Public Sector Finances UK - April 2023

23rd May 2023

How the relationship between UK public sector monthly income and expenditure leads to changes in deficit and debt.

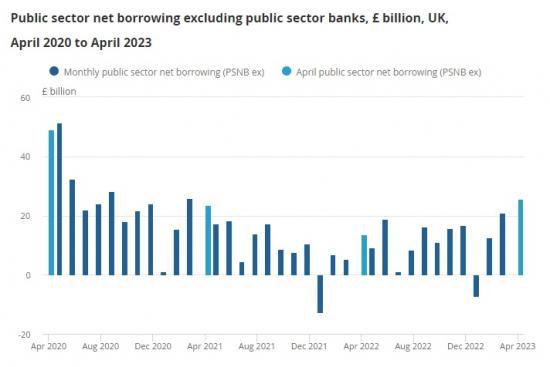

Public sector net borrowing (PSNB ex) in April 2023 was £25.6 billion, £11.9 billion more than in April 2022 and the second-highest April borrowing since monthly records began in 1993, with the growth in receipts being exceeded by the additional costs of the energy support schemes, increases in benefit payments and higher debt interest payable.

Central government debt interest payable was £9.8 billion in April 2023, £3.1 billion more than April 2022 and the highest April figure since monthly records began in 1997; the recent large movements in interest payable are because of the effect of Retail Prices Index (RPI) inflation on index-linked gilts.

Since our March 2023 publication, we have revised down our initial estimate of PSNB ex in the financial year ending (FYE) March 2023 by £2.1 billion to £137.1 billion, now £15.3 billion less than the £152.4 billion forecast by the Office for Budget Responsibility (OBR).

Public sector net debt (PSND ex) at the end of April 2023 was £2,536.9 billion or around 99.2% of gross domestic product (GDP), with the debt-to-GDP ratio at levels last seen in the early 1960s; excluding the Bank of England, debt was £2,273.6 billion or around 88.9% of GDP, £263.2 billion lower than the wider measure.

Public sector net worth (PSNW ex) was a deficit of £611.8 billion at the end of April 2023.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was £18.8 billion in April 2023, £5.6 billion below the OBR expectation; the total for the FYE March 2023 remains at £111.3 billion, £4.1 billion less than the £115.4 billion forecast by the OBR.

The initial outturn estimates for the early months of the financial year, particularly April, contain more forecast data than other months, as profiles of tax receipts, and departmental and local government spending are still provisional. The data for these months are typically more prone to sizeable revisions in later months.

Borrowing in April 2023

Initial estimates for April 2023 show that the public sector spent more than it received in taxes and other income, requiring it to borrow £25.6 billion. This was £11.9 billion more than that borrowed in April 2022 and the second highest April borrowing since monthly records began in 1993, behind April 2020.

Public sector borrowing consists of two broad components: the current budget deficit and capital expenditure (or net investment).

In April 2023, the public sector current budget deficit (or borrowing to fund day-to-day activities) was £19.4 billion, £10.1 billion more than in April 2022. Over the same period, public sector net investment increased by £1.8 billion to £6.2 billion.

Interest payable on central government debt

In April 2023, the interest payable on central government debt was £9.8 billion, £3.1 billion more than in April 2022, as rises in the Retail Prices Index have increased the interest payable on index-linked gilts. This represents the third-highest interest payable in any month on record, behind the £20.0 billion in June 2022 and the £18.0 billion in December 2022.

Energy support payments

In April 2023, central government spent £3.9 billion on subsidies, £1.8 billion more than in the April 2022. This growth was largely because of the cost of the Energy Price Guarantee for households and the Energy Bills Discount Scheme, which replaced the Energy Bill Relief Scheme for businesses across the UK from April 2023.

Other current grants

Central government paid £1.8 billion in "other current grants" in April 2023, £3.4 billion less than in April 2022. This fall was largely because of the £3.2 billion cost-of-living council tax rebate payments to households in England and Wales in April 2022.

Net social benefits

Net social benefits paid by central government in April 2023 were £25.4 billion, £4.5 billion more than in April 2022. This increase was in part because of inflation linked benefits uprating, along with the £2.2 billion Department for Work and Pensions (DWP): Means tested benefits cost-of-living payments, recorded this month.

