Council Tax freeze recommended for sixth year in a row

31st January 2013

The Highland Council is being recommended to freeze the Council Tax for a sixth successive year and confirm a budget of £548.436 million for 2013-14 when it meets on Thursday 7 February.

The Council Tax bands will remain: Band A: £775.33: Band B: £904.56; Band C: £1,033.78; Band D: £1,163.00: Band E: £1,421.44; Band F: £1,679.89; Band G: £1,938.33; Band H: £2,326.00.

Savings of £11.637 million have been found in the coming financial year as have all but £3.3 million of the £12.356 million target savings for 2014/15. The proposed budget for 2014/15 is £547.625 million.

Leading on the budget is Councillor Dave Fallows, Chair of the Finance Housing and Resources Committee. His Highlights of the budget are: -

A commitment to spend an additional £3million per annum for the next two years on Preventative Spend, with allocations in 2013/14 of £1m each for early years, deprivation, and shifting the balance of care (adult integrated care).

£2 million additional funding towards roads maintenance to improve road conditions in 2013/14. (This is a continuation of the sum allocated in 2012/13 on a one-off basis).

£1 million for Children’s Services to provide for the demand and pressure in out of authority placements, pending a review of service options for the future delivery of the service.

Implementation of the Living Wage at £7.50 per hour, which will benefit some 1,400 Council employees.

Agree to fund a 1% national pay award for staff in each year – the first increase for three years.

£864,000 of additional Council resources has been set aside for Welfare Reform. Of this sum £614,000 has been provided to maintain council tax benefit at its existing level, rather than pass on the 10% cut in benefit imposed by the UK Government. A further £250,000 will allow the Council to recruit additional staff, and provide additional funding to CABx, in order to provide a much greater level of support, and proactive advice, to those vulnerable people in the Highlands most impacted by these welfare reforms.

An additional £100,000 has been set aside to improve planning performance and services to the public.

The Council, he said, had already set aside £1 million from balances in 2012/13 for the Community Challenge Fund launched in January 2013.

He said: “There can be few people who do not recognise that these are challenging economic times. However, I am pleased to report that the Council has been able to manage savings largely through increased efficiency and with minimal impact on existing services. Once again, we asked the public for their views on a number of possible savings and those views have helped us considerably in forming this year’s budget and will continue to help in the next. Despite the financial pressures that we face, we have, this year, been able to target funding to key areas of frontline service delivery.”

He said the Council intended to formulate outline plans that look ahead for the full five year term of the Council. He said: “This is to give partner agencies and the public a clear idea of how we will match our future finances to delivery of the Programme for the Council. We remain committed to providing the very best services through continuing to become more efficient and challenging the way the Council delivers it wide range of essential services.”

He recognised the impact on jobs was always a concern. The net decrease in FTE posts in 2013/14 was estimated at 37.1. The loss of posts had to be seen in the context of the Council having 9,000 FTE staff and a good track record in managing vacancies and now a firm commitment to avoiding compulsory redundancies.

He said: “The Council is currently managing its vacancies to ensure that posts, which become vacant through the natural turnover of staff and are suitable for redeployment, are identified and held for that purpose in the first instance. The impact on staff will be minimised by firstly seeking redeployment opportunities within the Council and redundancy or early retirement will only be used as a last resort and where no reasonable redeployment opportunity exists.”

In a report to the Council, Director of Finance, Derek Yule states that financial years 2013/14 and 2014/15 represent the final two years of the current Scottish Government Spending Review and Local Authority Grant Settlement period.

Public sector spending levels continued to be affected by austerity measures to tackle the economic downturn and reduce the UK’s debt, and inflation levels remained high relative to Government targets and funding levels. All indications were that in the period beyond 2014/15, the UK public sector would face a continued period of austerity.

The total spend for the coming two years, he said, was reduced due to the removal of £56 million worth of annual funding for Police and Fire budgets as the result of the transfer of these functions to new Single Services effective from 1 April.

He said the Council tax income assumed within his report was based upon an a collection level of 97.5%, an increase of 0.25% on that assumed in the previous financial year. The increase was in line with actual levels of collections experienced for past years. Despite the economic downturn, collection levels remained healthy.

