HIE Business Panel Survey - October/November 2022

30th January 2023

This report presents findings from the most recent wave of the

Highlands and Islands Enterprise business panel survey carried

out in October and November 2022.

The survey was carried out while the UK was experiencing increased inflation, a cost of living crisis, and entering a recession.

During fieldwork the UK Government announced its "mini budget" and subsequent Autumn statement, which signalled higher taxes and likely spending cuts, alongside the existing widespread cost increases.

Against this background, businesses' confidence in the economy

continued the downward trend seen in recent waves and reached

its lowest level since 2020.

Business performance was mixed, but most said they had either

performed well or had been fairly steady. Aspects of business

performance (employment, exports and sales or turnover)

remained largely unchanged since the previous wave.

Reflecting the economic uncertainty of the time, business outlook

was fairly short-term, with two thirds of businesses unable to plan

more than six months ahead. That said, the majority of

businesses were confident that they would still be viable in six

months time - though fewer were confident than in June/July

2022. Business expectations seemed linked to how well they had

been performing, with those that had performed well expecting

to perform even better in six months time, and those that had

struggled expecting to perform below their current levels.

It was clear that the cost crisis was having widespread impacts

on businesses in the region. The majority had experienced

substantial cost increases (particularly for raw materials,

electricity and gas, and transportation of goods) and this was

impacting on profit margins and on plans for the future.

The cost crisis was impacting on the wellbeing of business owners, with reports of stress and worry, working longer hours, reductions in pay and difficulties balancing work and home life.

Employers also reported impacts on their staff, such as working

at or beyond capacity. Actions being taking in response included

engaging more with staff, increasing wages and encouraging

flexible working.

As seen in previous waves, sectoral differences were apparent.

Food and drink businesses had struggled in the past six months

and had delayed or postponed plans due to cost increases. They

were also more likely to have absorbed costs and to have made

use of private and public sector loans, and credits or overdrafts.

Tourism businesses, meanwhile were more likely to have performed well, but were less confident in their future viability, and had taken a range of actions in response to the cost crisis including increasing their prices, using cash reserves, reducing their operations, and closing for winter.

• Confidence in the economic outlook for Scotland was at the

lowest level since this was first asked (in October/November

2021): 41% of businesses were confident, while 58% were not.

Businesses in the Highlands and Islands were more confident in the

economic outlook for Scotland (41%) than those in the South of

Scotland (37%) and the rest of rural Scotland (33%).

• Reflecting on the last six months, 63% said their confidence had

decreased, 5% said it had increased, and 31% said it had stayed

the same, with net confidence the lowest it had been since

October/November 2020.

• Views on business performance over the last six months were

mixed, with 36% saying their business had performed well, 41%

saying business had been fairly steady and 22% saying they had

struggled.

• Over the past six months employment was fairly stable while sales

or turnover performance was mixed (34% said it had increased,

22% decreased, and 44% remained the same). Exports had

increased for 16% (higher than the 11% reported in June/July 2022), had decreased for 18% and were stable for 62%.

• Around a quarter (23%) of businesses felt able to plan no more

than a month ahead (with 9% planning week to week, and 14%

monthly). One in five (20%) felt able to plan no more than three

months ahead, 23% six months ahead, and 17% 12 months ahead.

Just over one in ten (13%) felt able to plan beyond the next 12

months.

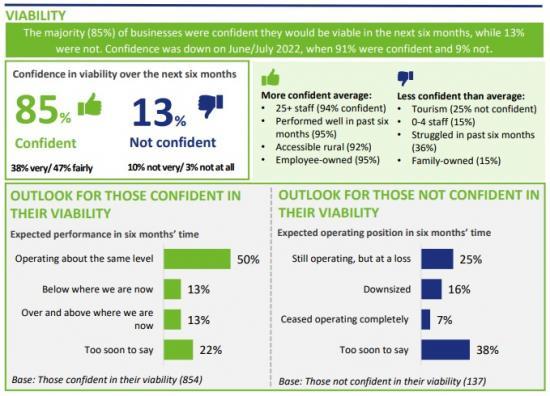

Future viability

• The majority (85%) of businesses were confident they would be

viable over the next six months, while 13% were not. Confidence

was down on the previous wave, when 91% were confident and 9%

not.

Among those that were confident in their viability, 50% expected to be

operating at about the same level in six months time, while 13%

expected to be operating below and 13% over and above their current levels. Around a fifth (22%) felt it was too soon to say.

• Among those not confident in their viability, 25% expected to be

operating at a loss in six months time, 16% expected to have downsized and 7% to have ceased trading completely. Just under two-fifths (38%) were unsure about their likely operating position.

Markets

• Over three quarters (77%) of businesses were importers (sourcing goods from outside Scotland): 76% imported from the rest of the UK and 33% from outside the UK. The majority of businesses (92%) sourced goods and materials from Scotland.

