Average House Prices Fell In May

2nd June 2023

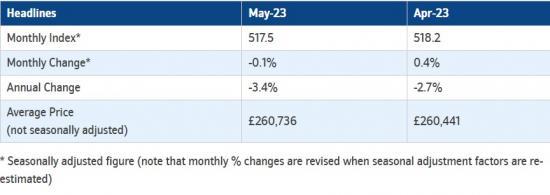

May saw a 0.1% month-on-month fall in house prices.

Annual rate of house price growth slipped back to -3.4%, from -2.7% in April.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said, "Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4% (from -2.7% in April). However, this largely reflects base effects with prices broadly flat over the month after taking account of seasonal effects. Average prices remain 4% below their August 2022 peak.

"Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels.

"Moreover, headwinds to the housing market look set to strengthen in the near term. While consumer price inflation did slow in April, it was a much smaller decline than most analysts had expected. As a result, investors' expectations for the future path of Bank Rate increased noticeably in late May, suggesting it could peak at c5.5%, well above the c4.5% peak that was priced in around late March. Furthermore, rates are also projected to remain higher for longer.

"If maintained, this is likely to exert renewed upward pressure on mortgage rates, which had been trending down after spiking in the wake of the mini-Budget in September last year.

"Nevertheless, in our view a relatively soft landing remains the most likely outcome since labour market conditions remain solid and household balance sheets appear in relatively good shape.

"While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks."