2021 Tourism Forecast From Visit Britain And The Rest Of The World From The IMF

12th January 2021

This forecast is from Visit Britain.

The annual VisitBritain forecast for the volume and value of inbound tourism to the UK is issued in December each year. We are updating more regularly at the present time to reflect the impact of COVID-19 on inbound tourism to the UK, as well as an estimate of impact on domestic tourism. (Last updated for both inbound and domestic December 2020.)

Inbound forecast for the UK in 2020 and 2021 (last updated December 11th):

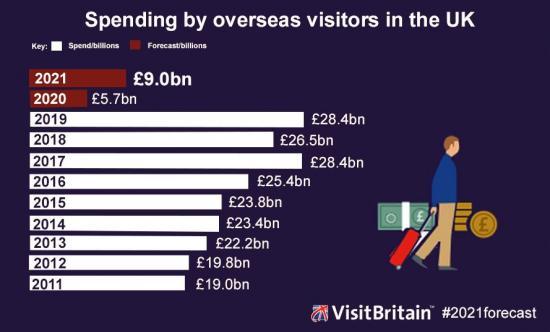

2020 forecast: VisitBritain's latest central scenario forecast for inbound tourism to the UK in 2020, as of December 11th, is for a decline of 76% in visits to 9.7 million and a decline of 80% in spending to £5.7 billion. This would represent a loss vs the pre-COVID forecast of 32.3 million visits and £24.7 billion spending.

Official inbound tourism statistics from the Office for National Statistics have only been published up to June 2020, and detailed statistics only up to March 2020. However, a number of other data sources are available which allow us to assess the state of inbound tourism to the UK. VisitBritain has issued a number of updates to its inbound forecast during 2020.

From mid-March to mid-July, COVID-19 triggered a near-total shutdown in international tourism to/from the UK with a few specific exceptions. Since then, available evidence suggests that there has been increase in visitor numbers from this low point, although they remain at a fraction of their usual level, and dipped again in November.

2021 forecast: Our central scenario for inbound tourism in 2021 is for 16.9 million visits, up 73% on 2020 but only 41% of the 2019 level; and £9.0 billion to be spent by inbound tourists, up 59% on 2020 but only 32% of the 2019 level.

We expect a small increase in inbound tourism during the early part of the year, although still at a very low level, followed by a recovery in the second quarter of the calendar year as restrictions start to ease, and then a gradual increase throughout the rest of the year. However, by the end of 2021 we do not expect inbound tourism to be back to, or even close to, normal levels.

In general, European inbound markets are forecast to recover quicker than long haul markets. However, there will be variations within each of Europe and long haul. There are forecast to be 13.6 million visits from Europe in 2021, 50% of the 2019 level; and 3.3 million visits from long haul markets, 24% of the 2019 level. The value of visitor spending in 2021 is forecast to be £5.0 billion and £4.0 billion from European and long haul visitors respectively.

There are a number of assumptions behind this forecast. The most crucial drivers will be the progression of COVID-19 and vaccinations, both in the UK and in our key inbound markets. It is assumed that in most advanced markets vaccinations begin in December 2020 / early 2021; that the majority within the most vulnerable groups will be able to be vaccinated in Q1 (Jan-Mar); but that it will take several months before the majority of the population is vaccinated. It is assumed that by the end of 2021 COVID-19 will be endemic and controlled rather than pandemic. In emerging markets, the forecast assumes that the population of international travellers is vaccinated at a similar rate to the general population in advanced markets.

The market composition effect (Europe recovering faster than long haul) is likely to push down average spend per visit but it is assumed that the net effect of other factors (such as changes in average length of stay and average spend per night) is neutral. The forecast does not specifically model journey purpose but assumes that visits to friends and relatives are likely to recover faster than average; business trips (excluding those delivering goods) are likely to recover slower than average; and holiday visits are likely to recover at a rate in between.

There are downside risks in the early part of the year, including a no-deal Brexit. Risks to the second half of the year are judged to be to the upside - for example, if vaccinations proceed quickly and confidence in international travel returns faster than expected. However, constraints on travel, for example closed borders, might persist for several months.

A number of other factors are likely to prevent inbound tourism recovery to pre-COVID levels even by the end of 2021. These include the economic situation, with demand hit by unemployment and fiscal tightening; new behavioural habits affecting leisure and business travel, both short and long term; potential loss of supply.

