Public Sector Finances UK - January 2023

21st February 2023

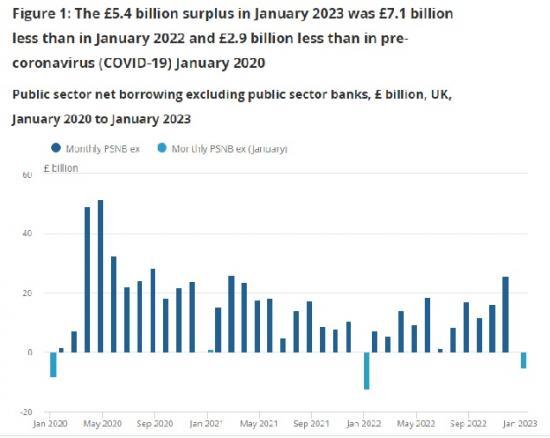

Public sector net borrowing (PSNB ex) in January 2023 was in surplus by £5.4 billion, which was a £7.1 billion smaller surplus than in January 2022 but a £5.0 billion larger surplus than forecast by the Office for Budget Responsibility (OBR).

Self-assessed income tax receipts were £21.9 billion in January 2023, which was the highest January figure since monthly records began in April 1999 and £5.5 billion or one-third higher than in January 2022.

January's high annual self-assessed tax receipts were partly offset by substantial spending on energy support schemes and large one-off payments relating to historic customs duties owed to the EU.

Central government debt interest payable was £6.7 billion in January 2023, which was the highest January figure since monthly records began in April 1997; the recent increases are largely because of the effect of Retail Prices Index (RPI) changes on index-linked gilts.

In the financial year-to-January 2023, the public sector borrowed £116.9 billion, which was £7.0 billion more than in the same period last year but £30.6 billion less than forecast by the OBR (after temporary differences because of student loan estimates are taken into account - see Section 10: Measuring the data).

Public sector net debt (PSND ex) at the end of January 2023 was £2,492.1 billion, or around 98.9% of gross domestic product (GDP), with the debt-to-GDP ratio at levels last seen in the early 1960s.

Public sector net debt excluding the Bank of England was £2,198.7 billion, or around 87.2% of GDP, which was £293.4 billion less than the wider measure.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was in surplus by £20.9 billion in January 2023, bringing the total net cash requirement for the financial year-to-January 2023 to £79.4 billion.

Borrowing in January 2023

Initial estimates for January 2023 show that the public sector spent less than it received in taxes and other income, resulting in a surplus of £5.4 billion. Each January, accrued receipts tend to be higher than in other months owing to receipts from self-assessed taxes, often leading to a public sector net surplus.

Central government forms the largest part of the public sector, and the relationship between its receipts and expenditure is the main determinant of public sector borrowing.

Initial estimates show that central government's current receipts in January 2023 were £107.8 billion, which was an increase of £12.6 billion (13.6%) compared with January 2022. Over the same period, current expenditure rose by £12.0 billion (16.4%).

Total expenditure, which includes depreciation and net investment, grew considerably to £103.6 billion in January 2023, which was £20.1 billion (24.0%) more than a year earlier.

The increase in central government's expenditure in January 2023 compared with the previous year was mainly because of substantial spending on energy support schemes and large one-off payments relating to historic customs duties owed to the EU.

Self-assessed tax receipts

Each January, accrued receipts tend to be higher than in other months owing to receipts from self-assessed (SA) Income Taxes.

In January 2023, SA Income Tax receipts have been provisionally estimated at £21.9 billion, which was the highest in any month since records began in April 1999, up one-third from a year ago.

SA Capital Gains Tax receipts (presented within "other taxes on income & wealth" in Tables 2 and 6) have been provisionally estimated at £13.2 billion, which was the highest in any month since records began in January 1998.

Payments close to the deadline, and the time taken for those to then appear in administrative data, mean that the proportion of self-assessed taxes recorded in January and February can vary year-on-year, and it is therefore advisable to consider these two months together when making annual comparisons.

Bank of England Asset Purchase Facility Fund

The Bank of England Asset Purchase Facility Fund (APF) received its second payment from HM Treasury under the indemnity agreement in January 2023.

This £4.2 billion of central government expenditure was recorded as a capital transfer to the Bank of England, which is a component of the net investment category in Tables 3 and 7.

As with other such payments, intra-public sector transfers are public sector net borrowing neutral. However, this increase in central government expenditure will affect measures that exclude the Bank of England.

Interest payable on central government debt

In January 2023, the interest payable on central government debt was £6.7 billion, which was the largest January interest payable on record - but significantly lower than the previous month.

The recent high levels of debt interest payable are largely a result of higher inflation, with the interest payable on index-linked gilts rising in line with the Retail Prices Index (RPI).

Of the £6.7 billion interest payable in January 2023, £3.3 billion reflects the impact of inflation on the index-linked gilt stock.

Note

Read the full ONS report HERE