Tweaking Around The Edges Of Council Tax Does Not Fix Its Fundamental Flaws

14th July 2023

Fraser of Allender Institute take a hard look at council tax in Scotland now that Scottish Government has consultation out with a view to increasing the higher bands.

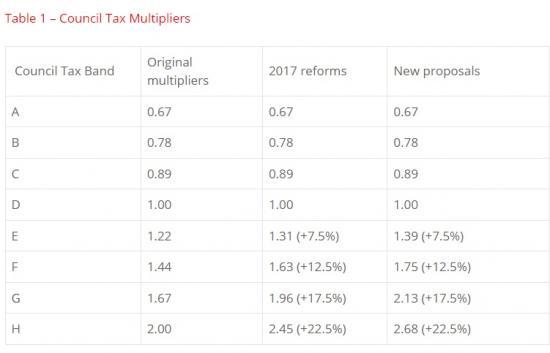

On Wednesday, the Scottish Government and COSLA released their anticipated (and widely leaked) consultation on Council Tax changes. The proposals set out would see a repeat of the 2017 increases in band multipliers for properties in Band E - H with the consultation seeking views on whether the changes to the mulitpliers should be higher or lower, or not happen at all. .

Table 1 shows the proposed changes in the context of the original multipliers set out in 1993 and the reforms in 2017. The proposed changes would lead to an increase in the amounts paid of £139, £288, £485 and £781 per household (or dwelling in official council tax speak) for those in Band E, F, G & H respectively.

The consultation documents note a number of valid points, but fails to mention others that are fairly fundamental to the operation of the Council Tax. Here we cover some of the main issues.

A fundamentally flawed tax

Council Tax is a regressive tax. By regressive, this means that the average tax rate (the % of the tax base paid in tax) falls as the value of the tax base rises. For Council Tax, the tax rate depends on the property you live in, meaning the relevant tax base is property value (as of 1991 - an issue we'll return to later). The highest valued properties pay a lower % of that value in their Council Tax bill.

The consultation document restates research that was completed as part of the 2015 Commission on Local Tax Reform that found that, in order for Council Tax in its current banded form to be progressive, the Band H rate would need to be in the order of 15x the Band A rate. Given this was based on 2013-14 property values, this figure may have since increased even further.

How do the proposed reforms link to ability to pay?

Although Council Tax is tied to property, it is income or savings that are required to pay the bill each year. As well as being regressive with respect to property, council tax is also regressive with respect to income. That is, as your income rises, the % of your income that you pay in the tax reduces.

There are some protections in the system to ensue those on the very lowest incomes do not pay some or any of their bill. The 2017 reforms also came with a condition that anyone who had income below the national average (median) would not pay any additional amounts if they were in Bands E - H. However, the regressivity with respect to income remains an issue that these reforms will not be able to address.

The elephant in the room: revaluation

An additional fundamental issue, absent from the consultation document, is the fact that the property values used to put properties into bands are based on 1991 values. Some properties have grown much faster in value than others since then. That means that two properties that were in the same band in 1991 may now be worth vastly different sums of money, and if there was a revaluation today they would no longer be placed together in the same band. The issue is further complicated by new builds where finding a comparable hypothetical 1991 value is difficult.

Read the full article in detail HERE

Council Tax Consultation - Views Sought On Changes To Higher Bands