• While the proportion of importers was consistent with the last survey wave, since June/July 2021, there has been an increase in the proportion sourcing goods and materials from the rest of UK (from 63% to 76%) and a decrease in those importing from outside the UK (from 39% to 33%).

• Around half (49%) of businesses were exporters (selling to markets outside Scotland), with 47% selling to the rest of UK and 29% outside the UK. The majority (95%) of businesses sold goods or services within Scotland, with 49% selling only in Scotland. The proportion of exporters was consistent with the previous survey wave, but has decreased since June/July 2021 (62%).

Cost crisis

• Almost all businesses (99%) had experienced cost increases in the past 12 months, with 83% reporting substantial cost increases.

• The biggest areas of cost increase were raw materials (82% saw an increase, 56% a substantial increase), electricity and gas (81% and 55%) and transportation of goods (77% and 45%), followed by equipment

purchase or repair (77% and 36%), business rates or insurance (72% and 17%) and other utilities (68% and 32%).

• The costs having the biggest impact on businesses were those that had increased the most: electricity and gas (53%), raw materials (51%) and transportation of goods (39%).

• The increased costs of raw materials, transportation of goods and staff wages had a bigger impact on businesses in the Highlands and Islands than on those across rural Scotland overall.

• The main impact of cost increases was reduced profit margins (69%), followed by delayed or postponed growth plans (42%), being unable to set prices for the coming year (37%) and loss or reduction in customer demand (35%).

• Three quarters (75%) of businesses had delayed or postponed plans because of cost increases. A range of plans were impacted including:

energy efficiency improvements (36%), new capital projects (35%),

increasing staff wages or benefits (32%) and investing in technology

(30%).

• In response to the cost crisis the majority of businesses were absorbing costs (70%) or increasing prices (68%). Other actions included making energy efficiency improvements (55%), using cash reserves (45%), sourcing alternative materials, goods or services (44%) and investing in the business (42%).

Financial concerns and use of finance

• The majority of businesses (87%) had financial concerns. The top

concerns were unpredictable costs (77%) and low profit margins or losses (61%), followed by low or no cash reserves (34%), increased interest rates on loans and debt (27%) and restricted access to finance (22%).

• Half (51%) of businesses were currently using or planning to use some form of finance, a decrease since October/November 2021 (when 63% were doing so). Around a third of businesses were already using or planning to use loans from banks or financial institutions (36%), public sector grants or loans (34%), or credit or overdrafts (33%).

• Cost increases were particularly apparent among those that had

struggled in the last six months and those unable to plan more

than a month ahead. Certain cost increases were also more

common among food and drink and tourism sectors - in raw

materials and equipment for the former, and in electricity and gas,

other utilities and staff wages for the latter.

• Response to the cost crisis also differed depending on business

performance. Those that had performed well were more likely to

have increased prices or invested in the business, while those that

had struggled were more likely to have scaled back by using cash

reserves, reducing operations or opening hours, closing for winter

and making staff redundant.

Business structure and recruitment

• Among employers, over four-fifths (83%) described themselves

as family-owned, rising to 93% in the food and drink sector, while

10% were employee-owned (with employees owning a majority

of the shares). More than one-in-ten (13%) businesses were

women-led.

• Around a third (32%) of businesses had recruited staff in the last

six months. Recruitment was more common among businesses

with 11+ staff and those in the tourism sector.

• Among those that had recruited staff, 24% had done so by

looking further afield in the UK and 11% from international

markets. In addition, 27% had helped source or provided

accommodation, 19% accommodated childcare requirements,

13% supported relocation costs, and 12% supported employment

for partners.

• Of those who had recruited staff in the past six months, around

three-quarters (74%) noted word of mouth as the most effective

channel, rising to 84% among small businesses (1-4 staff). Half

(49%) cited adverts on social media as the most effective route,

followed by paid-for recruitment services (30%) and adverts on

their own website (28%).

Wellbeing and support

•A majority of business owners/senior managers (79%) reported

impacts of the cost crisis on their own wellbeing.

• More than half (56%) of business owners/senior managers reported generally feeling worried or stressed due to the cost crisis, around half said they were working longer hours (49%) or struggling to balance work and home life (45%) and two-fifths had reduced their own pay and benefits (41%).

• Women-led businesses were more likely to have reported feelings of worry and stress, impacts on mental health, and reducing their pay or benefits. Businesses struggling in the last six months reported higher rates of impact in every category listed.

• Over six in ten (62%) employers reported seeing impacts of the cost crisis on their staff. Almost a third (32%) said staff were working at or beyond capacity, while around a quarter reported staff requesting flexibility in working patterns or locations (27%), low morale (25%) and requests for longer hours or additional work (24%). This was especially true in businesses with 25+ staff and among those that had struggled in the last six months.

