Borrowing Continues To Fall Faster Than Expected

25th August 2021

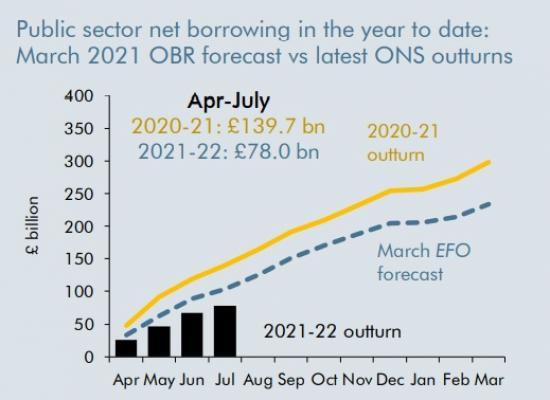

Government borrowing in July 2021 was £10.4 billion, down £10.1 billion from the same month last year. Year-to-date borrowing of £78.0 billion is now £26.1 billion below our March forecast profile. That reflects both stronger-than-expected receipts (thanks largely to a faster-than-expected economic recovery) and lower-than-expected spending (due to the faster-than-expected unwinding of covid-related government support).

• Public sector net borrowing (PSNB) totalled £10.4 billion in July 2021 and £78.0 billion in the first four months of 2021-22. These figures are respectively £5.2 billion below and £26.1 billion

below the monthly profiles consistent with our March forecast.

• Central government accrued receipts were £70.0 billion in July, £3.2 billion above our March forecast, and up £9.5 billion on last July. The year-to-date receipts surplus relative to forecast is

£15.6 billion, reflecting the much stronger performance of income tax and NICs, VAT and corporation tax.

• Central government spending in July was £79.8 billion, down £2.9 billion on last year and £2.9 billion below forecast. Year-to-date spending is down £28.1 billion on last year and is £9.4 billion below forecast. Lower spending relative to profile reflects lower spending on the CJRS and SEISS schemes, lower net Social Benefits and lower net current grants abroad.

• Net debt in July stood at 98.8 per cent of GDP. This is 4.2 per cent of GDP higher than a year earlier but 5.2 per cent of GDP below our March forecast, thanks both to lower central government cash spending in 2020-21, plus continued lower borrowing so far this year.

• Revisions: Borrowing last year (2020-21) was revised up £0.3 billion on last month's figure, but still down £5.1 billion on the initial estimate published in April. Year-to-date borrowing in the first three months of 2021-22 was revised down by £1.8 billion, thanks to an upward revision to current receipts of £0.7 billion, and a downward revision to central government spending of £1.0 billion).

Detail

1. The Office for National Statistics (ONS) and HM Treasury published their Statistical Bulletin on the July 2021 Public Sector Finances this morning. Each month the OBR provides a brief

analysis of the data and a comparison with our most recent forecast - in this instance our March 2021 Economic and fiscal outlook (EFO). We last published monthly profiles consistent with this forecast on 21 July, which were revised from those published on 6 May to bring them into line with the accruals treatment of the Brexit divorce bill payments through the year. We have used these revised profiles when comparing outturns to forecast.

2. Year-to-date borrowing in the first four months of 2021-22 of £78.0 billion was £26.1 billion below our forecast profile. This outperformance is largely due to central government accrued

receipts, which came in £15.6 billion (6.6 per cent) above profile, while central government spending was £9.4 billion (2.7 per cent) below profile. Borrowing by local authorities and public corporations were, respectively, £0.6 billion and £0.4 billion below profile.

3. The upside surprise in accrued receipts so far in 2021-22 is dominated by PAYE income tax and NICs (which are up £7.2 billion or 7.1 per cent on profile), corporation tax receipts (which are up £4.1 billion or 30.5 per cent), and VAT (which was up £1.4 billion or 3.4 per cent on profile).

4. Notable movements in the July cash receipts data include:

• Stamp duty land tax (SDLT) receipts are £0.7 billion (or 127 per cent) above monthly profile. This is mainly down to the exceptionally large number of property transactions in the final days of June before the ending of the temporary £500,000 nil-rate band. We had allowed for forestalling behaviour in our March forecast but had assumed all receipts would score in June. Some receipts relating to transactions at the end of June were paid over to HMRC in July.

• Cash receipts of VAT are £1.7 billion (or 11.1 per cent) above monthly profile. With cash receipts of VAT relating to spending 1-3 months earlier, the stronger pick up in consumer spending in the second quarter of 2021 is likely to be a key driver of the higher receipts.

• PAYE income tax and NICs cash receipts which came in £0.7 billion (or 2.3 per cent) above monthly profile. Receipts in July will mostly reflect June 2021 liabilities. Published RTI statistics suggest the number of paid employees in June increased by 1.3% from 12 months earlier (which is a rise of 365,000 employees) while median

monthly pay increased by 8.2 per cent compared with the same period of the previous year.

• Corporation tax remains stronger than expected at £0.2 billion (or 6.9 per cent) above monthly profile. This month’s surplus was primarily from non-financial companies. For the year-to-date, receipts have been stronger for very large companies in both the

financial and non-financial sectors. This suggests that profits are recovering more quickly than expected to pre-pandemic levels.

5. Lower-than-forecast central government spending so far in 2021-22 is mostly due to the Coronavirus Job Retention Scheme (CJRS) and Self-employed Income Support Scheme (SEISS), which came in, respectively, £1.8 billion (19.5 per cent) and £3.3 billion (37.3 per cent) below profile. Net social benefit spending is also £1.3 billion (1.6 per cent) below profile in the year to date, and net current grants abroad are also down £1.8 billion or 36 per cent.

6. Borrowing last year (2020-21) was revised up by £0.3 billion on last month’s figure, and down £5.1 billion on the initial estimate published in April, taking it to £29.4 billon below our March forecast (on a like-for-like basis excluding the future costs of write-offs against the pandemic loan guarantee schemes, which the ONS will include in the outturn data from next month). Year-to-date borrowing in the first three months of 2021-22 was revised down by £1.8 billion, thanks to an upward revision to current receipts of £0.7 billion, and a downward revision to central government spending of £1.0 billion.

7. In this month’s bulletin the ONS has given an indication of the size of some classification and methodology changes they will make to the public finances next month. Of these the largest impact (£20.9 billion) comes from the recognition of expected payments against government guaranteed loan schemes. This is more than £6 billion lower than we estimated in our March 21 forecast. The difference is attributable to a smaller than expected total stock of loans guaranteed, lower expected credit loss rate and ONS’s decision to record the present value rather than the nominal value as we had assumed. Our next forecast in October will incorporate the impacts of all the changes announced today.