Forecasting at this time is difficult, given the fast-moving situation and the unique circumstances. Events are moving fast during the COVID-19 pandemic and the outlook can change daily. We stress that this central scenario is merely one possible outturn and involves several assumptions and simplifications due to the fast-moving and uncertain situation. VisitBritain's new central scenario forecasts above for full year 2020 and 2021 therefore reflect a snapshot in time based on current understanding and a set of assumptions. Subsequent developments could change the outlook. We will revise this forecast a number of times during 2021.

Domestic outlook for Britain in 2020 and 2021 (last updated December 14th):

VisitBritain have also run a domestic tourism forecast. As with our inbound forecast, this represents a snapshot in time and makes a number of assumptions to provide an estimate of impact. Subsequent developments could change the outlook.

The forecast models each of the four journey purposes for overnight tourism (holidays, business, visiting friends and relatives and miscellaneous journeys), and 17 categories of spending for leisure day trips, separately.

2020 forecast: We have forecast a central scenario for Britain of £34.4 billion in domestic tourism spending in 2020, down 62% compared to 2019 when spending by domestic tourists in Britain was £91.6bn. This comprises £9.9bn from overnight tourism, down from £24.7bn in 2019, and £24.6bn from day trips, down from £67.0bn in 2019. In total, this represents a loss of £57.2bn (£14.7bn from overnights and £42.4bn from leisure day trips). The 2020 forecast is for a decline of 60% for overnights and 63% for leisure day trips, although with different pattern of recovery. While some categories of day trips started to recover first, others were still very limited.

2021 forecast: Our forecast is for a recovery to £61.7bn in domestic tourism spending in 2021; this is up 79% compared to 2020 but still only 67% of the level of spending seen in 2019. We are forecasting £18.0bn in domestic overnight tourism spending (82% growth on 2020 but 73% of the 2019 level) and £44.6bn in leisure day trip spending (82% growth on 2020 and 67% of the 2019 level).

As with our inbound forecast, this is a short-term forecast that describes one possible outturn and involves many assumptions and simplifications due to the fast-moving and uncertain situation; it is therefore subject to revision. The forecast assumes a slow recovery in early 2021 before a step change in the spring as restrictions ease and confidence returns, followed by a gradual recovery throughout the rest of the year and beyond. Medical assumptions are as per the inbound forecast. By the end of 2021 we do not expect that we will be back to pre-COVID levels of spending in any domestic tourism journey purpose or activity type, although we are forecasting that by the end of the year the value of spending will be back to 84% of 2019 levels.

----------------------------------------------------------------------

{b]Wish You Were Here -

International Monetary Fund[/b}

Author - ADAM BEHSUDI is on the staff of Finance & Development.

Tourism-dependent economies are among those harmed the most by the pandemic

Before COVID-19, travel and tourism had become one of the most important sectors in the world economy, accounting for 10 percent of global GDP and more than 320 million jobs worldwide.

In 1950, at the dawn of the jet age, just 25 million people took foreign trips. By 2019, that number had reached 1.5 billion, and the travel and tourism sector had grown to almost too-big-to-fail proportions for many economies.

The global pandemic, the first of its scale in a new era of interconnectedness, has put 100 million jobs at risk, many in micro, small, and medium-sized enterprises that employ a high share of women, who represent 54 percent of the tourism workforce, according to the United Nations World Tourism Organization (UNWTO).

Tourism-dependent countries will likely feel the negative impacts of the crisis for much longer than other economies. Contact-intensive services key to the tourism and travel sectors are disproportionately affected by the pandemic and will continue to struggle until people feel safe to travel en masse again.

"There is no way we can grow our way out of this hole we are in," Irwin LaRocque, secretary-general of the Caribbean Community (CARICOM), said at a virtual event in September.

From the white sand beaches of the Caribbean, Seychelles, Mauritius, and the Pacific to the back streets of Bangkok, to Africa's sweeping national parks, countries are grappling with how to lure back visitors while avoiding new outbreaks of infection. The solutions range from wooing the ultrarich who can quarantine on their yachts to inviting people to stay for periods of up to a year and work virtually while enjoying a tropical view.

