Scottish Income Tax: 2020-2021

5th March 2020

Rates and bands for Scottish Income Tax in financial year 2020 to 2021.

The Scotland Act 2016 provides the Scottish Parliament with the power to set all income tax rates and bands that will apply to Scottish taxpayers' Non-Savings, Non-Dividend (NSND) income for the tax year 2020 to 2021. This excludes setting the Personal Allowance, which remains reserved and is set by the UK Government in the UK Budget.

While the Scottish Parliament has the power to set the Scottish Income Tax rates and bands, HMRC will continue to be responsible for its collection and management. Therefore, Scottish Income Tax remains part of the existing UK income tax system and is not a fully devolved tax.

How Scottish Income Tax works

The income tax rates and bands payable by Scottish taxpayers will be those set by the Scottish Parliament. Receipts from Scottish Income Tax will be collected by HMRC and paid to the Scottish Government (via HM Treasury).

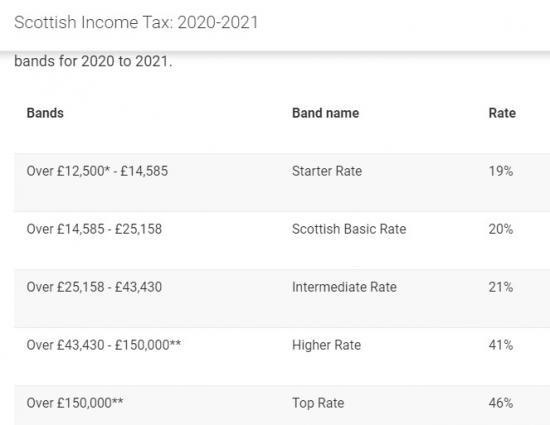

Scottish rates and bands for 2020 to 2021

Given the delay to the UK Budget, the rates and bands set out in the table below are based on an assumption that the Personal Allowance in 2020 to 2021 will be frozen at £12,500, by the UK Government, at the UK Budget on 11 March 2020. This is based on the last commitments made by the UK Government, in the Autumn Budget 2018.

On 4 March 2020 the Scottish Parliament set the following income tax rates and bands for 2020 to 2021.

** those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000.

For more details see the fact sheet HERE