Bank of England Asset Purchase Facility Fund

Between January 2013 and July 2022, HM Treasury received regular payments from the Bank of England Asset Purchase Facility Fund (APF) under the indemnity agreement. These payments have now stopped. As a result, central government interest and dividend receipts in April 2023 were estimated to be £1.0 billion, a reduction of £2.8 billion compared with April 2022.

This month the APF received its third payment from HM Treasury under the indemnity agreement. This £9.8 billion of central government expenditure has been recorded as a capital transfer to the Bank of England, a component of net investment.

As with other such payments, intra-public sector transfers are public sector net borrowing neutral. However, these central government transactions will impact our public sector net borrowing excluding the Bank of England (PSNB ex BoE) measure.

Borrowing in the financial year ending March 2023

Since our Public sector finances, UK: March 2023 bulletin published on 25 April 2023, we have reduced our initial estimate of borrowing for the 12 months to March 2023 by £2.1 billion, to £137.1 billion.

This was £16.1 billion more borrowing than in the financial year ending (FYE) 2022. It remains the fourth-highest FYE borrowing since monthly records began, behind FYE 2021 (during the coronavirus (COVID-19) pandemic) and both the FYE 2010 and FYE 2011 (after the effects of the global financial downturn).

Public sector borrowing is calculated as the difference between its spending and its income.

We estimate that spending in the financial year ending March 2023 was £1,154.6 billion, £17.4 billion below the Office for Budget Responsibility (OBR) forecast of £1,172.0 billion, and including an estimated £41.2 billion on central government energy support payments and £106.7 billion on the interest payable on central government debt.

We also estimate that income in the financial year ending March 2023 was £1,017.5 billion, £2.2 billion below the OBR forecast of £1,019.7 billion. This income included central government tax receipts of £697.5 billion and compulsory social contributions (largely National Insurance Contributions) of £177.6 billion.

The affordability of borrowing FYE March 2023

Expressing borrowing as a ratio of gross domestic product (GDP) - the value of the output of the economy - gives an estimate of its affordability and provides a more robust comparison of the UK's fiscal position over time.

The coronavirus pandemic had a substantial impact on the economy as well as public sector borrowing. Expressed as a proportion of GDP, borrowing in the FYE March 2021 was 15.0%, the highest for 75 years.

This proportion fell by 9.8 percentage points to 5.2% in the FYE March 2022 as the economy recovered from the coronavirus pandemic. However, initial estimates show that for the 12 months to March 2023, the proportion has risen by 0.2 percentage points to 5.4%, in part because of the impact of energy prices on the economy and public finances.

Public sector net worth

Public sector net worth excluding public sector banks (PSNW ex) was a deficit of £611.8 billion at the end of April 2023. This compares with a £529.0 billion deficit at the end of April 2022.

The main reason for the £82.7 billion deterioration in PSNW ex over the past year was a £153.2 billion increase in PSND ex, partly offset by a £62.7 billion increase in public sector non-financial assets.

Public sector net debt

The most widely used balance sheet measure is public sector net debt excluding public sector banks (PSND ex). It comprises the excess of the public sector's financial liabilities (in the form of loans, debt securities, deposit holdings and currency) over its liquid financial assets (mainly foreign exchange reserves and cash deposits), with both measured at face or nominal value.

Expressing debt as a ratio of gross domestic product (GDP - the value of the output of the economy) gives an estimate of its affordability and provides a more robust comparison of the UK's balance sheet over time.

The Bank of England's contribution to net debt

Public sector net debt excluding the Bank of England (BoE) was £2,273.6 billion, or around 88.9% of GDP, £263.2 billion (or 10.3 percentage points of GDP) less than the wider measure. This difference is largely a result of the BoE's quantitative easing activities, including the gilt-purchasing activities of the Asset Purchase Facility (APF) Fund.

The APF's gilt holding is not recorded directly as a component of public sector net debt. Instead, in April 2023, we record the £110.1 billion difference between the £814.4 billion of reserves created to purchase its gilts (at market value) and their £704.3 billion redemption value.

Revisions to public sector net debt including public sector banks (PSND)

Estimates of the contribution of public sector banks to net debt are derived from the balance sheet data, supplied to us by the Bank of England twice annually.

This month we have received the balance sheet data covering the period July to December 2022 for the first time, enabling us to update previous estimates of PSND and to improve our previous forecast covering the period January 2023 to date.

As a consequence of receiving these data, our estimate of PSND at the end of March 2023 has increased by £12.9 billion.

Note

The above are excerpt of the report. There is great deal more information and graphs etc. Read the full report HERE