Tourism receipts worldwide are not expected to recover to 2019 levels until 2023. In the first half of this year, tourist arrivals fell globally by more than 65 percent, with a near halt since April—compared with 8 percent during the global financial crisis and 17 percent amid the SARS epidemic of 2003, according to ongoing IMF research on tourism in a post-pandemic world.

The October World Economic Outlook projected the global economy would contract by 4.4 percent in 2020. The shock in tourism-dependent economies will be far worse. Real GDP among African countries dependent on tourism will shrink by 12 percent. Among tourism-dependent Caribbean nations, the decline will also reach 12 percent. Pacific island nations such as Fiji could see real GDP shrink by a staggering 21 percent in 2020.

Nor is the economic hit limited to the most tourism-dependent countries. In the United States, Hawaii saw one in every six jobs vanish by August. In Florida, where tourism accounts for up to 15 percent of the state's revenue, officials said it will take up to three years for the industry to recover.

Among G20 countries, the hospitality and travel sectors make up 10 percent of employment and 9.5 percent of GDP on average, with the GDP share reaching 14 percent or more in Italy, Mexico, and Spain. A six-month disruption to activity could directly reduce GDP between 2.5 percent and 3.5 percent across all G20 countries, according to a recent IMF paper.

Managing the revenue gap

In Barbados and Seychelles, as in many other tourism-dependent nations, the pandemic brought the industry to a virtual standstill. After successfully halting local transmission of the virus, the authorities reopened their island countries for international tourists in July. Still, arrivals in August were down almost 90 percent relative to previous years, drying up a vital stream of government revenue.

Barbados had gone into the crisis with good economic fundamentals, as a result of an IMF-supported economic reform program that helped stabilize debt, build reserves, and consolidate its fiscal position just before the crisis struck. The IMF augmented its Extended Fund Facility program by about $90 million, or about 2 percent of GDP, to help finance the emerging fiscal deficit as a result of plummeting revenues from tourism-related activity and increasing COVID-related expenditures.

"The longer this lasts, the more difficult it gets to maintain," says Kevin Greenidge, senior technical advisor to Barbados Prime Minister Mia Mottley. "What we don't want to do is operate policy-wise in a manner that will jeopardize the gains in terms of the fundamentals that we have made."

On the other side of the world, Seychelles, a country that entered the crisis from a similar position of strength, will still be challenged to return to medium-term fiscal sustainability without significant support. Just before the crisis struck, the government had rebuilt international reserves and consolidated its fiscal positions. Even so, the ongoing pandemic struck the Indian Ocean island nation very hard as tourism revenues fell while COVID-related expenditures increased.

"It is too early to determine whether the crisis represents a permanent shock and how it will shape the tourism industry going forward," says Boriana Yontcheva, the IMF's mission chief to Seychelles. "Given the large uncertainties surrounding the recovery of the sector, innovative structural policies will be necessary to adapt to the new normal."

All over the world, tourism-dependent economies are working to finance a broad range of policy measures to soften the impact of plummeting tourism revenues on households and businesses. Cash transfers, grants, tax relief, payroll support, and loan guarantees have been deployed. Banks have also halted loan repayments in some cases. Some countries have focused support on informal workers, who tend to be concentrated in the tourism sector and are highly vulnerable.

An analysis of the tourism industry by McKinsey & Company says that multiyear recovery of tourism demand to 2019 levels will require experimenting with new financing mechanisms.

The consulting firm analyzed stimulus packages across 24 economies totaling $100 billion in direct aid to the tourism industry and $300 billion in aid across other sectors with significant involvement in tourism. Most direct stimulus was in the form of grants, debt relief, and aid to small and medium-sized enterprises and airlines. The firm recommends new ways to support the industry, including revenue-sharing mechanisms among hotels that compete for the same market segment, such as a stretch of beachfront, and government-backed equity funds for tourism-related businesses.

Development challenge

The crisis has crystallized the importance of tourism as a development pathway for many countries to decrease poverty and improve their economies. In sub-Saharan Africa, the development of tourism has been a key driver in closing the gap between poor and rich countries, with tourism-dependent countries averaging real per capita GDP growth of 2.4 percent between 1990 and 2019—significantly faster than non-tourism-dependent countries in the region, according to IMF staff.

