insurance premiums, according to today's pricing data from MoneySuperMarket. www.moneysupermarket.com/car-insurance/

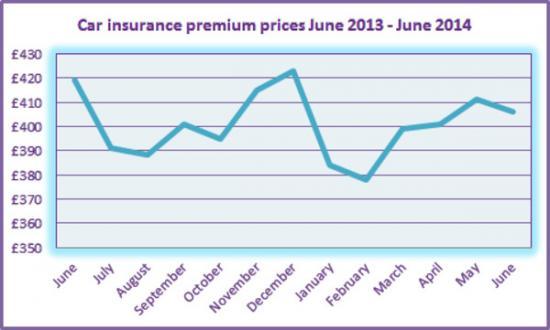

Analysis of 42.5 million car insurance quotes run on Britain's number one comparison site between January 2011 and June 2014 reveals that the average cost of car insurance fell last month, to £406 - down from £411 in May. This reduction of £5 (or 1.2 per cent) is the first drop in monthly car insurance prices since February. When comparing the cost of cover now to the same time last year premiums are currently £13 cheaper or 3.1 per cent lower.

This means that those actively looking for car insurance at the moment, whether buying cover for the first time or shopping around to renew a policy, should be able to make a considerable saving compared to the price they paid for their last policy without compromising on quality of cover. For those renewing a policy this is especially important - auto renewing won't secure the best deal, so actively scouring the market to find the most competitive deal is crucial. Finding the best deal on car insurance is quick and easy to do, and drivers can secure a saving of up to £255 using MoneySuperMarket.2

Kevin Pratt, insurance expert at MoneySuperMarket, said: "With news today that the Transport Committee is to urge the Government to do more to reduce insurance company claims costs, a further lowering of car cover premiums should be on the way. Insurance claims fraud has inflated car insurance premium prices for all drivers and anything that helps tackle this scourge is good news for honest motorists.

In the last year there has been considerable car insurance premium price fluctuation, with sharp decreases in July last year followed by increases at the end of 2013. However, the biggest change was the steep fall in pricing that occurred between December 2013 and January 2014, where prices fell from £423 to £384 - a nine per cent, or £39, saving.

Kevin Pratt continued: "Despite some small price increases earlier this year, the overall trend of deflation persists as competition among insurers continues. Sticking with an existing insurer is unlikely to secure the best deal. Even though a renewal quote might be cheaper than the price paid last year, drivers should still be able to save even more by switching to a different insurer, so shopping around is key."