An end to Poll Tax debts

4th December 2014

Proposal to end collections on February 1.

A proposal to end the collection of Poll Tax debts from February 1 next year is contained within the Community Charge Debt (Scotland) Bill, which is published today.

The Scottish Government has brought forward the bill to bring an end to collection of debts under the discredited tax, which was abolished in 1993 after only four years in operation in Scotland.

The issue was brought to the fore following the independence referendum, amid reports that the expanded electoral registers could be used to identify and pursue Poll Tax debts at a time of record democratic engagement.

The amount of Poll Tax arrears collected by local authorities across Scotland has fallen in recent years to less than £350,000 in 2013-14, and some local authorities have ceased recovery of debts altogether. Nonetheless, the Scottish Government will cover the cost to local authorities of the Poll Tax debt that they would have expected to recover under existing arrangements.

The Community Charge Debt (Scotland) Bill is available to view at http://www.scottish.parliament.uk/parliamentarybusiness/Bills/84355.aspx

The Community Charge was introduced in Scotland in 1989 and superseded by the introduction of the current Council Tax system in 1993.

On October 2 former First Minister Alex Salmond announced the Scottish Government's intention to bring forward legislation to ensure that councils could take no further action to recover ancient Community Charge or ‘Poll Tax’ debts. Last week, in the Programme for Government announcement, First Minister Nicola Sturgeon confirmed the Bill will finally end collection of debts from non-payment of the Poll Tax.

As of 31 March 2014, Scottish local authorities reported a total of £425.3 million uncollected Community Charge for the years 1989-90 to 1992-93 inclusive, with much of that expected now to be uncollectable due to practical considerations and also to the operation of the law of prescription.

The amount of Community Charge arrears collected by local authorities across Scotland has fallen in recent years from £1,312,000 in 2009-10 to £327,000 in 2013-14, according to local authority data returns to the Scottish Government. Some local authorities have ceased recovery of Community Charge debts altogether.

These debts are collected under payment arrangements set up with taxpayers as well as through deductions from social security benefits.

COSLA has consulted local authorities to ascertain how much Community Charge debt is still subject to ongoing repayment and how much is expected to be collected under these arrangements. This consultation produced a projected cost to local government of £869,000, which will be met by the Scottish Government as an additional allocation through the local government finance settlement. This will be included in the relevant Local Government Finance (Scotland) Order, which is presented to Parliament for approval.

Welcoming the introduction of the bill, Deputy First Minister John Swinney said:"The Poll Tax was a hated levy which caused misery in hard-working communities across Scotland and which was widely discredited as an unworkable tax, opposed across all sections of Scottish society.

"It is therefore entirely correct that at a time of record democratic engagement in Scotland, we legislate to ensure that people aren't dissuaded from registering to vote because they fear being chased for decades-old debts.

"The Community Charge Debt (Scotland) Bill proposes that from February 1, collections will cease and the Poll Tax will be consigned to history for once and for all. And while it is not contained as part of the Bill, the Scottish Government has committed to covering the cost of debts that councils would have expected to recover in the lifetime of existing recovery arrangements.

"It should be made absolutely clear that this bill relates only to the Poll Tax and does not affect Council Tax, which forms a key part of local authorities' finances. It is quite proper for councils to use current information to assess current Council Tax liability, however we object to the use of the electoral registers to pursue historic debts from a defunct and discredited tax.

“Scottish Ministers have called on the UK Government to transfer responsibility for elections, including the electoral registers, to the Scottish Parliament, allowing decisions on the purpose of the registers and who should have access to it to be made here. We welcome the recommendation of the Smith Commission for the transfer of all remaining responsibilities in relation to Scottish Parliament and local government elections to Scotland."

Related Businesses

Related Articles

Exciting Career Opportunities With The Highland Council Now Open For Applications

# 10 December 2025 Career opportunities with The Highland Council The Highland Council is looking to fill a variety of posts relating to civil engineering and flood risk management based in locations across the area. Included are opportunities specifically for civil engineering graduates and technicians, providing the ideal job with career progression for anyone recently qualified and ready for a varied and interesting role.

What the NC500 Research Projects Are Designed to Do - and Why They Matter for the Highlands

As the North Coast 500 approaches its tenth anniversary, it has become one of Scotland's most well-known tourism success stories. The 516-mile loop around the far north of the Highlands has been celebrated internationally, marketed as a world-class road trip, and credited with transforming visitor numbers in some of Scotland’s most remote areas.Help Shape the Future of Thurso

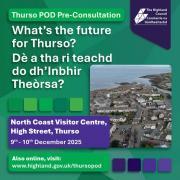

The Highland Council is inviting people that live, work, or study in Thurso, to come along to the public consultation events to have their say. This is an opportunity to help shape the future of Thurso, to gather views and ideas.

Are Scottish Councils Quietly Reversing Outsourcing? A Look at Insourcing, Cuts and the Highland IT Shift

A notable article in the Guardian on 6 December 2025 noted the high sums being paid by London councils outsourcing services to private firms. The article starts with the reduction in council funding by UK government since 2010.Council welcomes Visitor Levy flexibility plan

The Highland Council welcomes moves by the Scottish Government to introduce greater flexibility on how it could design a Visitor Levy Scheme for consultation. The Visitor Levy (Scotland) Act 2024 currently provides local authorities with discretionary powers to implement percentage-based levies following statutory consultation.Highland Council is reaching out for views to shape its next 26/27 budget.

As it looks to set out its forthcoming priorities, the council is seeking involvement from members of the public, including businesses, community groups, parents, and young people. All their opinions are going to be crucial in deciding how Highland Council will take on its budget challenge for 2026-2027.Have your say in Thurso's future £100million investment by attending public consultation events

Thurso is to benefit from £100m investment in education and community facilities and are rolling out the first phase of public consultations on 9 and 10 December 2025. The Highland Council is inviting people that live, work, or study in Thurso, to come along to the public consultation events to have their say; this is an opportunity to help shape the future of Thurso, to gather views and ideas.Finding new owners for empty homes - Scheme launched to help return more empty homes to active use

A new online portal has been launched to bring empty homeowners together with prospective buyers or developers with the aim of facilitating more properties to be used as homes again. Covering the whole of Scotland, this builds on the success of local pilots, referred to as "matchmaker schemes".Consideration for short term let control area in Skye and Raasay

Steps towards introducing a short term let control area have been considered by Highland Council's Isle of Skye and Raasay area committee. On Monday (1 December 2025) the committee heard evidence to justify the grounds for the introduction of a Short Term Let Control Area covering all or part of Skye and Raasay.Workforce North event spotlights Highland economy

EMPLOYERS and educators from across the Highlands have gathered to hear how a new initiative is aiming to transform the region's economy. Workforce North - A Call to Action brought together business leaders and teachers from primary and secondary schools from across the Highland Council area with a wide range of partners geared towards education, learning and skills development at Strathpeffer Pavillion.