Smaller, tourism-dependent nations are in many ways locked into their economic destinies. Among small island nations, there are few, if any, alternative sectors to which they can shift labor and capital.

Seychelles, for example, has benefited from increases in tuna exports during the COVID-19 period, which have somewhat offset tourism losses, but these additional earnings remain a fraction of tourism receipts. The government is also carrying out a plan to pay wages to displaced tourism-sector workers while offering opportunities for retraining.

Meanwhile, the government in Barbados is trying to maintain social spending and reprioritize capital spending to create jobs, at least temporarily, in nontourism sectors such as agriculture and infrastructure development.

The Caribbean Hotel and Tourism Association has projected that as many as 60 percent of the 30,000 new hotel rooms that were in the planning or construction phase throughout the Caribbean region will not be completed as a result of the crisis.

Still, the crisis is being viewed as an opportunity to improve the industry in the medium and long term through greater digitalization and environmental sustainability. The UNWTO has encouraged support for worker training in order to build digital skills for harnessing the value of big data, data analytics, and artificial intelligence. Recovery should be leveraged to improve the industry's efficient use of energy and water, waste management, and sustainable sourcing of food.

"In a sector that employs 1 in 10 people globally, harnessing innovation and digitalization, embracing local values, and creating decent jobs for all—especially for youth, women, and the most vulnerable groups in our societies—could be at the forefront of tourism's recovery," says UNWTO Secretary-General Zurab Pololikashvili.

Adjusting to a new normal

As the immediate impact of lockdowns and containment measures eased during the second half of 2020, countries started looking for a balance.

Thailand, Seychelles, and other countries approved programs that would admit tourists from “lower-risk” countries with special quarantine requirements. Fiji has created “blue lanes” that will allow seafaring visitors to arrive on yachts and quarantine at sea before they unleash “the immense economic impact they carry aboard,” Prime Minister Frank Bainimarama declared on Twitter. St. Lucia requires a negative COVID-19 test no more than seven days before arrival. Australia created a “travel bubble” that will eliminate quarantine requirements for travelers from New Zealand. CARICOM countries have also created a “regional travel bubble” that eliminates testing and quarantine for people traveling from countries within the bubble.

In a new era of remote work, countries and territories such as Barbados, Estonia, Georgia, Antigua and Barbuda, Aruba, and the Cayman Islands offer new long-term permits, lasting up to 12 months in some places, to entice foreign visitors to bring their virtual offices with them while spending in local economies.

Japan, which had seen its international arrivals triple from 2013 to 2018, started lifting border closures for travelers from certain countries at the end of October. To accommodate a post-pandemic tourism rebound, an IMF Working Paper recommends that the government continue a trend of relaxing visa requirements, draw visitors away from urban centers to less populated regions of the country, and complement a tourism comeback with improvements to labor resources and tourism infrastructure.

The World Tourism and Travel Council in a report on the future of the industry said the pandemic has shifted travelers’ focus to domestic trips or nature and outdoor destinations. Travel will largely be “kickstarted by the less risk averse travelers and early adopters, from adventure travelers and backpackers to surfers and mountain climbers,” the report says.

Leisure travel will lead the comeback in the tourism and travel sector. Business travel, a crucial source of revenue for hotels and airlines, could see a permanent shift or may come back only in phases based on proximity, reason for travel, and sector.

In the end, the return of tourism will likely hinge on what will be a deeply personal decision for many people as they weigh the risk of falling ill against the necessity of travel. The private sector backed by some tourism-dependent nations is developing global protocols for various travel industries, including a call for more rapid testing at airports to boost confidence in traveling.

“The fact is people do not feel comfortable traveling. We have not put in the necessary protocols to give them that comfort,” St. Lucia Prime Minister Allen Chastanet said at a September virtual event. “After 9/11, the TSA [Transportation Security Administration] and other security agencies around the world did a fantastic job of developing protocols that regained the public’s confidence to travel, and sadly with this pandemic we haven’t done that.”

Sources

https://www.visitbritain.org/2021-tourism-forecast

https://www.imf.org/external/pubs/ft/fandd/2020/12/impact-of-the-pandemic-on-tourism-behsudi.htm?utm_medium=email&utm_source=govdelivery