Banks & Finance News

7/2/2024

Exam Success For Wick Woman Louise Cormack

Phil Anderson Financial Services is thrilled to announce that Louise Cormack, a valued member of our team at the Wick Office in Caithness, has successfully passed her final exam and is now a fully qualified mortgage adviser. Louise's accomplishment comes after passing the Chartered Insurance Institute CF6 mortgage advice exam, completing the rigorous Certificate in Mortgage Advice.

15/1/2024

Phil Anderson Financial Services Welcomes New Directors: Peter Brown And Kevin Philip

Phil Anderson Financial Services, a leading financial advisory firm, is pleased to announce the appointment of two seasoned professionals, Peter Brown and Kevin Philip, as Directors. This strategic move reflects the company's commitment to enhancing its leadership team and providing exceptional financial services to its clients.

29/12/2023

Christmas is Past But Hi-Scot Credit Union Can Help Save For Next Christmas

3500 thousand credit union members save with Hi-Scot credit union. Starting to save in January will make things a lot easier by Christmas 2024.

2/7/2023

Hi-Scot Credit Union Keeps Interest Rates Low

At meeting of the board of the Hi-Scot Credit Union the directors agreed not to follow other institutions like banks to put up interest rates. Well worth checking what rates you can still get from a credit union.

31/5/2023

Say Hi To Your Highland And Islands Credit Union for Saving and Borrowing

Hi-Scot credit union covers the Highland and Islands and is a not for profit organisation helping more and more people. Hi-Scot has been growing slowly over recent years and now holds significant savings.

26/4/2023

Awards Success For Caithness Financial Advice Firm

Phil Anderson Financial Services has once again been named the Best Financial Adviser to work for at the Professional Adviser Awards in London. The prestigious award was collected by independent financial adviser Andrew Scouller, who accepted it on behalf of the entire firm.

11/3/2023

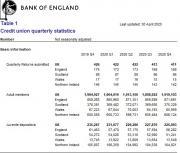

Credit Union Lending Reaches Record Levels As UK Borrowing Costs Rise

The figures were revealed as the government plans new rules for the sector, allowing it to deliver more products including car finance. Figures from the Bank of England show that credit unions are lending record sums to UK customers, as the cost of borrowing continues to rise.

4/3/2023

Exam Success For Caithness Mortgage Adviser

A Caithness-based mortgage adviser is celebrating after passing her final exam to gain the Diploma in Regulated Financial Planning. Kayleigh Ross works at Phil Anderson Financial Services in Wick as a mortgage adviser has passed the Chartered Insurance Institute Exam R06 - Financial planning practice.

9/2/2023

Turnover Boost Sees Financial Advice Firm Expand In Caithness

Award-winning, Independent Financial Advisory firm, Phil Anderson Financial Services has expanded it's Caithness operation with the opening of a new office and the appointment of additional team member. Following a record year, achieving a turnover of £1.63million, a 22% increase from the year before the firm has opened a new office at 13 Kirk Lane in Wick.

10/6/2022

Government Minister ‘deeply Grateful' For Sector's Role In Communities

Addressing credit union professionals at the ABCUL Conference last month, John Glen MP, Economic Secretary to the Treasury, highlighted the positive impact the sector have in communities across the country. The Minister thanked credit unions in his speech for "delivering services that your members, communities, and the country need...24/2/2022

Save And Borrow With Your Highland And Islands Based Credit Union - Hi-Scot

As the world begins to hesitantly open up, it's no surprise that the past two years have taught us the value of shopping local. But have you ever thought about banking local? "A credit union is rooted in the community, especially as it is owned by its members and not external shareholders," said David Mackay, General Manager of HI-Scot Credit Union.

30/11/2021

TSB Bank Thurso To Close As Axe Hits 70 Branches

The Thurso branch of the TSB will close on 22 April 2022. TSB will continue to have 7th largest branch network with over 200 branches No closures where TSB is currently "last branch in town" 10 further ‘pop-up' branches to be opened 150 fewer roles but all impacted staff to be offered alternative roles at TSB TSB has announced it will close 70 branches in 2022 as it responds to declining branch use and increasing numbers of customers switching to digital banking services.

19/11/2021

From Now To Net Zero: A Practical Guide For SMEs' Report

Climate change poses a risk to every aspect of our lives and reducing carbon emissions to achieve Net Zero is an essential step. The journey to Net Zero is a long one and the transition of our economy to a sustainable footing will be the most momentous change in business and industry of our generation.

30/9/2021

Virgin Money To Close Wick Bank

Virgin Money will close 31 of its 162 branches in the coming months as more customers shift to online banking. The Wick branch was part of the Clydesdale network before being acquired by Virgin.29/9/2021

Banking Protocol: Preventing Fraud And Protecting Members In Credit Unions

The Banking Protocol is a rapid response scheme that will enable credit union staff to alert police when they suspect a customer is being scammed. Police will attend the branch within the timeframe of an emergency response, enabling them to provide an effective customer intervention, secure evidence to enable them to investigate the potential scam and sometimes catch fraudsters in the act.20/6/2021

Credit Unions Are Growing In The UK But Still A Long Way To Catch Up With USA

The history of credit unions in USA has been one of growth over many years. The public in many states seem to have moved in greater numbers and saved even more with their local credit union.23/5/2021

World Council Launches The Global Credit Union Podcast

World Council of Credit Unions is excited to launch a new monthly podcast that will provide the international credit union community with an in-depth look at some of the interesting and important stories it has to tell, particularly in the areas of international advocacy, international projects, education and networking, and digital transformation. The Global Credit Union Podcast will also be telling stories about the work credit unions across the world are doing on behalf of their members.

30/4/2021

UK Credit Unions Has Reached Its Highest Reported Value At £3.98 Billion

The latest quarterly report by the Bank of England shows UK Credit Unions continue to increase in strength. The report published on 30 April 2021 showed - Adult membership of credit unions increased in 2020 Q4 after decreasing in 2020 Q3.

30/4/2021

New Partnership Supports International Credit Union Community

This new project aims to share research and resources with credit unions in the UK and Ireland. Filene Research Institute announced an exclusive partnership with the Dublin, Ireland-based CMutual to expand research and resources available to credit unions in the United Kingdom and Ireland.24/2/2021