Quarterly Business Investment Forecast

24th November 2023

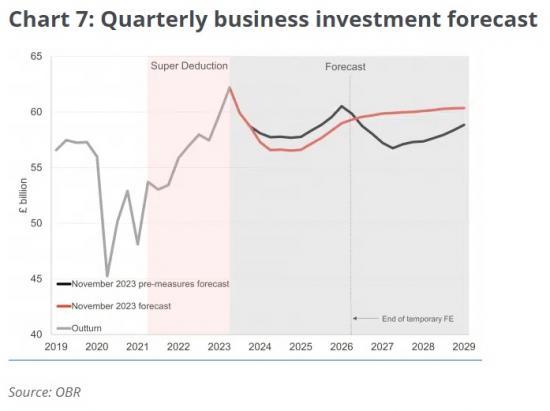

Implementing a permanent extension to FE is expected to lower corporation tax receipts by £10.9bn by 2028-29, while only raising capital stock by 0.2%.

This is forecast to increase potential output by 0.1% in 2028-29 and just under 0.2% in the long run. The real terms cost of permanent FE will fall over time, however, as the higher corporation tax deductions firms experience in the short run will result in lower tax deductions later.

As a share of GDP, the real terms cost of permanent FE is forecast to fall from 0.35% of GDP at the outset in 2027-28 (when the temporary measure was due to finish), to 0.15% of GDP after 10 years, and approximately 0.12% of GDP in the long run.

Overall, business investment requires certainty, and the introduction of permanent FE measure provides some improvement here, following three years of major changes in the corporation tax base and rates.

However, the investment requirements in place under the temporary policy remain the same, so an incentive remains towards certain types of investments. For example, FE is only available for investments in plant and machinery and excludes investments in assets such as cars, buildings, intangible assets and assets used for research and development (R&D). Additionally, the FE policy increases the incentive for marginal debt-financed investment, over equity-financed investment.

This is driven by the ability to deduct debt interest payments from taxable income and may potentially making more unprofitable projects viable. Therefore, while the move to a permanent measure is expected to increase business investment in medium to long run, there is no guarantee of the quality or productivity of these investments, which is required to boost output and economic growth.

Source

https://fraserofallander.org/autumn-statement-reaction-a-tax-cutting-statement-that-continues-to-raise-taxes-amid-slowing-growth-and-what-does-this-mean-for-scotland/