Inflation has risen fast recently and looks to continue upwards

23rd March 2022

From the Office for National Statistics today.

Prices for food and non-alcoholic beverages have increased recently. Inflationary pressure has come from across the basket.

Main points

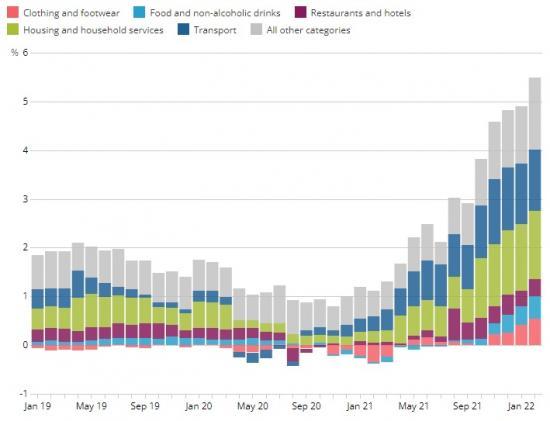

UK consumer price inflation has risen sharply in recent months, driven by a broad range of items, with particular pressure coming from food, durables, consumer goods and energy.

Energy, motor fuels and used cars have put strong upward pressure on inflation while food prices have also risen.

Recent inflation trends for the UK are broadly in line with those seen in other countries with similar pressures coming from crude oil and gas.

An increasing proportion of business have reported that their costs have increased and that they have raised their prices.

Of people surveyed in the Opinions and Lifestyle Survey (OPN) in the first half of March, 81% reported an increase in their cost of living.

Overview of consumer price inflation

Consumer price inflation has risen sharply over recent months prompting widespread discussion of increases in the cost of living. This analysis explores recent drivers of inflation and the factors that have been driving this increase. Consumer prices are affected by a range of different factors including costs of inputs, wages, changes in demand, availability of components and global economic factors.

The 12-month growth rate of the Consumer Prices Index including owner occupiers' housing costs (CPIH) rose to 5.5% in February 2022. Business prices also rose sharply in recent months to 15.2% for the input Producer Price Index (PPI) in November 2021, and 10.1% for the output PPI in February 2022. Business prices can give early indications of possible movements in CPIH as input and output prices pass through the economy and on to consumers.

The UK is not alone in experiencing high inflation in recent months. Using the internationally comparable CPI, which is the same as Eurostat's Harmonised Index of Consumer Prices (HICP), we can see that UK inflation has been broadly in line with the EU average for the last year. US inflation has risen considerably more quickly, reaching 8.1% in December 2021, while UK CPI has reached 6.2% in February 2022.

Many of the current drivers of this inflation are common across countries, with energy and fuel prices being subject to global market conditions and both the US and the UK seeing strong upward price pressure from used cars.

Energy prices have contributed to rising inflation

Housing and household services have put strong upward pressure on consumer price inflation in the UK and other countries since 2020. This has been driven by the increase in energy prices (gas and electricity), which have seen demand increase as economies reopened after the initial stages of the coronavirus (COVID-19) pandemic. It has also been driven by supply side issues such as weather conditions, including a cold winter in Europe and lower than usual availability of wind energy, leading to reduced gas stocks. More information is available on recent developments in natural gas and electricity markets.

Consumer prices for gas and electricity are typically less volatile than wholesale prices as they also account for other costs including distribution and customer engagement, which are more stable. In Great Britain, consumer price movements for gas and electricity are also tempered by the role of the Office of Gas and Electricity Markets (Ofgem) energy price cap.

Introduced in January 2019, the Ofgem price cap limits the price that energy firms can charge per unit for customers on variable tariffs, and limits adjustments to the default tariff price cap to twice a year: every April and October. Following the unusually high wholesale price increases in the latter half of 2021, the price cap was often lower than the price of available fixed rate contracts. The energy price cap is set to rise again in April 2022.

Over recent months around 80% of respondents to the Opinions and Lifestyle Survey (OPN) have reported increases in their energy bills, while around 37% of respondents in the second half of February 2022 said that they have reduced their fuel consumption. Recent analysis looks in more depth at energy prices and their effects on households.

Motor fuels and used cars have put strong upward pressure on price growth

Transport has seen steady increases in price growth since September 2020, following a period of falling prices between April and August 2020. This reflects trends in various components of transport but most notably in fuels and lubricants and purchases of motor vehicles. Figure 6 shows that this trend is also not specific to the UK, and the US in particular has seen exceptionally high price growth for transport.

Price growth for the operation of personal transport equipment, which includes motor fuels and vehicle maintenance, had a negative pull on inflation through most of 2020 as people across the world travelled less, businesses closed, and fewer goods were transported in response to the coronavirus (COVID-19) pandemic. This trend later reversed as businesses began to reopen and lockdowns eased, increasing demand for motor fuels.

Prices for fuels and lubricants tend to be strongly driven by the cost of inputs such as crude oil, which typically move in line with global market trends.