Current long-term empty domestic properties qualify for 10% reduction in their council tax charge. In line with the Council’s Programme commitment to bring empty properties back into use, it is recommended that the Council agrees to remove the existing 10% Council Tax reduction of long-term empty domestic properties and instead levy a full 100% Council tax charge with effect from 1 April 2013. It is further proposed this situation is reviewed within the first year. Any additional income will be retained locally with decisions on use to be considered by the Council.

The Council is also being commended to establish a fund of £4.3 million for “Strategic Change and Development”. The purpose of this Fund will be to:-

Support delivery of change programmes.

Initial cost of structural change and service redesign and

Support for Council priorities, including preventative spend and spend to save initiatives.

Related Businesses

Related Articles

Exciting Career Opportunities With The Highland Council Now Open For Applications

# 10 December 2025 Career opportunities with The Highland Council The Highland Council is looking to fill a variety of posts relating to civil engineering and flood risk management based in locations across the area. Included are opportunities specifically for civil engineering graduates and technicians, providing the ideal job with career progression for anyone recently qualified and ready for a varied and interesting role.

What the NC500 Research Projects Are Designed to Do - and Why They Matter for the Highlands

As the North Coast 500 approaches its tenth anniversary, it has become one of Scotland's most well-known tourism success stories. The 516-mile loop around the far north of the Highlands has been celebrated internationally, marketed as a world-class road trip, and credited with transforming visitor numbers in some of Scotland’s most remote areas.Help Shape the Future of Thurso

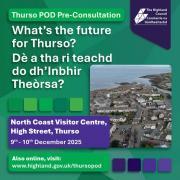

The Highland Council is inviting people that live, work, or study in Thurso, to come along to the public consultation events to have their say. This is an opportunity to help shape the future of Thurso, to gather views and ideas.

Are Scottish Councils Quietly Reversing Outsourcing? A Look at Insourcing, Cuts and the Highland IT Shift

A notable article in the Guardian on 6 December 2025 noted the high sums being paid by London councils outsourcing services to private firms. The article starts with the reduction in council funding by UK government since 2010.Council welcomes Visitor Levy flexibility plan

The Highland Council welcomes moves by the Scottish Government to introduce greater flexibility on how it could design a Visitor Levy Scheme for consultation. The Visitor Levy (Scotland) Act 2024 currently provides local authorities with discretionary powers to implement percentage-based levies following statutory consultation.Highland Council is reaching out for views to shape its next 26/27 budget.

As it looks to set out its forthcoming priorities, the council is seeking involvement from members of the public, including businesses, community groups, parents, and young people. All their opinions are going to be crucial in deciding how Highland Council will take on its budget challenge for 2026-2027.Have your say in Thurso's future £100million investment by attending public consultation events

Thurso is to benefit from £100m investment in education and community facilities and are rolling out the first phase of public consultations on 9 and 10 December 2025. The Highland Council is inviting people that live, work, or study in Thurso, to come along to the public consultation events to have their say; this is an opportunity to help shape the future of Thurso, to gather views and ideas.Finding new owners for empty homes - Scheme launched to help return more empty homes to active use

A new online portal has been launched to bring empty homeowners together with prospective buyers or developers with the aim of facilitating more properties to be used as homes again. Covering the whole of Scotland, this builds on the success of local pilots, referred to as "matchmaker schemes".Consideration for short term let control area in Skye and Raasay

Steps towards introducing a short term let control area have been considered by Highland Council's Isle of Skye and Raasay area committee. On Monday (1 December 2025) the committee heard evidence to justify the grounds for the introduction of a Short Term Let Control Area covering all or part of Skye and Raasay.Workforce North event spotlights Highland economy

EMPLOYERS and educators from across the Highlands have gathered to hear how a new initiative is aiming to transform the region's economy. Workforce North - A Call to Action brought together business leaders and teachers from primary and secondary schools from across the Highland Council area with a wide range of partners geared towards education, learning and skills development at Strathpeffer Pavillion.