Will Tax Rates Go Up In Tomorrows Scottish Budget? They Are Already Higher Than UK Rates

18th December 2023

As rumours ripple around the internet another increase in income tax rates for higher rate payers it is worth noting that marginal rates already hit many more than you would think. The Fraser of Allender already laid out the issue recently.

Marginal Tax Rates

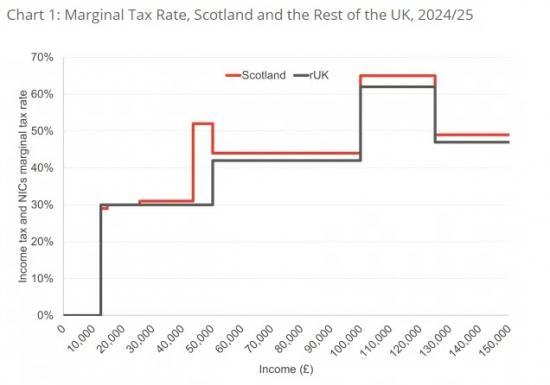

Marginal tax rates are a term used to describe the rate of tax an earner pays on each additional unit of income they earn. They are calculated as the total rate of income tax plus NICs for each unit of income earned, considered alongside personal allowances and any taper rates that may apply.

Generally, marginal tax rates are designed in a progressive way, where the marginal tax rate increases in steps as a worker earns more. In the rUK, this tends to be the case, except for earnings between £100,001 and £125,000, where the marginal tax rate increases to 62%, before falling to 42% for all earnings beyond £125,000. This increase in the marginal tax rate for earnings between £100,001 and £125,000 is due to the taper rate, where for each £2 earned above £100,000, there is a £1 reduction in the £12,500 tax free personal allowance.

Like employees in rUK, earners in Scotland experience a sharp increase in their marginal tax rate for earnings between £100,001 and £125,000, rising to 65%. However, earners in Scotland also face a significant increase in their marginal tax rate to 52% for earnings between £43,663 - £50,270, which earners in the rUK do not.

You may ask what is driving this increase in the marginal tax rate in Scotland?

This sharp increase in the marginal tax rate is driven by deviations in Scottish income tax policy from the rUK. In the rUK, rates of NICs fall from 10% to 2% at the same level of earnings (£50,270) that income tax increases from 20% to 40%. However, because earners in Scotland move up to the higher rate band at a lower threshold of £43,662, they start paying a higher rate of tax of 42% without any immediate reduction in their NICs rate.

Some argue that this sharp rise in the marginal tax rate may disincentives earnings at the margin. By this, we mean that if a worker is earning £43,662 each year, they may be disincentivised to earn more because they would have to pay 52p of each additional pound they earn (up to £50,270).

Although this distortion in the Scottish marginal tax rate may impact workers incentive, it does bring in an additional £600 million of tax revenue each year. [2]

In the following section, we explore two potential reforms to Scottish income tax policy that could smooth out this distortion in marginal tax rates, whilst importantly, ensuring there is no significant reduction in the revenues from income tax that the Scottish Government currently collects.

The Big Scottish Tax Question For The Scottish Budget on 19 December 2023

Will Higher Tax Rate taxpayers be hit with a new higher rate band potentially adding one or two percent a the higher end?

Read the full paper HERE

Council Tax Council Tax Freeze already Announced

Hanging in the background is the controversial announcement to freeze council tax rates announced by the First Minister out of the blue at the party conference without any negotiations. A freeze benefits richer households more than poorer households yet is portrayed as saving for everyone. Whilst that may be true the saving at the lower end is much less. Councils also were taken by surprise in view of the potentially disastrous affect on their budgets even though Scottish Government say it will be fully compensated for by government. What exactly fully compensated means remains to be seen.