For almost every turning point in crude oil price growth, coke and refined petroleum products and fuels and lubricants followed within a month, showing the speed of the pass-through from crude oil prices to consumer prices for petrol and diesel.

At the beginning of the coronavirus pandemic, there were falls in the oil price in response to falling demand. The Organization of Petroleum Exporting Countries (OPEC) agreed cuts to output in mid-2020, which led to rising prices, coinciding with initial easing of some of the most stringent coronavirus pandemic-related movement restrictions. Prices continued to rise in early 2021 as the global economy continued to reopen, including international travel, but has since fallen back.

Consumer prices fell at the beginning of the coronavirus pandemic as both crude oil prices and consumer demand fell. As a result, consumers were more affected by the higher prices for motor fuels coming through in 2021 when demand was more similar to pre-coronavirus pandemic levels. In February 2022 petrol prices reached 147.6 pence per litre, the highest on record at that time.

Used cars have also been making strong contributions to consumer price growth since mid-2021, likely reflecting both increased total demand for cars and substitution effects caused by delays in supplies of new cars.

Between April 2021 and January 2022 prices for used cars increased by around 32%, compared with an increase of 3% for new cars over the same period. This trend in inflation has also been seen in the US, where used car prices have put strong upward pressure on consumer price inflation.

New car production has been hit by widespread delays in large part because of a worldwide shortage of semiconductors, which are used in many features of new cars. Existing supply issues for semiconductors have been exacerbated by larger than usual fluctuations in demand during the coronavirus pandemic, including for personal electronics as more people work from home.

At the same time, over the last two years people have generally driven less than average, meaning that one- or two-year-old cars will typically have driven fewer miles than would have been the case before the coronavirus pandemic. As a result, second-hand cars are retaining their value more than previously.

Prices for food and non-alcoholic beverages have increased recently

Price growth for food and non-alcoholic beverages has risen sharply over recent months, in line with trends seen in other countries and input prices as seen in the Producer Price Index (PPI).

Given the variety of goods included in food and non-alcoholic beverages it is typical to see a range of price movements offsetting one another each month, reflecting factors including seasonality of different products, changes in supply and demand, and pricing decisions by manufacturers and retailers, such as temporary discounting. It is notable, therefore, that since December 2021 all components of food and non-alcoholic beverages have been putting upward pressure on consumer price inflation.

Bread and cereals, meat, and milk, cheese and eggs have all seen considerable increases in their contribution to total CPIH growth in recent months. In early March the Agricultural and Horticultural Development Board (AHDB) reported record increases in grain prices and reduced dairy output putting upward pressure on prices, citing factors including poor silage quality and labour shortages as well as rising input costs.

Food and beverage firms with 10 or more employees in the Business Insights and Conditions Survey (BICS) have reported decreased turnover, increased input costs and supply chain challenges at higher rates than the average for all industries sampled in the survey over recent months.

Businesses were asked about how prices for items bought and sold have changed over the previous month compared with normal price fluctuations. Since April 2021, the proportion of food and beverage firms reporting increased costs above normal fluctuations has increased from around 18% to around 61% in February 2022. Over the same period, those reporting that they have increased prices has risen from around 7% to around 39% in February 2022.

Increased costs for fuel and energy also feed through as input costs to firms, increasing overheads for manufacturing, delivery and retail. Almost half of food and beverage firms with 10 employees or more reported being affected by rising wholesale gas prices in February 2022, compared with around 25% of firms across all sectors surveyed by BICS.

In terms of consumer demand, predominantly food stores have seen somewhat different trends to those seen in the rest of the retail sector since the beginning of the coronavirus (COVID-19) pandemic. Figure 12 shows movements in sales volumes for predominantly food stores and all retail since January 2019, with demand for food increasing at the beginning of the coronavirus pandemic while demand for all retail fell sharply. This reflects substitution effects as we entered lockdown, with many restaurants and takeaways closing for an extend period, and consumer uncertainty about the ongoing availability of goods at that time.

During subsequent periods of lockdown restrictions, demand for food remained relatively high as demand for other types of retail fell. Demand for all retail rebounded following the end of lockdown restrictions and, most recently, has risen, while demand for food fell slightly in January 2022.

Inflationary pressure has come from across the basket

In recent months, consumer prices have risen across the basket, with particularly strong upward pressure coming from essentials such as energy and motor fuels. Food prices have also increased considerably, all of which is felt directly by consumers as they see changes in the cost of transport, energy bills and food costs on a weekly or monthly basis.

In the most recent responses to the Opinions and Lifestyle Survey (OPN) 81% of those asked reported that their cost of living had increased in the previous seven days. Of those, 92% reported an increase in the price of food shopping, 80% reported an increase in gas or electricity bills and 76% an increase in the price of fuel.

Note

The above are extracts are from the ONS report

To read it with much more data, graphs and information go to https://www.ons.gov.uk/economy/inflationandpriceindices/articles/priceseconomicanalysisquarterly/march2022