Best Year Ever For Hi-Scot Credit Union

23rd December 2019

As 2019 draws to an end, the staff and volunteers at HI-Scot credit union are reflecting on a successful year for the organisation.

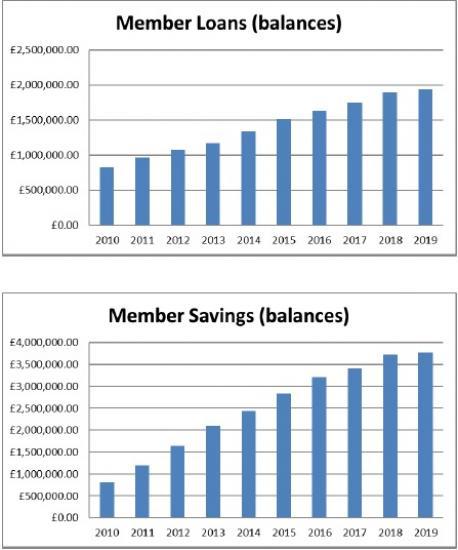

"We are pleased to report that 2019 was another twelve months of growth for HI-Scot," said Margaret Ann MacLeod, Chair of the Board of Directors, "This is good news not only for the credit union, but for our members and the communities we serve across the Highlands and Islands."

At the recent HI-Scot AGM, the members attending approved a 0.5% dividend. The AGM took place in six venues across the Highlands and Islands, using tele-conferencing to allow members from different areas to participate.

"In the current financial climate, this year's dividend is a positive indicator of HI-Scot's position in the community," said David Mackay, HI-Scot's General Manager, “We are proud to offer a range of services to our members and provide a real alternative to high street banks.”

One of the benefits of banking with HI-Scot is that members' money stays within the financial community of the Highlands and Islands. Owned completely by their members, the credit union does not have external shareholders, so any profits are ploughed back into the organisation - for example, in the form of an annual dividend.

“Of course, your money is completely safe with HI-Scot, as we are covered by the Financial Services Compensation Scheme,” adds David Mackay, “Saving and borrowing with the credit union makes a lot of sense.”

Why not make it your New Year's Resolution to check out what HI-Scot can offer you?

For more information see www.hi-scot.com

Related Businesses

Related Articles

HI-Scot Launches HI-Save Campaign

As the cost of living continues to rise across Scotland, HI-Scot Credit Union is launching HI-Save, a new community campaign aimed at encouraging people across the Highlands and Islands to begin saving regularly and to build stronger financial resilience. The campaign comes in response to stark figures.

Keep It Local - Why More Highlanders and Islanders Are Turning to HI-Scot Credit Union

In the Highlands and Islands, community spirit runs deep. From Shetland to Skye, from Caithness to Uist, people know the power of looking out for one another.The Pros And Cons Of Credit Union Saving and Borrowing

Many people want to save and help their community by making funds available at good rates from a local entity such as Hi-Scot Credit Union that covers Highland and Islands. Credit Unions encourage savings as well as offering affordable borrowing but lets take a closer look.More people have bank accounts but one in ten have no cash savings, FCA survey reveals

The Financial Conduct Authority (FCA) has found that one in ten people have no cash savings at all, and another 21% have less than £1,000 to draw on in an emergency. The regulator's research also shows that one in four people in the UK have low financial resilience, meaning that they have missed payments, are struggling to keep up with commitments, or don't have savings to help them through difficulties.Highland and Islands Has Its Own Community Owned Credit Union - Saving or Borrowing Use It

Credit unions have been around a long time. Hi-Scot credit union covers the Highland and Islands and it is easy to save or borrow at good rates.

Sleep Could Be Boosted By Saving Small Amounts

Saving money regularly can help improve sleep, a new report suggests. Putting a monthly amount aside, however small the sum, also helped people to relax and be more optimistic about the future, the study by academics at Bristol University found.Adult Membership Of Credit Unions Is Increasing And Members Taking Out More Loans

The latest information from the Bank of England shows that adult membership of credit unions across the UK is increasing. The total number of adult members has been steadily increasing.

Christmas is Past But Hi-Scot Credit Union Can Help Save For Next Christmas

3500 thousand credit union members save with Hi-Scot credit union. Starting to save in January will make things a lot easier by Christmas 2024.

Hi-Scot Credit Union Keeps Interest Rates Low

At meeting of the board of the Hi-Scot Credit Union the directors agreed not to follow other institutions like banks to put up interest rates. Well worth checking what rates you can still get from a credit union.

Say Hi To Your Highland And Islands Credit Union for Saving and Borrowing

Hi-Scot credit union covers the Highland and Islands and is a not for profit organisation helping more and more people. Hi-Scot has been growing slowly over recent years and now holds significant savings.