• More than four-fifths (82%) of employers are taking action to

support staff in response to the cost crisis. Almost two-thirds (64%)

were engaging with staff to understand their needs and around half

were increasing wages (51%) and encouraging flexible working

(50%). Around a third were targeting support at those on the lowest

wages (34%) and offering mental health support (32%).

Business structure and recruitment

• Among employers, over four-fifths (83%) described themselves

as family-owned, rising to 93% in the food and drink sector, while

10% were employee-owned (with employees owning a majority

of the shares). More than one-in-ten (13%) businesses were

women-led.

• Around a third (32%) of businesses had recruited staff in the last

six months. Recruitment was more common among businesses

with 11+ staff and those in the tourism sector.

• Among those that had recruited staff, 24% had done so by

looking further afield in the UK and 11% from international

markets. In addition, 27% had helped source or provided

accommodation, 19% accommodated childcare requirements,

13% supported relocation costs, and 12% supported employment

for partners.

• Of those who had recruited staff in the past six months, around

three-quarters (74%) noted word of mouth as the most effective

channel, rising to 84% among small businesses (1-4 staff). Half

(49%) cited adverts on social media as the most effective route,

followed by paid-for recruitment services (30%) and adverts on

their own website (28%).

Read the full report HERE

Pdf 61 Pages.

Related Businesses

Related Articles

Workforce North event spotlights Highland economy

EMPLOYERS and educators from across the Highlands have gathered to hear how a new initiative is aiming to transform the region's economy. Workforce North - A Call to Action brought together business leaders and teachers from primary and secondary schools from across the Highland Council area with a wide range of partners geared towards education, learning and skills development at Strathpeffer Pavillion.

Tartan challenge for UHI students offers £1,500 prize

Students from across the University of the Highlands and Islands (UHI) partnership have been challenged to design a tartan and be in with a chance of winning a £1,500 cash prize. Highlands and Islands Enterprise (HIE) has launched THE COMPETITION to mark 60 years since the regional development agency (then named Highlands and Islands Development Board) was established in November 1965.

The Rural AI Roadshow - How AI can help your rural business thrive

Scotland's enterprise agencies (Scottish Enterprise, Highlands and Islands Enterprise, South of Scotland Enterprise) The Scottish AI Alliance and The Data Lab have joined forces to plan and deliver an inspiring and educational Rural AI Roadshow. There will be three, one day, Rural AI Roadshow conferences taking place across Scotland in January 2026.

Digital and AI innovation round-up for November

Scotland's digital future is accelerating, with AI and tech innovation transforming businesses. In this blog, HIE's Theresa Swayne shares November insights on funding, leadership, and how organisations can harness technology to stay ahead.

Reflections from SEWF Rural: global lessons for the Highlands and Islands social impact economy

As we mark 60 years since the region's economic and community development agency was established, it's timely to reflect on the global aspects of our work on shaping rural futures. The recent Social Enterprise World Forum (SEWF) Rural Gathering in Sabah, Malaysia, welcomed changemakers from Australia, Ireland, India, Canada.

Scottish Entrepreneurial Ecosystem Guide - FREE To Download

Scottish Enterprise's Entrepreneurial Ecosystem Guide provides an overview of more than 150 organisations that support new and growing companies in Scotland. The guide includes incubators, accelerators, specialist industry programmes, co-working spaces and networking organisations.

Funding approved for Wick Harbour port consultant

A specialist ports consultant has been appointed to develop a long-term strategic plan for Wick Harbour Authority (WHA) in Caithness. WHA has secured £47,775 from Highlands and Islands Enterprise (HIE) and the Nuclear Restoration Services, NRS Dounreay towards the cost of the services.

Enterprise and innovation agencies join forces in new framework

Scotland's three enterprise agencies have joined the UK's national innovation agency to agree a collaboration framework that aims to help Scotland become one of the most innovative small nations in the world. The Innovation Collaboration Framework for Scotland brings together Highlands and Islands Enterprise, Scottish Enterprise, South of Scotland Enterprise and Innovate UK with a commitment to support ambitious businesses to invest in research to drive economic growth, create good jobs and help tackle major societal and environmental challenges.

£3.4m HIE investment in Arnish Road, Stornoway

The project, led by the Stornoway Port Authority, will involve upgrading the full length of the 3.3km Arnish Moor Road. Highlands and Islands Enterprise (HIE) has approved a £3.4m contribution to a £7.2m public funding package for a major project to transform road access to strategic industrial and port sites on the Isle of Lewis.

As HIE reaches 60, new chair says best is yet to come

The newly appointed chair of Highlands and Islands Enterprise (HIE) says the region is on the threshold of a new era of economic growth. Angus Campbell's term as chair began officially on 1 November - 60 years to the day since HIE's forerunner, the Highlands and Islands Development Board (HIDB) opened for business with just six employees.