Phishing Attacks - Who Is Most At Risk?

28th September 2022

Fraudsters send messages over email, text or social media, posing as trusted organisations to trick people into handing over money or personal details. But who is most at risk, and what can we do to protect ourselves?

New data have revealed half of adults reported receiving a "phishing" message in the month before being asked.

Those aged 25 to 44 years are most likely to be targeted, according to results from the Telephone-operated Crime Survey of England and Wales (TCSEW).

Traditionally sent via email, phishing involves messages from fraudsters posing as legitimate organisations to extract personal information, or money, from the victim.

They have exploited significant events, including the coronavirus (COVID-19) pandemic and the rising cost of living, to target victims.

There is also evidence of fraudsters taking advantage of widespread behavioural changes because of the pandemic, such as the rise in online shopping.

This includes a nine-fold rise in "advance fee fraud" (victims making upfront payments for goods or services which then do not materialise) and a 57% rise in "consumer and retail fraud" from pre-pandemic levels.

Advance fee fraud is significantly higher than pre-pandemic levels

Incidents of fraud, England and Wales, year ending March 2017 to year ending March 2020, Crime Survey of England and Wales, and year ending March 2022 interviews, Telephone Operated Crime Survey of England and Wales.

It comes amid a general rise in fraud, with a 25% rise on pre-pandemic levels (to around 4.5 million offences) in the year to March 2022.

Almost two thirds (61%) of these were flagged as cyber-related (conducted online).

Phishing scams continue to pose a significant threat for both individuals and businesses. I would urge everyone to be vigilant of unexpected messages or calls that ask for your personal or financial information. Remember, your bank, or any official source, will never ask you to supply personal information via email or text message

- Detective Chief Superintendent Oliver Shaw, City of London Police.

COVID-19 and the rising cost of living

Fraudsters are always adapting their phishing attacks, and recent emerging trends have exploited the COVID-19 pandemic and rising cost of living.

In the latest year, 4.8% of all fraud was perceived to be coronavirus-related, rising to 6.3% of all cyber fraud. In one campaign, victims received text messages apparently from the NHS claiming they had been in close contact with someone who had the Omicron variant.

The message provides a link to a website claiming to be hosted by the NHS where they can book a test, prompting them to provide personal information and pay a delivery fee.

The National Fraud Intelligence Bureau (NFIB) at City of London Police, the national policing lead on fraud, has also identified new trends, as phishing attacks target those in a difficult financial situation.

They include the promise of energy and council tax rebates or encouraging people to apply for a "cost of living payment", mimicking genuine government support packages.

Of those who replied to or clicked on a link in a phishing message, more than a third (35%) said they did so for financial or material gain, and 30% to pay an invoice or bill, according to the TCSEW.

In the two weeks to 5 August 2022, more than 1,500 reports were made to the Suspicious Emails Reporting Service (SERS), run by the National Cyber Security Centre, about scam emails pretending to be legitimate energy rebates from Ofgem, the energy regulator in Great Britain.

The emails use the Ofgem logo and colours and have the subject header "Claim your bill rebate now".

It is shameful that in a time of financial hardship, criminal are targeting members of the public by claiming they are entitled to receiving rebates and refunds. If an email is genuine, the company will never push you into handing over your details.

Detective Chief Inspector Hayley King, City of London Police

Cifas, a UK fraud prevention service, said there is a "real concern due to the rise in living costs, criminals will look to target loan products and deferred credit services."

Common campaigns they have encountered include fraudsters posing as utility providers offering deals on energy bills, or competitions to win fuel vouchers.

What tactics are used?

Traditionally phishing has involved email messages.

However, other methods of communication are increasingly being used, with "smishing" (using text messages) now just as common as email phishing.

Almost a third (32%) of respondents to the TCSEW reported receiving a message via text or instant messaging, which may have been phishing, in the month before being asked.

This was a similar proportion to those who had received suspicious emails which could have been phishing (34%).

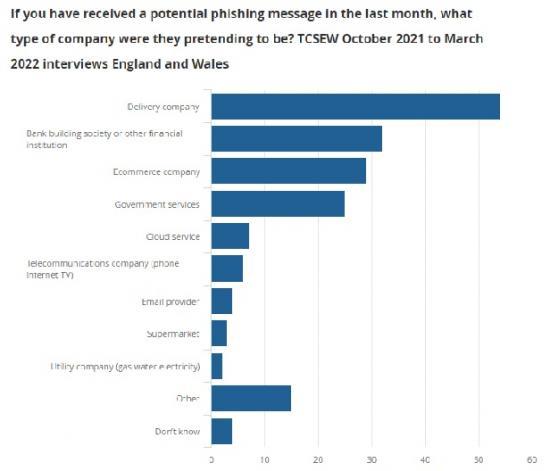

More than half (54%) of those who received phishing messages said the sender had been posing as a delivery company, as fraudsters take advantage of the rise of online shopping and homeworking.

A third (32%) received messages apparently from their bank or building society, and a quarter (25%) from government services.

More than half of those who received phishing messages reported they were from senders posing as delivery companies.

This article is from the Office for National Statistics. To read much more with images go HERE