10 key facts about UK tax and public finance policy that will underpin the choices faced by governments in coming decades.

30th August 2023

This report highlights 10 key facts related to taxes and the public finances that will underlie the fiscal policy challenges and choices faced by citizens and governments in coming decades. It is part of the ‘UK 2040: Options' project, which is exploring policy options to improve outcomes for children born today and reaching adulthood around 2040.

Looking across the next 20 years, there will be important and difficult choices over both the level of taxation and the design of different taxes. Both will affect the type of society we live in.

Fundamental facts

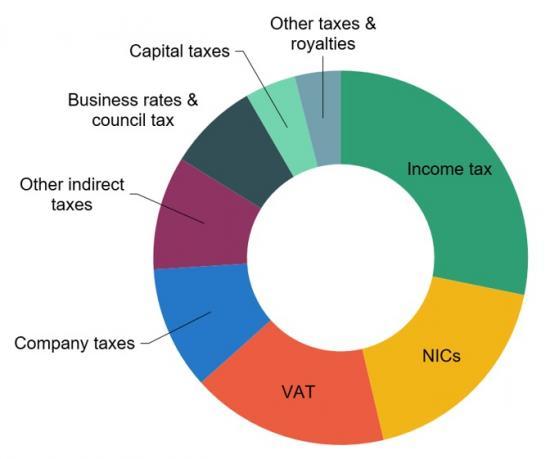

1. Tax revenue is 37% of national income (the highest level seen in the UK since the 1940s) and rising. Maintaining government services in the face of an ageing population, increasing health and social care costs, and the costs associated with responding to climate change would require taxes to increase further in coming decades.

2. UK public debt - as measured for the purpose of fiscal rules - is currently around 90% of national income. Future governments would need to run a primary surplus - meaning raising revenues higher than non-interest spending – simply to stop debt rising further.

3. Tax rates are much lower on capital incomes than on labour incomes. This distorts the labour market (away from employment and towards self-employment). It is horizontally inequitable because similar people face very different tax bills.

4. Income tax has been made more complex since 2010. A freeze in thresholds will see the share of adults paying income tax reach a level not seen since at least the early 1990s and the share paying higher rates reach an all-time high. These important changes are being determined by the rate of inflation, rather than by active policy choice.

5. VAT zero rates and exemptions cost £100 billion in forgone revenue. They place a large compliance burden on firms and are a very poorly targeted way to redistribute income to lower-income households.

6. There is a clear intergenerational divide in wealth. The returns to wealth tend to be undertaxed relative to labour income and, in some cases (including the capital gains made on main homes), are completely untaxed.

7. Council tax is regressive. In England and Scotland, it is based on values that are over 30 years out of date. Tax bills bear increasingly little relation to the actual value of the houses we live in. Stamp duty hinders people from moving house.

8. The long-run trend towards cutting the UK corporation tax rate while broadening the tax base has been sharply reversed in recent years. There is ongoing uncertainty over the plan for investment allowances. This uncertainty will hamper business investment, which is already weak by international standards.

9. In recent decades, governments have added a series of new taxes explicitly aimed at changing behaviour. Such taxes must be designed with care.

10. Tax rates on greenhouse gas emissions vary wildly, including by the source of the emissions and the type of end user. This makes reducing carbon emissions more costly than it needs to be.

Read the full report HERE