Consumer Price Inflation, UK - December 2023 - 5.2%

17th January 2024

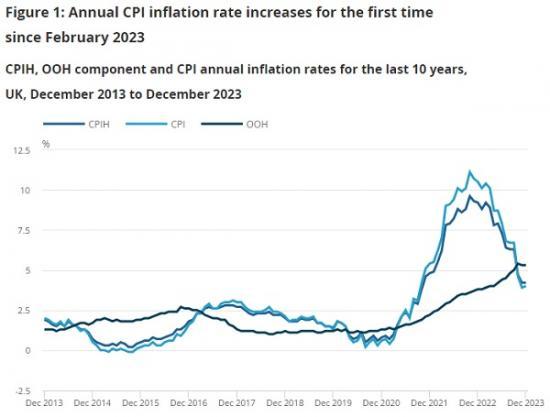

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 4.2% in the 12 months to December 2023, the same rate as in November.

On a monthly basis, CPIH rose by 0.4% in December 2023, the same rate as in December 2022.

The Consumer Prices Index (CPI) rose by 4.0% in the 12 months to December 2023, up from 3.9% in November, and the first time the rate has increased since February 2023.

On a monthly basis, CPI rose by 0.4% in December 2023, the same rate as in December 2022.

The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 5.2% in the 12 months to December 2023, the same rate as in November; the CPIH goods annual rate slowed from 2.0% to 1.9%, while the CPIH services annual rate remained at 6.0%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to December 2023, the same rate as in November; the CPI goods annual rate slowed from 2.0% to 1.9%, while the CPI services annual rate increased from 6.3% to 6.4%.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 4.2% in the 12 months to December 2023, the same rate as in November and down from a recent peak of 9.6% in October 2022. Our indicative modelled consumer price inflation estimates, as reported in our Consumer price inflation, historical estimates and recent trends, UK: 1950 to 2022 article, suggest that the October 2022 rate was the highest in over 40 years (the CPIH National Statistic series begins in January 2006). The annual rate in December 2023 was the joint lowest since October 2021.

The unchanged annual rate between November and December 2023 was a result of prices rising by 0.4% on the month, the same rate as it was between November and December a year earlier.

The owner occupiers' housing costs (OOH) component of CPIH rose by 5.3% in the 12 months to December 2023, the same rate as in November. OOH costs rose by 0.4% on the month in November 2023, the same rate as it was between November and December a year earlier.

The Consumer Prices Index (CPI) rose by 4.0% in the 12 months to December 2023, up from 3.9% in November and down from a recent peak of 11.1% in October 2022. Our indicative modelled consumer price inflation estimates suggest that the October 2022 peak was the highest rate in over 40 years (the CPI National Statistic series begins in January 1997). The annual rate in December 2023 was the second lowest since September 2021.

The small rise in the annual rate between November and December 2023 was a result of prices rising by 0.4% on the month, the same rate to one decimal place as it was between November and December a year earlier.

The main drivers of the annual inflation rate for CPIH and CPI are the same where they are common to both measures. However, the owner occupiers' housing costs (OOH) component accounts for 16% of the CPIH and is the main driver for differences between the CPIH and CPI inflation rates. This makes CPIH our most comprehensive measure of inflation. We cover this in more detail in Section 4: Latest movements in CPIH inflation of this bulletin and provide a commentary on the CPI in Section 5: Latest movements in CPI inflation. We also cover both CPIH and CPI in Section 3: Notable movements in prices, though the figures reflect CPIH.

Notable movements in prices

The identical CPIH annual inflation rates in November and December reflected downward contributions from three divisions (most notably food and non-alcoholic beverages) and upward contributions from five divisions (most notably alcohol and tobacco).

Alcohol and tobacco

Prices in the alcohol and tobacco division rose by 12.8% in the year to December 2023, compared with a rise of 10.2% in November. Prices rose by 1.2% between November and December this year, compared with a fall of 1.1% between the same two months a year ago.

The increase in the annual rate was largely the result of the increase in tobacco duty, after the government announced higher taxes in their autumn statement. Tobacco prices rose by 4.1% between November and December compared with a 0.3% rise between the same two months last year, leading to an annual increase of 16.0%.

Alcohol made a smaller contribution to the rise in the annual rate. Alcohol prices fell by 1.6% between November and December 2023 and by 2.3% between the same two months last year, leading to an annual increase of 9.6%.

Recreation and culture

Prices for recreational and cultural goods and services rose by 0.2% between November and December this year, compared with a fall of 0.2% a year ago. The annual rate rose to 6.0% in December 2023, up from 5.5% in November.

The increase in the rate between November and December 2023 was the result of small upward effects from a variety of the more detailed classes. The largest contributions came from DVDs, computer software, computer games consoles, sports equipment, toys, plants and flowers, cat food, live music, theatre admissions, and package holidays. Short-term movements in some of these categories should be interpreted with a degree of caution as the movements depend upon the composition of best seller charts.

Transport

Prices in the transport division fell by 1.3% in the year to December 2023, compared with a fall of 1.4% in November. Prices rose by 0.6% between November and December this year, compared with a rise of 0.5% between the same two months a year ago.

The reduction in the pace of decline was mainly the result of air fares, with motor fuels also providing a small positive contribution, however these were offset by a strong downward contribution from used cars.

Air fares rose as usual between November and December. This year, they rose by 57.1%, compared with 61.1% a year ago. However, because the weight for this subclass increased significantly between 2022 and 2023, this amplified the impact of the December 2023 monthly movement on the headline, resulting in a positive contribution to the change in annual consumer price inflation. The annual rate for air fares was 0.8% in December 2023, down from 3.3% in October and 31.4% in May this year.

The average price of petrol fell by 8.2 pence per litre between November and December 2023 to stand at 142.8 pence per litre, down from 155.3 pence per litre in December 2022. Diesel prices fell by 7.6 pence per litre this year to stand at 151.4 pence per litre, down from 179.1 pence per litre in December 2022.

These movements resulted in overall motor fuel prices falling by 10.8% in the year to December 2023, compared with a fall of 10.6% in the year to November.

Second-hand car prices fell for the seventh consecutive month. Between November and December 2023, they fell by 2.8%, compared with a rise of 0.3% between the same two months last year. On an annual basis, prices fell by 8.4% in the year to December, compared with a fall of 5.4% in the year to November.

Food and non-alcoholic beverages

Food and non-alcoholic beverage prices rose by 0.5% between November and December 2023, compared with a rise of 1.6% a year ago. The annual rate was 8.0% in December 2023, easing for the ninth consecutive month from a recent high of 19.2% in March 2023, the highest annual rate seen for over 45 years. The December 2023 rate is the lowest since April 2022.

The easing in the annual rate for food and non-alcoholic beverages was driven by milk, cheese and eggs, where prices rose by 0.5% on the month, compared with a rise of 4.1% a year ago. Prices of a variety of products in this class fell on the month having increased in price the year before leading to downward contributions from low-fat milk, yoghurt, cheese, and eggs.

This resulted in an annual rate for milk, cheese and eggs of 3.3%, the lowest observed since October 2021.

Other smaller but still notable downward contributions to the change in the rate came from meat, fish, and sugar and jam. The only partially offsetting upward effect came from bread and cereals, where cakes, and chocolate biscuits provided upward contributions.

Although the annual inflation rate for food has been slowing, food prices are still high following relatively sharp rises over the latest two years. The overall price of food and non-alcoholic beverages rose by around 26% over the two years between December 2021 and December 2023. This compares with a rise of around 9% over the 10 years between December 2011 and December 2021.

Read the full ONS report HERE