UK Environmental Taxes - 2023

9th May 2024

Environmental taxes, using an internationally agreed definition, raised £52.5 billion in the UK in 2023, up 4.9% from £50.1 billion in 2022.

Revenue from energy taxes accounted for 75.0% of all UK environmental tax revenue in 2023, followed by transport (22.5%) and pollution and resource (2.4%) taxes.

Fuel Duty accounted for 63.2% of UK energy taxes in 2023, while the UK Emissions Trading Scheme and Renewable Energy Obligations together accounted for 33.5% of taxes in this category.

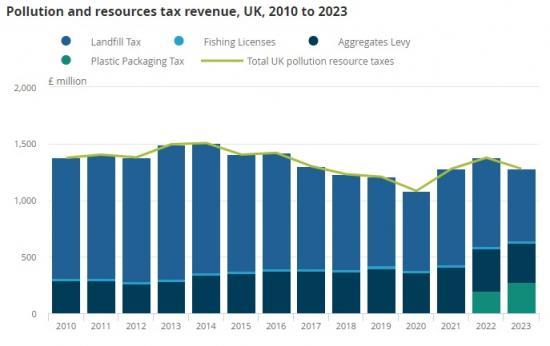

Total pollution and resources taxes have fallen since 2022, caused by a fall in revenue from Landfill Tax and the Aggregates Levy, but Plastics Packaging Tax revenue increased, raising £279 million in 2023.

UK environmental tax revenue as a proportion of both gross domestic product (GDP) and total taxes and social contributions have remained relatively stable in recent years, following a decline from levels seen from 2009 to 2019.

On average, environmental taxes increased from £575 for each UK household in 2020 to £623 in 2021.

The electricity, gas, steam and air conditioning supply sector remains the largest industry contributor to environmental tax revenues (25.5%), despite this contribution falling in 2021 compared with 2020.

Total environmental tax revenue

Following international definitions (section 4.4.3 of the United Nations's (UN) System of Environmental-Economic Accounting Central Framework (PDF, 2.6MB)), environmental taxes are those whose base is a physical unit, for example, a litre of petrol or a passenger flight, that has a proven negative impact on the environment. These taxes should reduce the activity, and therefore reduce negative environmental impacts. Increases in tax revenue can occur from either rising tax rates, increased activity, or both.

While other initiatives may promote environmentally positive behaviour, they may not currently be considered an environmental tax under this definition. For example, clean air zone charges and charges on single-use plastic bags by retailers are not currently classified as taxes. Environmental taxes yet to be classified for economic statistics purposes may be reviewed as part of our economic statistics classification forward work plan.

Environmental taxes are grouped into three main tax categories: energy, transport, and pollution and resource taxes.

Data throughout this release are presented in current prices and have not been adjusted for inflation. More information on our environmental taxes measures can be found in our Environmental accounts on environmental taxes Quality and Methodology Information (QMI) report.

UK environmental tax revenue continued to increase in 2023

In 2023, UK environmental tax revenue was £52.5 billion, a 4.9% increase from 2022 and is now back in line with the pre-coronavirus (COVID-19) pandemic peak in 2019 (also £52.5 billion).

We see increases between pandemic-affected 2020 and 2023 for all three tax categories.

The largest contributor to this increase was the UK Emissions Trading Scheme, which replaced the EU Emissions Trading Scheme in 2021. This scheme contributed £5.8 billion of environmental tax revenue in 2023, equivalent to 64.7% of the total net revenue increase since 2020.

Following the easing of pandemic restrictions, Fuel Duty and Air Passenger Duty together contributed £5.1 billion to the total environmental tax revenue increase from 2020 to 2023. This is the equivalent of 56.9% of the net revenue increase.

Total net revenue includes negative contributions, such as the Contracts for Difference scheme in 2023, so percentage contributions may not sum to 100%. Contracts for Difference is classified as an environmental tax and aims to support low carbon electricity generation. For more information, see Contracts for Difference on GOV.UK.

Fuel Duty remains the largest contributor to UK energy taxes, at 63.2% in 2023, with the UK Emissions Trading Scheme and Renewable Energy Obligations together contributing 33.5% in 2023. Combined, these three amounted to 96.7% of energy tax revenue and 72.6% all environmental tax revenue in 2023.

UK environmental tax revenue as a percentage of GDP is lower compared with the EU average

UK environmental taxes as a proportion of both gross domestic product (GDP) and total taxes and social contributions has historically been below the EU countries' average. In 2022, these proportions were 2.0% and 5.5% respectively, compared with averages for EU countries of 2.3% and 6.4%, respectively. UK proportions on both bases have remained relatively stable in recent years, following a decline from 2009 to 2019 levels, where environmental tax revenue as a proportion of GDP averaged 2.4% and as a proportion of total taxes and social contributions averaged 7.3%. This decline has been observed across EU countries in this time too, where from 2009 to 2019 the average proportions were 2.7% and 7.6%, respectively.

Read the full ONS report HERE