Chancellor Did His 'Fuel Duty' - AA

21st March 2015

The AA welcomed the extension of the fuel duty 'big freeze' beyond September as it continues relief for drivers hit by pump price surges but also because it warns any future government that they would get a frosty reception if tempted to raise fuel duty in the short term.

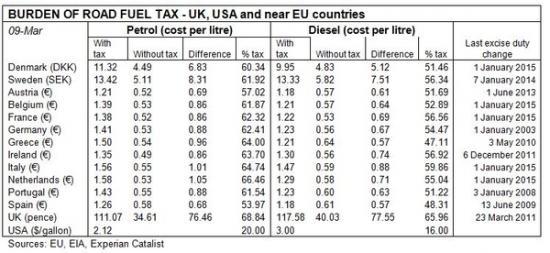

However, UK road fuel tax continues to be the highest in the EU.

"The Coalition has done its 'fuel duty' by shielding drivers from some of the impact of volatile fuel prices over the past four years by freezing fuel duty and we welcome the further freeze and cancellation of the scheduled fuel duty rise for September 2015.

“With petrol and diesel prices surging and falling by more than 35p a litre since 2010, the continued four-year fuel duty freeze allows the Coalition to dodge the fuel-protest bullet ," says Edmund King, the AA's president.

An AA Populus survey of 17,874 AA members found that 81% worried that fuel duty and Vehicle Excise Duty will increase following the election in May - 49% of the sample being very worried. Among lower-income drivers, the concern rises to 87%.

Meanwhile, AA members have called for two-thirds of fuel duty to be invested in roads – financing road resurfacing, repairs, drainage, cycleways, electric car infrastructure and other developments that would make road travel and mobility safer, cheaper, more reliable and less polluting.

The AA also welcomed plans to publish a transport strategy for the north and company car incentives for 'greener' cars. Incentives for North Sea oil investment and driverless cars research is also welcome.

The AA is disappointed that drivers going to Wales will continue to be taxed when they cross the Severn Bridge after 2018. It was hoped that, unlike Dartford, tolls would be

abolished after 2018 when the project reverts to public ownership – in other words, when users have paid for it.

“At least white van man will find his tolls reduced under the proposals announced today - in Scotland all drivers and businesses benefit from toll free crossings so why not those in England and Wales?” said King.

The AA has published the new rates of VED here http://www.theaa.com/motoring_advice/car-buyers-guide/cbg_roadtax.html

ends

Media contact: AA Public Affairs on 01256 493493

Fuel Duty

The government will cancel the RPI inflation fuel duty increase of 0.54 pence per litre scheduled for 1 September 2015.

As announced at Autumn Statement 2014, from 1 April 2015, the government will apply a reduced rate of fuel duty to aqua methanol. The rate will be set at 7.90 pence per litre. The government will review the impact of this incentive at Autumn Statement 2016.

The Council of the European Union has fully approved the government's application to extend the rural fuel duty rebate scheme to seventeen areas of the UK mainland. The scheme will be implemented on 1 April 2015 and will enable retailers in eligible areas to register for a 5 pence per litre fuel duty discount.

Vehicle Excise Duty (VED)

From 1 April 2015 VED rates for cars, vans, motorcycles and motorcycle trade licences will increase by RPI. Heavy Goods Vehicle (HGV) VED and Road User Levy rates will be frozen for one year.

As announced at Budget 2014, from 1 April 2016 a vehicle manufactured before 1 January 1976 will be exempt from paying VED.

Business travel taxes

As announced at Budget 2014, the appropriate percentage of list price subject to Company Car Tax (CCT) will increase by 2 percentage points for cars emitting more than 75 gCO2/km, to a maximum of 37%, in both 2017-18 and 2018-19. In 2017-18 there will be a 4 percentage point differential between the 0-50 and 51-75 gCO2/km bands and between the 51-75 and 76-94 gCO2/km bands. In 2018-19 this differential will reduce to 3 percentage points.

The appropriate percentage of list price subject to CCT will increase by 3 percentage points for cars emitting more than 75 gCO2/km, to a maximum of 37%, in 2019-20. There will be a 3 percentage point differential between the 0-50 and 51-75 gCO2/km bands and between the 51-75 and 76-94 gCO2/km bands.

From 6 April 2016 the Fuel Benefit Charge (FBC) multiplier for both cars and vans will increase by RPI.

From 6 April 2016 the main Van Benefit Charge (VBC) will increase by RPI. As announced at Budget 2014, the government will extend VBC support for zero emission vans to 5 April 2020 on a tapered basis.

As announced at Budget 2014, the government will extend the Enhanced Capital Allowance (ECA) for zero emission goods vehicles to 31 March 2018.