Hi-Scot Credit Union Is 13 Years Old And Still Growing

30th October 2019

The number thirteen might be unlucky for some, but not HI-Scot credit union who are celebrating thirteen years of serving their members across the Highlands and Islands of Scotland.

From humble beginnings as an idea conceived by hard-working volunteers determined to bring an ethical, community-minded option for saving and borrowing to the islands, Western Isles credit union (HI-Scot's original incarnation) opened its doors in 2006.

"HI-Scot has continued to grow, year on year, since 2006," said General Manager, David Mackay, "In 2011 we expanded to Highland region and the Orkney and Shetland Islands and now have over 3000 members."

With almost £4 million held on deposit, HI-Scot members are certainly seeing the benefits of saving regularly through the credit union. Many members use payroll deduction, an easy way to save every week or month, and a service offered by many employers, including Comhairle nan Eilean Siar and NHS Western Isles.

Members also benefit from a range of loan products, meaning that a new car, washing machine or kitchen can become an affordable reality. Over the past thirteen years, HI-Scot have approved over £9.5 million in loans and, with a process which considers each application individually, tailor member's borrowing to their personal circumstances. There's no "Computer says no" with HI-Scot!

"As people start to look for more ethical ways of banking, credit unions offer their members something that High Street banks cannot," David Mackay said, "HI-Scot is owned entirely by its members and so operates with their interests at heart."

HI-Scot is based in James Street, Stornoway, but the credit union is accessible in all areas of the Highlands and Islands thanks to online services and local Access Points. More information can be found on HI-Scot's website: www.hi-scot.com

“It's been a great thirteen years and the credit union is thriving.” David added, “All of us at HI-Scot look forward to many more years supporting our members across the Highlands and Islands to save, borrow and plan for tomorrow.”

In Caithness Bill Fernie who is a director of Hi-Scot Credit Union will be at the Pulteney Centre, Wick on on 11 December at 4.00pm to hold a local meeting as part of the Annual General Meeting. Notices will appear at a later date.

Related Businesses

Related Articles

3500 thousand credit union members save with Hi-Scot credit union. Starting to save in January will make things a lot easier by Christmas 2024.

At meeting of the board of the Hi-Scot Credit Union the directors agreed not to follow other institutions like banks to put up interest rates. Well worth checking what rates you can still get from a credit union.

Hi-Scot credit union covers the Highland and Islands and is a not for profit organisation helping more and more people. Hi-Scot has been growing slowly over recent years and now holds significant savings.

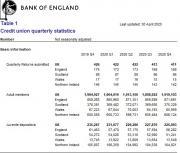

The figures were revealed as the government plans new rules for the sector, allowing it to deliver more products including car finance. Figures from the Bank of England show that credit unions are lending record sums to UK customers, as the cost of borrowing continues to rise.

Addressing credit union professionals at the ABCUL Conference last month, John Glen MP, Economic Secretary to the Treasury, highlighted the positive impact the sector have in communities across the country. The Minister thanked credit unions in his speech for "delivering services that your members, communities, and the country need...

As the world begins to hesitantly open up, it's no surprise that the past two years have taught us the value of shopping local. But have you ever thought about banking local? "A credit union is rooted in the community, especially as it is owned by its members and not external shareholders," said David Mackay, General Manager of HI-Scot Credit Union.

The Banking Protocol is a rapid response scheme that will enable credit union staff to alert police when they suspect a customer is being scammed. Police will attend the branch within the timeframe of an emergency response, enabling them to provide an effective customer intervention, secure evidence to enable them to investigate the potential scam and sometimes catch fraudsters in the act.

The history of credit unions in USA has been one of growth over many years. The public in many states seem to have moved in greater numbers and saved even more with their local credit union.

World Council of Credit Unions is excited to launch a new monthly podcast that will provide the international credit union community with an in-depth look at some of the interesting and important stories it has to tell, particularly in the areas of international advocacy, international projects, education and networking, and digital transformation. The Global Credit Union Podcast will also be telling stories about the work credit unions across the world are doing on behalf of their members.

The latest quarterly report by the Bank of England shows UK Credit Unions continue to increase in strength. The report published on 30 April 2021 showed - Adult membership of credit unions increased in 2020 Q4 after decreasing in 2020 Q3.