Despite Financial Issues Confidence Has Improved For Rural Businesses According To HIE Report

25th August 2023

There's been further improvement in the confidence businesses in the Highlands and Islands have in Scotland's economic outlook and on the performance of individual enterprises. However, concerns over finances remain prominent.

This is according to the latest survey of Scotland's rural businesses and social enterprises.

Commissioned by Highlands and Islands Enterprise (HIE) in partnership with South of Scotland Enterprise (SOSE), the survey was carried out by Ipsos in June. There were 1,014 responses received from enterprises across the region and in a wide range of sectors.

More than half (55%) said they were confident in Scotland's economic outlook. This is up from 50% in the previous survey at the start of the year.

A third (33%) said they had performed well over the past six months, up from 29%, while those saying they had struggled had declined slightly from 26% to 24%.

Improved performance, however, did not always equate to more profits. While 34% of respondents reported an increase in turnover, only 17% said profits had grown and 37% said they had declined. Accommodation and food services were particularly impacted, with 43% reporting increased sales or turnover, while 61% reported decreased profit margins.

The survey took place against the continuing backdrop of economic challenges. The cost of living and energy crises, rising mortgage rates, and ongoing industrial action all contributed to reduced economic output during May, while labour market and skills challenges remained.

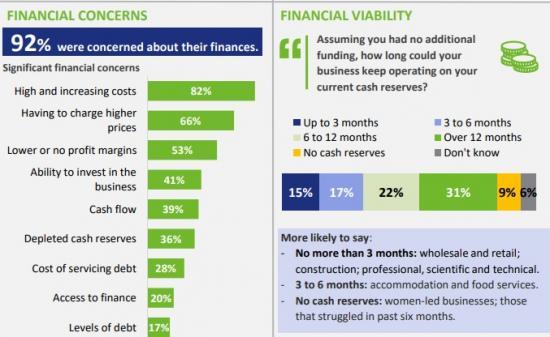

Almost all businesses (92%) who took part were concerned about at least one aspect of their finances, with high and increasing costs (reported by 82%) dominating. This was followed by having to charge higher prices (66%) and having lower or no profit margins (53%).

Cash reserves also appear to be depleted. Without additional funding, just under a third (31%) of businesses said they could only operate on their cash reserves for up to six months, a further nine per cent have no cash reserves.

In response to the challenges, a high proportion (89%) were taking steps to improve their productivity and competitive position. Actions included introducing more efficient working practices (58%), adapting products/services (49%), adopting new technologies (47%), investing in premises or equipment (46%), and collaborating with other businesses (45%).

Most employers (88%) were also supporting their employees, including taking actions related to fair work. These included providing training and development - both internal (66%) and external (41%); offering financial incentives such as increased wages (60%) and bonuses and other financial benefits (36%); and providing promotion/career progression opportunities (40%).

Other actions included offering flexible working (52%) as well as increased hours (24%), home or hybrid working (22%), changing the working week or core hours (20%), and making temporary contracts permanent (15%).

Looking ahead, nearly three quarters (71%) anticipated stability in their performance over the next six months. Almost a fifth (18%) expected their performance to improve, while nine per cent anticipated a decline.

This wave of the survey also sought to understand more about the potential role of technology such as automation and artificial intelligence (AI) in the business community's response to economic challenges.

While many recognised this can help enhance productivity, support innovation, enable more efficient use of employees and save money, less than a third said they were using it. However, most (68%) of those using or planning to use automation felt it was important or essential to the future of their business.

Of those not using it, 90% said they were unlikely to do so in future. Barriers included cost of implementation, understanding of its application, access to advice support, and digital connectivity. Concerns were also raised about cybersecurity, data protection and ethical issues.

Martin Johnson, HIE's director of strategy and regional economy, said, "As always, we're extremely grateful to all those who took part in the survey. From their feedback we're getting a very helpful picture of how the pressures of recent years are changing the region's economy and how individual enterprises are responding to this. It's a very dynamic and adaptable economy, and this is a great strength when conditions are challenging.

"On the whole, businesses are innovating, applying flexibility to working practices and investing in their employees. Profit margins are certainly being squeezed, but it’s heartening that confidence in the economy and business performance are improving."

Mr Johnson also encouraged more businesses to explore the use of technology. He added, "Bringing new technologies into business operations can be very daunting. It’s a fast-moving picture with many different options available, and of course it costs money. But there is help available from a whole range of sources, including the enterprise agencies and services from the likes of the National Manufacturing Institute for Scotland, the Scottish Manufacturing Advisory Service and others. The Find Business Support web portal is a good place to start, and we encourage businesses to look into this because the business benefits of technology and automation can be substantial."

The survey fieldwork was conducted between 30 May and 30 June 2023, using a combination of online survey and telephone interviewing. In total 1,014 eligible surveys with businesses and social enterprises across the Highlands and Islands were achieved (917 by telephone, 97 online).

The full Business Panel report is available HERE

Pdf 58 Pages

HIE Business Panel Summary Findings

Pdf 4 Pages

Comment

Reports like this are a snapshot of what is happening at one point in time. It does not go into detail as to what will happen the future for example in accommodation businesses with the costs of government enforced registration for licencing in Scotland where there is the possibility that some small say bed and breakfast places may just give up in the coming year or two. Another significant factor will be interest rates on any loans and credit cards and the fact that almost1.5 million people will see significant increases in mortgage payments once they come off their existing fixed agreements in the next 12 to 18 months.

Related Businesses

Related Articles